Banking

Premier Bank awards winners

Premier Bank Limited organised a prize giving ceremony to celebrate another successful campaign namely Locker Campaign-Magic Box recently.

The campaign was organised by the Retail Banking Division of the bank, said a press release.

Al-Arafah Islami Bank holds workshop

A day-long Workshop on “AML & CFT issues for BAMLCOs” was held at Al-Arafah Islami Bank Training and Research Academy (AIBTRA) on Tuesday.

Md. Habibur Rahman, Managing Director of Al-Arafah Islami Bank Limited inaugurated the workshop as chief guest, said a press release.

News:Daily Sun/19-Feb-2014

Pubali Bank launches VISA Debit Card

Pubali Bank Limited (PBL) on Tuesday announced the launching of VISA Debit Card for its customers.

Pubali Bank Limited (PBL) on Tuesday announced the launching of VISA Debit Card for its customers.

Helal Ahmed Chowdhury, Managing Director and CEO of Pubali Bank Limited inaugurated the launching of VISA Debit Card as chief guest.

Speaking on the occasion, Helal Ahmed Chowdhury said that ‘Pubali Bank is committed to tender smart and convenient banking services to its clients in the fastest possible time. As a step of fulfilling the commitment and based on clients’ augmented demand presented the VISA Debit Card’.

He also added that customers may use their VISA Debit Card for shopping at Point-of-Sale merchants, for transacting on the internet as well as perform Cash Withdrawal, balance enquiry and generating mini statements from any VISA ATM.

Bad loan writing off norms set for micro lenders

The microcredit regulator has for the first time formulated a guideline on writing off bad loans for micro-finance institutions.

Presently, there is no specific guideline on writing off classified or bad loan for MFIs having loan recovery record of around 90%.

The Microcredit Regulatory Authority (MRA) recently formulated a uniform guideline to bring discipline in the credit disbursement system.

Under the new guideline, classified loans that remain as bad loans for two years and are kept as 100% provisioning will be eligible for writing off.

The oldest classified loan will have to be written off first and, if any fake or unidentified loan is found, the concerned institutions must inform the regulator before writing it off.

Approval of the board of directors of the institution requires before writing off the loan, and such writing off will have to be made either on June 30 or December 31 each year.

Even after writing off a loan, the MFIs will have to continue making efforts to realise the loan and after such loan realisation, they have to be shown as earnings.

Md Shazzad Hossain, a director of MRA, said microcredit institutions have a recovery record of more than 90% in Bangladesh. “From this point of view, that’s not important to make a write off guideline.”

What the MRA has been trying to do is to put the industry on the right track since its inception, he said.

“New rules and regulations is a step forward to develop the industry in accordance with the international standards.”

Since its inception in 2006, the MRA has been continuously making efforts for creating an enabling environment in the microfinance industry for its sustainable development by formulating new rules and regulations.

Bangladesh has become the first country in the world to establish a separate entity, MRA, under a separate act to license, monitor and oversee the MFIs, as microfinance had been a private sector initiative all along and flourished without any formal regulatory entity from the government in most parts of the world.

Though Bangladesh has been the pioneer of microcredit, it lagged behind some countries in enacting a regulatory framework for this sector. Over the years, it has brought a number of changes in its rules and regulations.

Presently, there are 732 MFIs or NGOs under MRA operating in the country. Of the MFIs, only five are very large, 21 large, 115 medium, and rest are small ones.

The country’s first microfinance institution Bangladesh Rural Advancement Committee (BRAC) was established in 1972 through which microfinance activities had started in Bangladesh.

News:Dhaka Tribune/18-Feb-2014

Banks divert investment to risk-free government securities

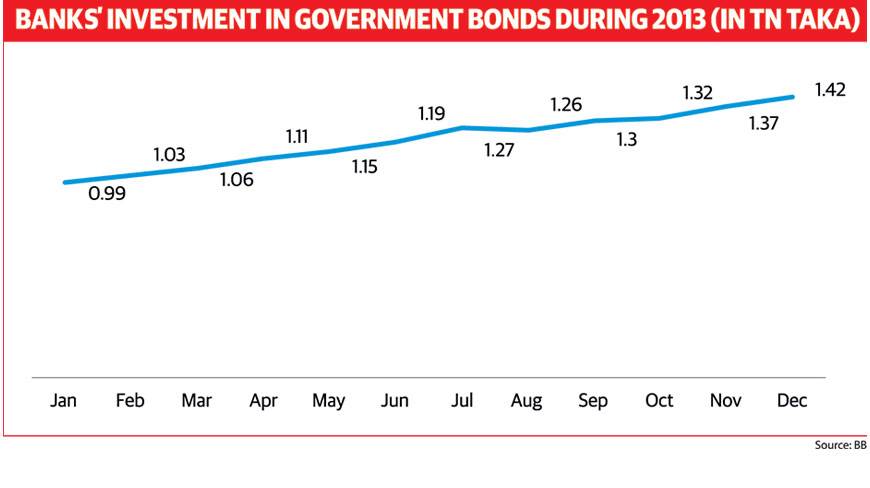

The investment of banks in the government securities increased by 43% year-on-year in January this year as private sector entrepreneurs were reluctant to take loan due to sluggish business climate.

It increased to Tk141,942 crore in January 2014 over the last 12-month period from Tk99,000 crore in January last year, according to latest Bangladesh Bank statistics.

During the period, private sector credit growth increased by 13% to Tk783,709 crore, which is much less than the monetary policy target.

The country’s commercial banks are awash with excess liquidity due to less than expected investment amid lower credit demand with almost all kinds of business expansion remained suspended amid political uncertainty ahead of the general election held on January 5.

As a result, banks increased their investment in the government securities instead of keeping the money idle, said a Bangladesh Bank senior executive.

“Bangladesh Bank is selling the government securities keeping in mind whether the government would face interest burden,” Deputy Governor SK Sur Chowdhury told the Dhaka Tribune yesterday.

Excess money after maintaining statutory liquidity ratio (SLR) in the banking system as of January 9 this year stood at Tk89,337 crore, including Tk79,000 crore or 88.5% remained invested in the government securities.

“The banks are not bound to invest in government securities, but they invested here for risk-free return,” said a senior executive of a private bank. “The amount of investment increased when the banks considered it risky to invest in private sector due to political turmoil.”

The banks get around 10% interests on investment in government securities against an average of above 15% they could get through lending otherwise.

“Lending to private sector has the risk of becoming classified, but there is no risk of investment in government securities,” Bangladesh Bank Executive Director Mahfuzur Rahman told the Dhaka Tribune.

Banks can lend up to 81% of their liquidity. It was about 56% in case of the state-owned banks till December 13 last while about 78% for private commercial banks.

The investment in government securities in the first quarter of last year increased by 7% to Tk100,000 crore when private sector credit posted negative growth by 0.15% to Tk425,000 crore.

The quarterly credit growth in the government securities increased by 6.45% to Tk118,000 crore in June last year, followed by 2% to Tk130,000 crore in September and 7.1% to Tk141,000 in December while private sector credit growth increased by 2.7% to Tk446,000 crore, 1% to Tk442,000 crore and 2.6% to Tk 463,000 crore respectively.

The excess liquidity increased by Tk29,000 crore or 48% last year to stand at Tk89,000 crore in January 2014 from Tk60,000 crore in the same month last year.

News:Dhaka Tribune/18-Feb-2014