The government is set to form two institutions -- a bank and a separate entity -- for running the pension fund for public servants, after the cabinet gave it the green light.

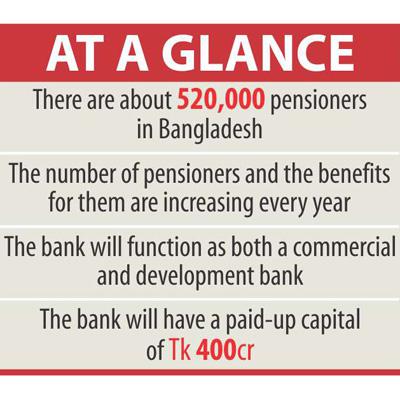

At present, there is no specific authority for doing the pension-related work of about 520,000 pensioners in Bangladesh.

Subsequently, the latest Pay and Service Commission recommended setting up a bank that will have all the serving and retired government employees as shareholders.

The bank will function as both a commercial and development bank.

To be called Samriddhi Sopan Bank, the bank will be set up under the government employees' welfare board and will have a paid-up capital of Tk 400 crore.

The next steps will be taken through a joint decision of the public administration ministry, and the finance and the banking divisions.

The finance ministry in its proposal in light of the recommendations of the Commission suggested setting up a separate office under the finance division.

The International Monetary Fund also recommended the government take a separate initiative for the pension-related works, as the number of pensioners and the benefits for them are increasing every year.

The benefits for the pensioners have been raised much under the new pay scale too.

To pay the additional facility granted to the pensioners under the new pay scale, an extra Tk 3,691 crore will be required on top of the allocation of Tk 6,981 crore in this year's budget, according to the finance ministry.

At present, the pensioners get 80 percent of their last basic salary, which has been raised to 90 percent under the new pay scale.

The minimum net pension has been fixed at Tk 3,000.

There will be Tk 1,500 monthly as medicare allowance of up to 65 years of age; the existing amount is Tk 700.

For the over-65s, it will be Tk 2,500 instead of the existing amount of Tk 1,000.

The commission recommended allowing a government employee to take up voluntary retirement after 20 years in service. But, it has been kept unchanged at existing 25 years.

The age for going into retirement due to physical inability has been set at five years of service instead of existing 10 years.

The IMF has made an analysis on the basis of the existing pay scale and advised the implementation of a contributory pension scheme for civil servants to replace the current non-contributory regime.

It also recommended reforms to the government pension fund via the creation of notional accounts and an investment fund to accumulate the system's assets.

Consideration could also be given to institutionalising a non-contributory pension regime for the poor, as the existing transfer mechanisms to the elderly poor are very low.

News:The Daily Star/14-Sep-2015

Chairman of the board of directors of

Chairman of the board of directors of Muklesur Rahman, managing director and CEO of

Muklesur Rahman, managing director and CEO of