Dhaka Stock Exchange

Six stockbrokers suspended, as SEC spots share tricks

Sarwar A Chowdhury

Sarwar A Chowdhury

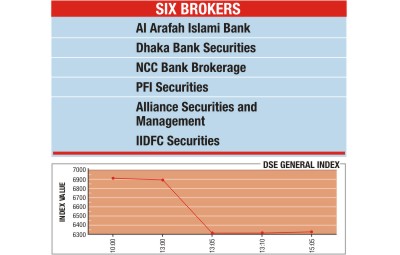

The stockmarket regulator yesterday suspended six stockbrokers' trading activities for 30 days on charges of their involvement in the ongoing volatility in the secondary market.

The Securities and Exchange Commission (SEC) took the action after trading was halted by the share index breaker within five minutes into the start of transactions. The benchmark index slumped by 600 points on Dhaka Stock Exchange before the circuit-breaker put brakes on trading on the twin bourses.

The suspended stockbrokers are Al Arafah Islami Bank, Dhaka Bank Securities, NCC Bank Brokerage, PFI Securities, Alliance Securities and Management and IIDFC Securities.

Also, the regulator stripped managing directors and chief executive officers of the six brokerage houses of official duties and responsibilities for the next 30 days. They are: Rezaur Rahman of Al Arafah Islami Bank, Kamrul Aziz Nippon of Dhaka Bank Securities, Manjum Ali of NCC Bank, Kazi Fariduddin Ahmed of PFI, Pankaj Roy of Alliance Securities, and Ashrafun Nessa of IIDFC.

SEC officials said the surveillance department of the commission found irregularities in the brokerage houses in a primary investigation. Buy offers came from these brokerage houses at comparatively higher prices, but sell-offs occurred at much lower prices than the buyers' offers, the officials said. There was a buy offer, for instance, at Tk 330 for a stock, but sellers sold it for Tk 300.

In another move, the stockmarket regulator postponed the book building method for initial public offers following heavy criticism by market experts and intermediaries.

In recent times, the book building method turned out to be a tool for manipulating prices in Bangladesh, although it is a widely practised price-fixing mechanism for IPOs, market analysts said.

At a press briefing yesterday, the Dhaka Stock Exchange said the companies that were listed under the book building system should be probed to find out how the price distortion took place by deceiving retail investors.

The book-building method was introduced in Bangladesh in 2009 and only three instances of such practices were found. But a number of companies are in the pipeline to list on the stockmarket under the system.

The SEC will also sit with all market stakeholders to discuss the market situation on Sunday, and the market will remain closed that day as decided by the regulator.

News: The Daily Star/Bangladesh/21 Jan 2011

BB calls for proper probe into worsening capital market

Bangladesh Bank wants a proper investigation into the current volatility of stock market and it has decided, in principle, not to pump any money into the share market, BB sources said yesterday.

Repo auctions to ensure adequate supply of liquidity in the banking sector will, however, be continued, sources added.

On last Monday and Tuesday, the BB disbursed a total of Tk 4 billion in favour of Investment Corporation of Bangladesh (ICB) in two equal installments.

The BB acts as the money market controller as it mainly reins in the inflation through proper monetary policy while SEC regulates the capital market, but the central bank is being held responsible for the volatility in the capital market, which is irrational, the central bank said in a statement yesterday.

A stable and comprehensive stock market plays a very important role for a long-term financing source. For building up confidence among the investors and ensuring a stable share market, the BB took a number of supportive measures much earlier, it said.

The BB had to control the liquidity flow to rein in inflation for ensuring stability in the banking sector, and serve the depositors’ interests through monitoring, it mentioned adding that it recently took a growth supporting monetary policy.

The new policy ensures that low interest loans are not used as consumer loans or go outside the money market. In view of it, the BB specified some sectors like agriculture and SMEs for increased loan flow.

Bangladesh Bank Governor, Dr Atiur Rahman, at a meeting with the bankers in late 2009, warned that some banks were investing their excess liquidity in the capital market. “It won’t be an offence if they do it strictly following BB and SEC’s compliance guidelines,” he added.

The capital market, otherwise, might witness a very volatile situation and banks’ main capital might also be in danger, he warned adding: “This would affect both the depositors and the equity.”

In October 2009, BB issued a circular in line with Bank Company Act, 1991 instructing the scheduled banks to open separate subsidiary company by January 2010 for merchant banking, which is yet to be fully implemented.

Earlier, in July of the same year, the central bank issued another circular asking them not to exceed their share market investment limit, 10 percent of their total liabilities, according to the act.

Despite their failure to meet the January 2010 deadline of separating merchant banking from the mainstream banking activities, the BB did not take any actions against them. Instead, it kept on reminding them of share buying limit.

News: Daily Sun/Bangladesh/21 Jan 2011

Share index breaker deployed

Stock market tumbled one more time yesterday that counts fifth straight crash in a row. It's been very thwarting for the regulator's efforts of containing volatility and repealing the hope for a calm and confident market. The latest move -- the introduction of circuit-breaker, which halts the market if the index gains or loses more than 225 points -- also turned futile. Trading began two hours late and the plunging stocks halted it within one and a half hours, after hitting the circuit-breaker threshold.

Analysts said the circuit-breaker will not help control the volatility and restore confidence, unless liquidity inflow increases to support fresh buying. "It's not a solution. It's not an effective tool," said Yawer Sayeed, chief executive of AIMS, an asset manager. His remark came after the benchmark DSE General Index (DGEN) lost 226 points or 3.17 percent, amid panic sales. The slump made the investors violent on the streets again. "The result of the circuit-breaker will be nothing but protests, as you have seen today," said Salahuddin Ahmed Khan, former chief executive of Dhaka Stock Exchange. "It's not an effective solution. The circuit-breaker will result in decreased share prices," said Khan. "Such intermediate measures will not bring about effective results."

Stocks lost 660 points on January 11 and a day later, it sprinted up 1,000 points or 15 percent on a stimulus from the regulator. But a freefall returned the next day as liquidity crunch kept institutional investors shy from buying. Many investors entered the market late, inspired by bubbling in share prices in the last one and a half years. Now their hopes of making easy money is shattered by the consistent downfall, as banks that had earlier fed the bubble amid slack regulatory monitoring started liquidating investments ahead of the year-end, and complied with tightened monetary policy of Bangladesh Bank. Khan said the slump brought another problem -- a confidence crunch. "It appears that the market is heading towards a crisis," he said, suggesting increased money flow. "Any intermediate step will not be effective. It will rather deepen the instability."

Hasan Imam, chief executive of Race Asset Management Ltd, said the circuit-breaker is just one tool to manage the volatility. "It must be used carefully because it has some downsides. If the circuit-breaker is not used properly, it may intensify the panic," he said. Imam said the circuit-breaker may not bring stability unless the liquidity crunch is addressed.

News Source: The Daily Star/Bangladesh/20 Jan 2011

Dhaka stocks finish higher amid instability

On Wednesday Dhaka stocks rose sharply for the two consecutive sessions after buying spree in financial issues pushed the turnover up amid instability. Market operators said strong buying in banking, non-banking and insurance issues by retail and institutional investors helped maintain the bullish trend on the Dhaka Stock Exchange (DSE) with turnover rising significantly. The market opened with a flying start, rising 302 points in just ten minutes, and then followed volatile trading as it shed 124 points before its closure. The benchmark DSE General Index (DGEN) surged by 2.38 per cent or 178.60 points to close at 7690.69, after a record gain of 1012 points or 15 per cent Tuesday.

The broader All Shares Price Index (DSI) moved up by 2.10 per cent or 131.43 points to 6380.79. The DSE-20 Index comprising blue chips was up by 1.15 per cent or 54.86 points to 4828.52. The regulator's market friendly steps helped regain investors' confidence and the buying binge closed the market up, dealers said. "Confidence is being restored among investors. I think the market is going to be stable in the coming days," said Ahmad Rashid Lali, managing director of the Rashid Investment Services. The central bank is set to unveil its half-yearly monetary policy this month, he said, hoping that the policy would give some specific directions with regard to the capital market as it faces liquidity crisis.

Analysts, however, voiced doubt over the sustainability of the Tuesday's "unusual" gains stemming from the regulator's series of interventions. Many of them called it a government intervention and it looked like an artificial spike as it rose more than 15 per cent or 1012 points - the highest one-day spiral. Banking issues, the market's bellwether, continued to flex their muscle and gained 2.38 per cent. Among the notable gainers, non-banking financial institutions 4.21 per cent, general insurance 6.28 per cent and life insurance 6.26 per cent, which helped the market maintain its upward trend.

The other major sectors--fuel and power and pharmaceuticals--lost 0.70 per cent and 0.41 per cent respectively. Turnover sharply rose to Tk 16.50 billion, up by 69.0 per cent over the previous session. The gainers took the strong lead over the losers as out of 246 issues traded, 147 advanced, 94 declined and five remained unchanged. On Tuesday, the DSE general index gained 1,012.65 points or 15.58 per cent to close at 7512.09, just a day after the Securities and Exchange Commission suspended trading of shares after free fall of 660 points within 50 minutes traded Monday.

United Commercial Bank topped Wednesday the turnover list with shares worth Tk 777.96 million changing hands. The other turnover leaders were National Bank, United Airways, Southeast Bank, Bextex, Bay Leasing, AB Bank, Titas Gas, Peoples Leasing and Grameenphone. Saiham Textile was the highest gainer posting a rise of 19.98 per cent followed by Prime Life Insurance, Square Textile, Uttara Finance, Standard Insurance, Karnaphuli Insurance, Federal Insurance, UCBL, Meghna Cement and Asia Pacific Insurance. The day's prominent losers included AIBL First Mutual Fund, Standard Ceramics, Savar Refactories, Meghna Pet, Dulamia Cotton, Chittagong Vegetable, BSC, Hakkani Pulp and Papers, Rupali Bank and Reckitt Benckiser Bangladesh Ltd. Meanwhile, the man blamed for the last year's major stock falloff stepped down from his post at the Securities and Exchange Commission (SEC) in a development that could assuage investors' worry, officials said.

SEC chairman Ziaul Haque Khondker told reporters Wednesday that Mr. Alam resigned Tuesday from his post on "personal grounds" and the Finance Ministry accepted his resignation letter. He also said that the authority sent his resignation letter to the Ministry of Establishment Wednesday. His resignation came weeks after controversial personal directive cause a major fall in the share market on December 08 last year. Dhaka Stock Exchange's benchmark DGEN index sank more 6.37 per cent of 547 points in the first 80 minutes of trading on December 8, in a day of extreme volatility that saw market regain most of the losses in late hours to close at minus 1.56 per cent.

The steepest fall sparked wildcat street protests in Dhaka and half a dozen district towns by thousands of retail investors who sniffed conspiracy by a "vested group" in the sudden stocks fall. Investors blamed two SEC orders that barred execution of share buying before cashing of cheques and misuse of netting facilities for the plunge.

News: Financial Express/Bangladesh/13 Jan 2011

Investors recent at merchant banks’ failure to give loan at 1:2

Stock market investors demonstrated in different merchant banks and brokerage houses in the capital yesterday against the latter’s failure to supply loan in line with the Securities and Exchange Commission’s (SEC) new directive.

The SEC, market regulator, on Monday increased the ratio of share credit to 1:2 from 1:1.5 to increase purchasing power of the stock investors.

The decision was followed by a massive 660-point fall in the key index of the Dhaka Stock Exchange (DSE) on Monday that prompted its regulator to suspend trading.

Investors’ demonstration led to a trade suspension of Al-Arafah Islami Bank and IDLC Securities for some time as lenders could not supply credit in line with the new directive yesterday.

Ekramul Haque, managing director of Al-Arafah, told daily sun they could not provide with loan at the new credit ratio due to fund shortage. “We will be able to overcome fund shortage by February”, he added.

Besides, Prime Bank Investment and Uttara Finance and Investment also faced demonstration for this.

BRAC EPL Investment Limited confessed that it could not provide loan following the new directive for fund shortage.

Small scale investors also alleged that merchant banks and brokerage houses gave loans to the bigwigs instead of them.

“We do not have Aladdin’s magic lamps that over night we can manage enough fund to meet the investors’ demand, said a merchant banker preferring not to be named. “The problem will be resolved but it will take time”.

Money market is still tight as the lenders are borrowing money at high rate fixed by the central bank, said Akter H Sannamat, managing director of Prime Finance and Investment Ltd.

Source: Daily Sun/ Bangladesh/ Jan-12-11