Banking

Atiur for bringing unbanked people under banking net

Bangladesh Bank Governor Dr Atiur Rahman said the central bank has given due importance on financial inclusion and financial literacy programmes in a bid to bring unbanked people under banking network.

“Bangladesh tops South Asian countries, after Sri Lanka, in terms of financial inclusion,” he added.

At present, there are 1.5 crore mobile banking accounts in the country and some 1.33 crore poor people of different ages have opened bank accounts at Tk 10 under the programme, he added.

The BB Governor made the remarks while inaugurating School Banking Conference, Khulna-2014 at Tiger Garden Hotel in Khulna on Saturday.

SK Sur Chowdhury, Deputy Governor, Bangladesh Bank, was present as special guest where students, teachers, guardians and officials of Bangladesh Bank and other commercial banks attended.

Bangladesh Bank recently issued a circular for opening bank accounts for the street children at Tk 10. Children, those who have no guardian, can open an account in any bank of the country, Dr Atiur added.

Financial inclusion programme has become one of the main weapons for ensuring sustainable development in a developing country, he said, adding, people who are deprived of financial services will be brought under the programme for the economic development of the country.

Airtel subscribers to enjoy NCC Bank mobile banking

NCC Bank Limited has recently signed an agreement with Airtel Bangladesh Limited to provide mobile banking services to Airtel subscribers.

Airtel customers will be able to enjoy the service by following a simple registration process, says a press release. Under this agreement, Airtel customers can avail cash-in, cash-out, money transfer, mobile top-up, school fee payment, bill payment and other services under the service brand “NCCB SureCash”. Progoti Systems Limited is the software solution partner of NCCB for this service.

Md Omar Faruque Bhuiyan, head of Cards and Mobile Banking of NCC Bank, and Rubaba Dowla, head of mCommerce of Airtel Bangla-desh, signed the agreement.

News:The Independent/6-Apr-2014Bank Asia re-elects two vice-chairmen

Mohd Safwan Choudhury and AM Nurul Islam Anu have recently been re-elected vice-chairmen of Bank Asia at a meeting of the bank’s board of directors held in Dhaka.

Safwan, a former president of the Sylhet Chamber of Commerce and Industries, is the managing director of M Ahmed Tea & Lands Co Ltd, Phulbaria Tea Estates Ltd, M Ahmed Cold Storage Ltd, Premier Dyeing and Calendering Ltd, and M Ahmed Food & Spices Ltd.

He is the chairman of the Bangladesh Tea Association and president of Friends in Village Development Bangladesh, an NGO providing education to the under-privileged children.Nurul, a former teacher of the University of Dhaka and a former CSP, was director of National Bank since 2003 and acted as chairman of its audit committee. Subsequently, he joined Bank Asia and acted as chairman of the bank’s audit committee for three years. At present, he heads the Risk Management Committee of Bank Asia.

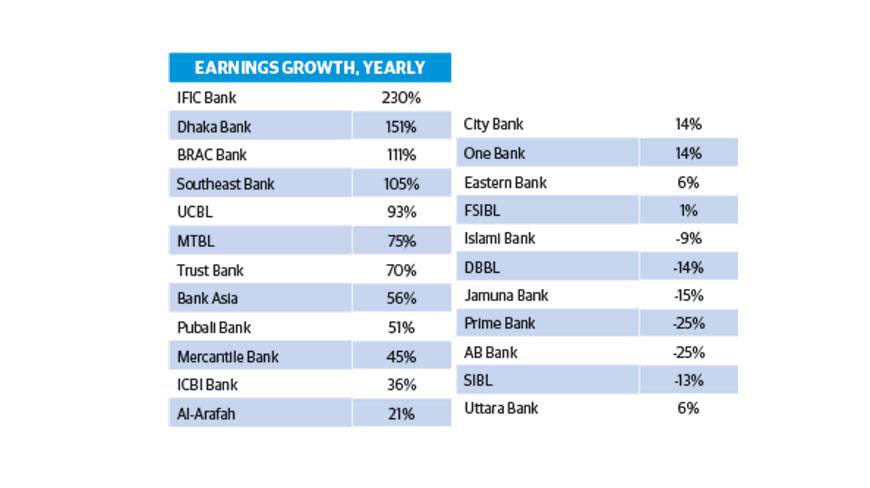

News:New Age/6-Apr-2014Most listed banks see annual profits soar

Seven banks miss deadline to make earnings public

Most of the listed banks annual profits surged in 2013 on the back of the central bank’s relaxing rules on loan rescheduling to recover losses during political unrest in the second half of the year.

So far 23 out of 30 listed banks have announced their profit earnings but the remaining seven banks are yet to publish despite expiry of deadline for making earnings public.

Annual profits of only six banks dropped and 17 banks soared.

Seven banks missed deadline to make their financial statements public in line with the listing regulation of stock exchanges.

The companies will have to make available financial statements before the expiry of three months from the end of each financial year even if the figure is provisional and subject to audit, according to the Dhaka Stock Exchange.

Though last year was a difficult year for banks as business activities were battered by the political turmoil, Bangladesh Bank’s move to relax loan rules helped them recoup losses, said analysts.

BB in a notice issued in December last year advised banks to reconsider loan rescheduling and down payments until June this year on a case-by-case basis for borrowers in all sectors affected by political turbulence.

IFIC Bank was the top profit earner as its profit growth jumped 230% to Tk137 crore compared to the previous year.

Profits of Dhaka Bank grew 151%, BRAC Bank 111% and Southeast Bank 105% during the period, according to the earnings per share disclosed on DSE website.

“The bank profits soar on the central bank’s move. Due to the move, there was a shift in the fourth quarter than the previous ones,” said a banker.

But the story behind BRAC Bank’s impressive growth is perhaps due to higher non-fund based income, said an analyst at BRAC EPL Brokerage Ltd.

The market, however, reacted cautiously to the positive profit-disclosures in the banking sector.

“Equity investors along with others concerned would have to wait for some time in order to get a true picture of the bank earnings because the rescheduled loans might default later,” said Md Moniruzzaman, managing director of IDLC Investments Ltd.

Last year, most banks experienced unsatisfactory credit flow due to political unrest and an increase in default loans, he said.

Mohammad Akib, an executive at Zenith Investments Ltd, said, “Banks yearly earnings were not so significant to generate buying interest among the investors.”

Seven banks that missed deadline to make financial statements public are Exim Bank, Rupali Bank, Standard Bank, National Bank Ltd, NCC Bank, Premier Bank and Shahjalal Bank.

All these banks apart from Standard Bank also failed to post their financial figures of 2012 within deadline and delayed more than three months.

The supposedly small-scale investors at a city brokerage on Thursday expressed their frustration over the delay to disclose financial information and the structural problem of not posting complete financial online before the annual general meetings.

According to them, the delayed disclosures raise possibilities of insider trading due to information asymmetry in the equity markets, leveraging the market in jitters.

“Three months is an enough time to announce yearly earnings for the banks, given all the data entries are usually done using advanced technologies,” said Shahidul Islam, chief executive officer of VIPB Asset Management Company Limited.

Overall, banks that saw better income than the previous year are giving higher dividends for 2013, according to the DSE. Despite the fact, banking shares fell by 3.16% last week on the premier bourse, disappointing investors the most.

News:Dhaka Tribune/6-Apr-2015

UCBL holds remittance fair in Sylhet

Managing Director of UCB Muhammed Ali and Additional Managing Director Mirza Mahmud Rafikur Rahman, along with other clients of the bank, are seen at UCB Remittance Fair and SME Entrepreneurship Meet in Sylhet on Friday. United Commercial Bank Limited organsied a remittance fair in Sylhet on Friday.

Managing Director of UCB Muhammed Ali inaugurated the fair as chief guest, said a press release.

During the fair, SME Conference and UCash distributors meeting were held.