New Service

BB offers online fund transfer

Employees of different organisations and firms now can draw their salaries from their bank accounts under an electronic fund transfer (EFT) network of 40 banks that the central bank introduced yesterday.

Bangladesh Bank (BB) Governor Atiur Rahman formally inaugurated the paperless system at the central bank premises after the introduction of an automated cheque processing system last year.

The new system will enable any corporate customer to pay salaries to its employees through accounts in different banks.

The central bank governor said the step is a milestone in making the banking sector of Bangladesh more technology-dependent, automated and customer friendly.

In the first phase, credit transaction has been introduced, while the debit transaction will start later, BB officials said at the inaugural function.

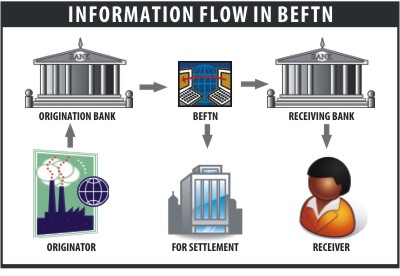

Rahman said, with the introduction of Bangladesh Electronic Fund Transfer Network (BEFTN), the customers will be able to do various transactions including electronic process payment of salary, overseas and local remittance and utilities' bill payment and government tax payment through the 40 banks.

He also said the system will be quicker and cost-effective compared to paper-based clearing system.

The banks will be able to provide internet and mobile banking facilities if they want, the governor added.

BB Deputy Governor Ziaul Hasan Siddiqui said the system will also quicken remittance transfer.

He said 30 percent of the remittance recipients are the clients of the banks of the network and the rest 70 percent are of other banks.

Siddiqui said, through the EFT the clients of other banks will also get remittances quickly.

BB Deputy Director Ali Kamran Al Zahid, who presented detailed information of the EFT to the journalists, said cheques and other paper-based payments are expensive and have increasing fraud risks, but electronic payments are more secured, fast and less expensive.

He said payment through cheque costs $1.2, while it is only 10 cents under the electronic system.

The automated system was introduced with the financing from the UK Department for International Development (DFID) under a project taken in 2006. As a part of it, initially the automated cheque clearing system was introduced in October last year in Dhaka.

The system came to effect in Sylhet in January this year, while in Chittagong in February.

The BB officials said about 80 percent cheques are now being settled through the automated system.

News: The Daily Star/ Bangladesh/ Mar-01-2011

Rupali Bank to go online in 6 months

Rupali Bank Limited, a state-owned bank will be turned into one of the best banks in the country in near future as the bank will take a number of initiatives to achieve the goal, chairman of the bank Ahmed Al-Kabir said. Mr Kabir said the bank will launch online services in six months as there is no option other than this to survive competition. He directed the corporate chiefs to complete the installation in time. He said customer-friendly environment in all branches of the bank will be ensured to earn faith from the customers so that they become interested to deposit bigger amount.

The chairman expressed the view at 'Conference-2011 of heads of corporate branches' as the chief guest where M Farid Uddin, managing director of the bank was present as the special guest. Enamul Islam Khan, general manager of the bank, presided over the conference. The chairman said personal behaviour of everybody should be decent and clients' needs must be fulfilled in consultation with seniors if required. He laid emphasis on professional training to serve the clients better service and achieve bank's goal.

The chairman said the bank will open ten GM offices within next six months. Jaglul Karim, deputy managing director, Kazi Mohammad Neamot Ullah, general manager, among others, spoke at the conference.

News: The Financial Express/Bangladesh/11 Feb 2011

BRAC Bank's new SME SMS Alert Service

BRAC Bank, one of the largest private banks in Bangladesh has recently introduced their new service SME SMS Alert service. This service has surely opened a new window to the consumers. Through this service BRAC Bank's consumers can now get alerts about their loan updates regularly. This service will alert the small and medium business holders about their payment date of installments and the confirmation message of the deposit. In this era of technology this initiative is a worthy one as people remain busy in their work most on the time. An SMS alert will make the consumers aware about their loans and bank can collect loan deposit from the customers more easily.

For more help and 24 hour service they have also started their customer care line and the number is 16221. BRAC is already providing its consumers the Evening Banking service in more than one branches. Besides, they have multiple card facilities amongst which Travel Prepaid card, VISA card facilities are mentionable.

BRAC Bank also established a Kidney Research Institute in Mirpur, Dhaka which is dedicated to help the poor people. This institution has been inaugurated in 2010 as a non profitable institution. Amongst so many social activities these are very popular and BRAC Bank is extending its activities nation wide.

BRAC Bank's online shopping facility in Bangladesh

For the first time ever in Bangladesh, BRAC Bank Ltd. (BBL) has launched Bangladesh's first e-commerce banking platform in alliance with Visa, thereby opening an opportunity for Bangladeshi citizens to use Visa cards for shopping online. Any Bangladeshi with internet access now can shop online with a Visa card or any card issued by BRAC Bank. Attending as the chief guest, Dr. Atiur Rahman, Governor of Bangladesh Bank, inaugurated the country’s first e-commerce banking system at a city hotel.

Md. A. (Rumee) Ali, Chairman of BBL, Syed Mahbubur Rahman, Managing Director and Chief Executive Officer of BBL and Uttam Nayak, Group Country Manager (India and South Asia) of Visa were present along with senior officials, leading merchants and clients.

“The central bank has continuously been facilitating bringing banking to the doorsteps of the general mass. This online shopping is another milestone in that journey. I am happy to inaugurate this service brought first time in Bangladesh and that too by a Bangladeshi bank,” the Banglaesh Bank Governor said.

Md. A. (Rumee) Ali, said, “I think this will pave the way for many companies to start doing business online.

This hopefully will be the start of online business revolution for Bangladeshi companies enabling them to keep up with the rest of the world and innovate how they interact with their customers.”

Uttam Nayak in his speech said that e-commerce would not only reduce cost of transaction but also save couple of hours rather than shopping physically.

E-commerce facilitates remote payments which are better than face-to-face payments, he said and adding it will give an opportunity to include more people in banking transaction, one’s who buying goods and other’s who selling goods.

Firoz Ahmed Khan, Head of Retail Banking, while demonstrating the new service features at the launching ceremony said that the new shopping platform would work just any other developed online stores work.

Consumers can browse and choose their products on either the online super-stores or individual shops and then they can add the products to their cards through checking out finally, they simply need to put their details from BBL or Visa card.

Online ticket booking with ones credit card and general retail purchases online have been something many credit card holders have been waiting to be able to do for years while many working Bangladeshis facing problems as the shops are normally closed at 8 pm., he said.

BRAC Bank online shopping is open for 24 hours making it possible for retail products, companies and stores to keep earning long after shopping hours are over, he added.

Refinancing Deal Signed between BB and Southeast Bank

Southeast Bank Limited signed a participatory agreement with Bangladesh Bank at the head office of the central bank to avail of refinancing facility for Small and Medium Enterprises Financing on Sunday. Mr. Mahbubul Alam, Managing Director of Southeast Bank Limited and Mr Sukamal Sinha Choudhury, General Manager, SME & Special Programs Department of BB signed the agreement on behalf of respective sides. Mr. Md. Harunur Rashid Chowdhury, Executive Director of Bangladesh Bank presided over the meeting.

Through this agreement Southeast Bank will be able to avail refinancing facility from an ADB supported fund amounting USD 95.00 million equivalent to Tk 6.67 billion. Bangladesh Bank has been entrusted with the responsibility to administer the fund. The fund will help Southeast Bank to widen and expand its SME lending program in rural and semi urban areas at a subsidized rate.

Senior officials of SME and Special Programs Department of Bangladesh Bank attended the ceremony. From Southeast Bank Mr. Mohammed Gofran, Deputy Managing Director, Mr. Panu Ranjan Das, Vice President, Mr. M.M. Khaled Omar, Senior Assistant Vice President & Head of SME, Mr. Donald Rosette, Assistant Vice President and Head of R&D were also present.

Source: Financial Express/Bangladesh/24 Jan 2011