The finance ministry has for the first time set 13 annual performance targets for the 14 state-owned financial institutions, including banks, to make them accountable.

A binding agreement was signed yesterday by the chairmen and managing directors of the 14 institutions, and Banking Secretary M Aslam Alam.

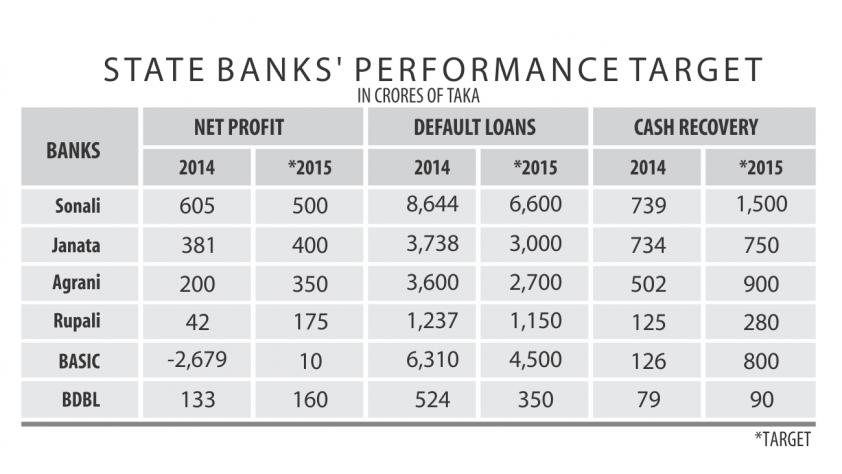

In the agreement, the banks were given various targets for 2015, in regard to the reduction of default loans, cash recovery, profit and loan growth.

For evaluation, the banks will be given points from a total of 100 for their performance at the year's end.

For hitting the automation target, the institutions can score 20 points; for reducing default loans 10 points, and another 10 points for cash recovery from defaulters. Ten points can also be scored for making profits.

The binding agreement is similar to the ones secretaries recently signed in the presence of Prime Minister Sheikh Hasina for improving performance of ministries, Alam said.

As an extension of that agreement, the financial institutions under the finance ministry had to sign another one, he added. Finance Minister AMA Muhith said the initiative has been taken for modernisation and reform.

It would increase accountability of the institutions, which, in turn, would help enhance people's trust on them, he said.

Agrani Bank's Chairman Zaid Bakht told The Daily Star that the targets are challenging but achieving them will not be impossible; the banks will have to put in their best efforts.

“It is challenging in the sense that realising loans from top defaulters is very difficult.”

If the banks take initiatives to recover loans from big defaulters, they file writ petitions with the higher court, which stalls loan recovery.

Sonali Bank

In the performance criteria in 2015, Sonali Bank's total loans cannot exceed Tk 30,500 crore, which is 5.41 percent more than the previous year.

It would have to realise a minimum of 5 percent from its written-off loans and raise the number of its automated branches to at least 500 by 2015. In 2014 the number of such branches was 120.

The bank also cannot have more than 35 loss-making branches; it had 31 loss-making branches in 2014.

Janata Bank's total loans cannot increase more than 6.67 percent over that of 2014's. The bank had loans amounting to Tk 29,059 crore in 2014.

Also, it would have to collect 5 percent from its written-off loans.

Janata Bank should have 500 automated branches by this year; it had 174 such branches until December 2014.

Agrani Bank

Agrani Bank can increase its loans by 10 percent in 2015 over 2014's; its total loans would stand at Tk 23,000 crore.

Its capital adequacy ratio would be 11 percent, which was 10.10 percent in 2014. The number of its automated branches should reach 800 by this year.

Rupali Bank

Rupali Bank's loans cannot rise more than 12.54 percent year-on-year, or beyond Tk 13,500 crore, in 2015. At present, it has only two automated branches; that number has to be increased to 300 this year.

Other than these four banks, BASIC Bank, Bangladesh Development Bank Ltd, Krishi Bank, Rajshahi Krishi Unnayan Bank, Karmasangsthan Bank, Ansar-VDP Bank, Probashi Kalyan Bank, House Building Finance Corporation, Jiban Bima Corporation, and Sadharan Bima Corporation also signed the agreement.

News:The Daily Star/10-Apr-2015

Senior Vice President & Head of Retail Banking of

Senior Vice President & Head of Retail Banking of