Bangladesh Bank should intervene to restore stability in the trouble-hit Islami Bank Bangladesh Ltd and avoid spillover impact on the entire banking industry, analysts said yesterday.

IBBL has been going through massive changes – from the owners to the board, committees and top management – for the past one year.

Two independent directors of the bank—vice chairman Syed Ahsanul Alam and chairman of the risk management committee Abdul Mabud—resigned from the board on Thursday, two days after their removal from their executive posts.

A group of seven directors have threatened to quit their jobs en masse if any of them is forced to step down.

The recent rift in the board has got a lot of attention from the businesses, the bank's depositors and the banking community as a whole.

Yet, Bangladesh Bank, the country's banking regulator, has kept mum on the issue.

“The situation demands a statement from Bangladesh Bank,” the Centre for Policy Dialogue (CPD) said yesterday in its review on the economy.

“The central bank needs to play an important role on the matter. But we are not seeing any clear statement or role from the central bank,” CPD Executive Director Fahmida Khatun said at a media briefing at Brac Centre Inn in the capital.

The think-tank said a number of recent developments have created concerns about the smooth functioning of Islami Bank and its future. The CPD listed the concentration of shares into the hand of a single owner-borrower as one of the key concerns.

“An orderly transition in the bank is urgently required,” the CPD said, adding that the central bank has a role to protect the interest of depositors and borrowers of the bank and improve its governance.

Ahsan H Mansur, executive director of the Policy Research Institute (PRI), another think-tank, said the government itself is taking the bank towards collapse by appointing some unfit people to the board.

The fate of IBBL, the country's largest and best private commercial bank, will be similar to that of state banks because of political interference, he said. He said BB was opposed to the changes but overruled by the government. So, BB has nothing to do other than remaining silent.

Mansur suggested the central bank be more cautious about the loans being approved by the board.

“It should strengthen the monitoring so that loans don't go to the same people or the people close to the board members.” “The big challenge for the central bank will be to stop loan irregularities of the bank,” he said.

Biru Paksha Paul, former chief economist of the central bank, said it is the central bank's responsibility to look into the disorders in a bank.

Khatun of the CPD said there was allegation against the IBBL that it was involved in terror financing and funding political violence, and the government took steps against it.

She said the CPD welcomed the government move up to the point. She said investigations must take place if any of the bank's activities had harmed the country or the people and were against the spirit of independence.

The bank has reached a stage in the last two years that it is now facing many problems, said the economist, adding that when the largest borrower becomes the largest owner then it becomes a problem for the bank's corporate governance.

Mirza Azizul Islam, a caretaker government adviser, however, said BB should not make public statement over the recent crisis of IBBL at the moment.

“The central bank should allow the ongoing internal change at IBBL and observe the situation,” he said.

He suggested BB strengthen the monitoring of IBBL's loan activities and take internal measure to restore peace within the organisation.

news:daily star/28-may-2017

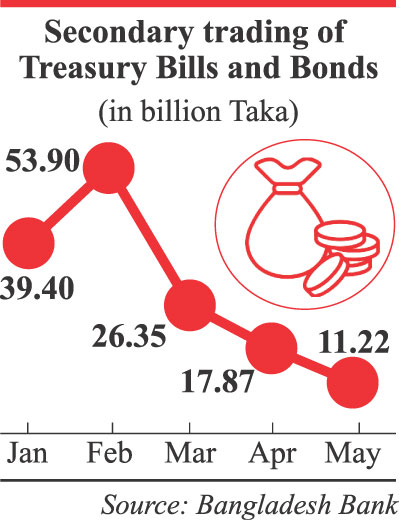

The government has planned to introduce a buyback arrangement for its securities to bring dynamism in the secondary market, officials said.

The government has planned to introduce a buyback arrangement for its securities to bring dynamism in the secondary market, officials said.