Banking

Rupali Bank holds business confce

Rupali Bank Limited organised Annual Business Conference-2014 at a hotel in Cox’s Bazar on Sunday.

Dr Ahmed Al Kabir, Chairman, Rupali Bank Limited, was present as chief guest while M Farid Uddin was present as special guest, said a press release.

Directors of the bank Abu Sufian and AKM Delwar Hossain, Deputy Managing Directors Abu Hanif Khan and Khalilur Rahman Chowdhury, General Mangers Arifur Rahman and Hosne Ara Begum attended the meeting.

Training on BLP begins in Al-Arafah Islami Bank

A week-long training course on “Banking Laws and Practices” (BLP) organised by Al-Arafah Islami Bank Ltd began at Al-Arafah Islami Bank Training and Research Academy on Sunday.

Md. Habibur Rahman, Managing Director of the bank inaugurated the course as chief guest, said a press release.

Md. Zahid Hasan, Principal of the training institute was also present on the occasion.

General Banking, Foreign Exchange and Investment desk related officials of selected branches of the bank participated in the course.

Sonali profits plunge 70pc

Overcautious lending following Hall-Mark scam causes profits to nosedive in 2013

Sonali Bank continues to reel from the after-effects of the Hall-Mark scam unearthed about two years ago, with its operating profits in 2013 plummeting as fear-gripped officials hesitate to give out fresh loans.

The bank's full-year operating profits fell 70 percent to Tk 330 crore in 2013 from the previous year.

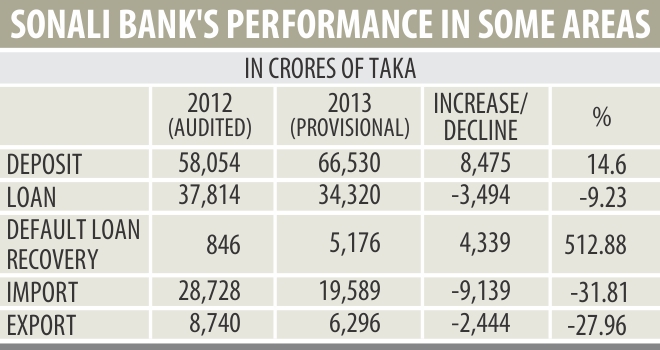

Pradip Kumar Dutta, managing director of Sonali Bank, said the major reason behind the drop in profits is the huge mismatch between deposits and credit. In 2013, the bank's deposit rose by about 15 percent but its loan portfolio shrank 9.23 percent.

The bank faced a severe crisis in liquidity management last year and even failed to maintain the mandatory cash reserve requirement ratio, which led to fines of around Tk 82 crore from the central bank.

To overcome the liquidity crisis, Sonali took a large amount of deposits at high interest rate in 2013, for which it had to pay Tk 600 crore more in interests.

“However, the bank's liquidity situation has improved now,” he said, adding that the bank currently invests Tk 4,000 crore to Tk 5,000 crore on average every day in the call money market.

The fall in commission from international trade financing is also to blame. Last year, the bank's import business slid 31.81 percent and export business 27.96 percent in comparison to 2012, causing its non-interest revenues to fall by Tk 380 crore from 2012's amount.

However, it was not all doom and gloom for the bank: not only did its default loans drop 23.48 percent in 2013, its recovery of default loans was at Tk 4,330 crore, which is 511 percent higher than in 2012. In 2013, the bank's default loans stood at Tk 9,638 crore.

Subsequently, the bank did not have any shortfall in capital and provisioning; rather it had a surplus in the two categories.

“Last year was the year of default loan recovery,” M Aslam Alam, secretary of the finance ministry's banking division, said at the bank's annual conference yesterday at the capital's Hotel Sonargaon.

He, however, termed the bank's accomplishments in 2013 “one dimensional and not multi-dimensional”, while calling for improved performance in all indicators.

The banking division secretary went on to call out the branch managers for their proclivity for deposit collection and disinterest for giving out fresh loans, due to which the profits took a massive hit.

“It is not acceptable that banks will collect deposit and keep it idle. It must be invested,” Finance Minister AMA Muhith said at the conference.

Sonali Bank Chairman AHM Habibur Rahman, however, acknowledged that many bank officials are afraid of giving out fresh loans due to the Hall-Mark scam.

“It is not proper to avoid risk by not giving fresh loans using the scam as an excuse,” he said, adding that loans have to be given by following rules properly and then there will be no problem in future.

He further said 2012 was a year of disaster for Sonali Bank due to scams involving the Hall-Mark Group, which left the state-run bank's image badly dented.

“After the new board took office, it fixed 2013 as the year of restoring the image. The bank is now overcoming the danger situation. Now the condition is gradually improving.”

Crackers break into Sonali security, steal $2,50,000

Crackers broke into the Sonali Bank computer network and transferred at least $250,000 in the middle of 2013, a senior official said on Sunday.

M Aslam Alam, secretary (bank and financial institutions division) of the the finance ministry, divulged the scam in the presence of the finance minister, Abul Maal Abdul Muhith at the bank’s annual conference at the Sonargaon Hotel.

Aslam identified loopholes in the bank’s risk management system. ‘The bank has various risk factors which need to be properly identified and resolved.’

He said the looting of money from the bank’s Kishoreganj branch by digging a tunnel, breaking the password and loss of $0.25 million of the bank and inoperative closed circuit television cameras in the head office were all related to the risk management inefficiency.

Aslam criticized the bank’s business model by saying that ‘historically, Sonali Bank provided loans for corporate houses most of whom have became defaulters. The bank should change its business model and provide loans for small and medium enterprise across the country.’

He said that bank executives were enthusiastic about collecting deposits but were reluctant to disburse loans. ‘Such an attitude resulted in a negative loan and advance performance and a poor performance in earning operating profit in 2013,’ he said.

Aslam’s statement followed a series of fund embezzlement scams, including the one involving Hallmark loan.

Muhith said that the Sonali Bank loan scam incidents in 2012 had happened for lack of efficiency in internal control system of the bank.

‘To increase customer confidence in the bank the bank, the management should concentrate on increasing its internal control system,’ the minister said.

Muhith warned of the hassle of online banking saying that the bank should be aware of technical glitches of online banking.

The finance minister expressed his satisfaction about the banking sector performance saying that ‘the banking sector now stands on a strong footing with satisfactory expansion.’

The Sonali Bank board of directors chairman, AHM Habibur Rahman, presided over the conference where the bank’s managing director Pradip Kumar Dutta spoke.

The secretary identified the introduction of core banking as a serious challenge for the bank.

He said that risk management was not only a theoretical issue. ‘it is very much a practical one.’

Habibur Rahman admitted that the bank have the faults that the secretary identified and said the bank would now focus on SME.

He said that the Hallmark scam had happened because of the involvement of some unscrupulous bank officials.

He said that the bank had come out from the image crisis it suffered because of the Hallmark scam and it was giving priority to the recovery of defaulted loans and further business development.

The managing director gave picture of the bank’s performance in 2013 at the conference.

ONE Bank opens branch in Kushtia

ONE Bank Limited opened its 70th branch in Kushtia on Sunday.

Sayeed H. Chowdhury, Chairman, ONE Bank Limited, inaugurated the branch, said a press release.

Administrator of Zila Parishad of Kushtia Zahid Hossain Zafor, President of Kushtia Chamber of Commerce Alhaj Abul Kashem, Board of Directors of the bank Zahur Ullah, Kazi Rukunuddin Ahmed, Managing Director M. Fakhrul Alam and Senior Executives of the bank were present.