Banking

IBBL signs remittance agreement with UAE Exchange of Malaysia

.jpg) Islami Bank Bangladesh Limited signed a remittance agreement with UAE Exchange of Malaysia on providing safe and rapid remittance services to expatriate Bangladeshis through banking channel

Islami Bank Bangladesh Limited signed a remittance agreement with UAE Exchange of Malaysia on providing safe and rapid remittance services to expatriate Bangladeshis through banking channel

The agreement was signed in presence of Mohammad Abdul Mannan, Managing Director of the bank, said a

press release. Bazlur Rahman Khan, Director, UAE Exchange, Md. Mahbub-ul-Alam, DMD of the bank and

Sontosh Nayar, CEO, UAE Exchange of Malaysia signed the agreement on behalf of their respective sides at Islami Bank Tower recently.

News:Daily Sun/1-Apr-2014UCBL goes green by using high-tech in EC meeting

United Commercial Bank Limited has gone green with utilization of technology as its Executive Committee held a complete paperless meeting on Sunday.

The meeting focused on more usage of technology and less paper-work as part of the bank’s move of going green, said a press release.

Anisuzzaman Chowdhury, Chairman of Executive Committee of the bank presided the meeting.

EC members and directors Showkat Aziz Russel, MA Sabur, Md. Janhangir Alam Khan and Shabbir Ahmed and Managing Director Muhammed Ali were present.

UCBL has been ‘going green’ through unitilising technology in the meeting of senior management since the

previous one where video conferencing technology was used to communicate with managers in different

regions. UCB aims to take more green initiatives which will ensure less paper consumption through adapting better technology.

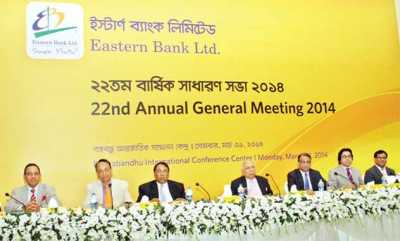

News:Daily Sun/1-Apr-2014EBL declares 20pc cash div

Eastern Bank Limited (EBL) declared 20 percent cash dividend for its shareholders for the year 2013.

The announcement came at the 22nd Annual General Meeting of the bank on Monday, said a press release.

The AGM unanimously approved 20 percent cash dividend for the shareholders. M. Ghaziul Haque, Chairman of the Board of Directors of the bank presided over the meeting.

Mir Nasir Hossain, A.Q.I. Chowdhury, OBE, Meah Mohammed Abdur Rahim, Asif Mahmood, Ormaan Rafay

Nizam, Gazi Md. Shakhawat Hossain, Directors, Ali Reza Iftekhar, Managing Director and CEO and Safiar

Rahman, Company Secretary of the bank and a large number of shareholders attended the AGM. M. Ghaziul

Haque presented the Directors’ Report and Financial Statements for the year 2013 and replied to various queries from shareholders.

Amid intense competition, EBL continued to maintain its growth both in terms of business volume and

profitability, the meeting was told. In the year 2013, the bank earned 5.94 percent profit and its total assets

stood at Taka 157,882 million at the end of 2013, which is 7.29 percent higher than the previous year.

During the year, the profit before tax has grown by 14.60 percent to Taka 4,836 million.

Southeast Bank declares 21pc dividends

Southeast Bank Limited declared 16 percent cash and 5 percent bonus dividends for its shareholders for the year 2013.

The announcement came at the 19th Annual General Meeting (AGM) of the bank held at Bashundhara Convention Centre-2 at Baridhara in Dhaka on Monday.

Bank’s directors, sponsors and large number of shareholders attended the meeting.

Alamgir Kabir, FCA, Chairman of the bank, presided over the AGM.

Shahid Hossain, Managing Director of the bank in his address highlighted the bank’s operational performance in 2013 and outlined the future plans and programmes undertaken by the bank to boost up operational efficiency and profitability of the bank.

The AGM discussed the bank’s operational performance. The bank earned an operating profit of Tk 6,700.20 million in 2013.

As on 31st December, 2013, the bank’s total deposits amounted to Tk 177,519.46 million, total assets reached Tk 220,930.85 million. Its Earning Per Share (EPS) was Tk.3.87 (consolidated), Net Asset Value Per Share was Tk 25.11 (consolidated) and Net Operating Cash Flow per share was Tk.23.58 (consolidated).

The Price Earning Ratio of the bank was 4.68 times in 2013. The Capital and Reserves of the bank soared to a record high of Tk 21,807.57 million as on 31st December 2013.

The shareholders approved 16 percent cash dividend and 5 percent stock dividend and also the financial statements of the bank for the year 2013. Shareholders also elected directors and approved appointment of external auditors for the year 2014.

The 18th AGM of Dutch-Bangla Bank held

Dhaka- The 18th Annual General Meeting (AGM) of Dutch-Bangla Bank Limited was held on March 30, 2014 at

Officers Clttb, Baily Road, Dhaka utttfer fh^ Chairmanship of Mr. Abedur Rashid Khan, Chainnan, the Board of Directors of the

Bank. The honorable Chairman welcomed the honorable Members present in the AGM, reports in a press

release.

The bank declared Cash Dividend @ 40% (i.e. Taka 4 per share of Taka 10 each) for the General Public

Shareholders and Foreign Sponsors/ Shareholders for the year 2013. The Local Sponsors of the Bank will not receive any dividend. A

good number of members participated in the discussion on the overall performance of the Bank in the AGM.

Among others, Directors of the Board including Mr. Say em Ahmed (Chairman, Executive Committee of the

Board), Mr. Md. Fakhrul Islam, Dr. Irshad Kamal Khan, Mr. Chowdhury M. Ashraf Hossain, Mr. Md. Yeasin Ali, the Managing Director

of the Bank Mr. K. S. Tabrez and Company Secretary Mr. Md. Monirul Alam, PCS were present in the AGM. Mr.

M. Sahabuddin Ahmed, Founder of Dutch-Bangla Bank & Chairman of Dutch-Bangla Bank Foundation was also present in the meeting.

The Financial Statements of the Bank for the year ended December 31, 2013 were placed before the meeting

and the members made a critical review of the performance of the Bank. The honorable members expressed

their satisfaction with the activities of the Bank during the year 2013.

The honourable Shareholders also praised the Bank Authority for declaring highest cash dividend of 40% for 2013 within all listed banking companies.

The deposit of the Bank increased by 15.8% from Tk.125,433.1 million in 2012 to Tk.145,230.1 million in

2013, while loans & advances increased by 16.1% from Tk. 91,648.9 million in 2012 to Tk.106,422.8 million in 2013 and foreign-trade business increased by 6.2%.

The Bank earned net profit after tax of Tk.2,000.8 million in 2013 as against Tk.2,314.1 million in 2012.

Capital Adequacy Ratio stood at 13.7%, as against 12% in 2012, that was well above 10.0% minimum regulatory requirement as per Basel-II.

The meeting unanimously reappointed M/s. Hoda Vasi Chowdhury & Co. as the auditor of the Bank for the year 2014.

News:Bangladesh Today/2014