BB offers online fund transfer

Posted by on Tue, Mar 01 2011 05:16 am

Employees of different organisations and firms now can draw their salaries from their bank accounts under an electronic fund transfer (EFT) network of 40 banks that the central bank introduced yesterday.

Bangladesh Bank (BB) Governor Atiur Rahman formally inaugurated the paperless system at the central bank premises after the introduction of an automated cheque processing system last year.

The new system will enable any corporate customer to pay salaries to its employees through accounts in different banks.

The central bank governor said the step is a milestone in making the banking sector of Bangladesh more technology-dependent, automated and customer friendly.

In the first phase, credit transaction has been introduced, while the debit transaction will start later, BB officials said at the inaugural function.

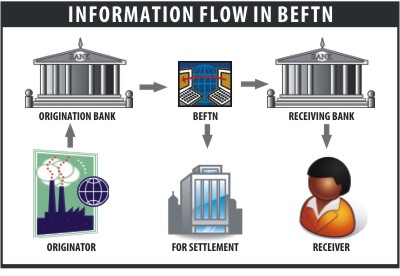

Rahman said, with the introduction of Bangladesh Electronic Fund Transfer Network (BEFTN), the customers will be able to do various transactions including electronic process payment of salary, overseas and local remittance and utilities' bill payment and government tax payment through the 40 banks.

He also said the system will be quicker and cost-effective compared to paper-based clearing system.

The banks will be able to provide internet and mobile banking facilities if they want, the governor added.

BB Deputy Governor Ziaul Hasan Siddiqui said the system will also quicken remittance transfer.

He said 30 percent of the remittance recipients are the clients of the banks of the network and the rest 70 percent are of other banks.

Siddiqui said, through the EFT the clients of other banks will also get remittances quickly.

BB Deputy Director Ali Kamran Al Zahid, who presented detailed information of the EFT to the journalists, said cheques and other paper-based payments are expensive and have increasing fraud risks, but electronic payments are more secured, fast and less expensive.

He said payment through cheque costs $1.2, while it is only 10 cents under the electronic system.

The automated system was introduced with the financing from the UK Department for International Development (DFID) under a project taken in 2006. As a part of it, initially the automated cheque clearing system was introduced in October last year in Dhaka.

The system came to effect in Sylhet in January this year, while in Chittagong in February.

The BB officials said about 80 percent cheques are now being settled through the automated system.

News: The Daily Star/ Bangladesh/ Mar-01-2011

Comments