Banking

Farmers Bank hits controversy

Rubel Brothers and Apollo Multipurpose Agro Industries are loan defaulters of state-owned BASIC and Janata banks respectively and yet had no trouble getting fresh loans from the Farmers Bank.

The bank itself managed fake credit information bureau reports for the two clients to enable them to qualify for loans, Bangladesh Bank said in a report.

This is part of a long list of irregularities that the newly-established bank indulged in. The bad lending practices have now come out in the open after a central bank study.

The BB carried out special inspections into the bank's Gulshan, Motijheel and Shyampur branches between September and November last year and found irregularities in sanctioning loans that amount to Tk 400 crore.

The central bank had warned the bank's directors, including Muhiuddin Khan Alamgir, chairman of the lender's board and a senior leader of the ruling Awami League, on these irregularities. The BB also asked the bank to punish the corrupt officials, but they did not pay heed to the advice.

Depositors are at risk as the bank has failed to follow the rules and regulations in sanctioning and disbursing loans, SK Sur Chowdhury, deputy governor of the BB, said yesterday.

The investigation found that the bank had concealed its classified loans to inflate profits and resorted to irregularities in recruitment.

For example, the bank disbursed loans of Tk 38.26 crore to six companies -- EBL Securities, International Securities, Prime Islami Securities, Kazi Equities, BD Securities and Union Capital -- but marked them as investment.

This is a punishable offence.

Its Motijheel branch disbursed about Tk 27 crore loans to three companies, including non-existent Anamika Enterprise, without taking proper collateral.

Rubel Brothers, which had defaulted on Tk 48 crore loans from BASIC Bank, borrowed Tk 4 crore from the Motijheel branch of Farmers Bank in May 2014 by way of fake credit reports.

In July 2014, the bank sanctioned Tk 13.5 crore for Apollo Group although its sister concern Apollo Multipurpose Agro Industries is a defaulted client of Janata Bank.

The client, after taking the loan, paid Tk 3.2 crore to Janata Bank to regularise the loan defaults of Apollo Multipurpose Agro Industries, according to the BB report.

The branch also issued loans of Tk 1.81 crore to Adurey Housing concealing the fact that the company was a loan defaulter.

The central bank also detected anomalies in Tk 143 crore loans given by the bank's Gulshan branch between 2014 and 2015.

The branch increased the cash credit limit of little-known Rom and Hus Enterprise to Tk 45 crore from Tk 10 crore between February 26 and June 6, 2015.

Influenced by Mahabubul Haque Chisty, chairman of the bank's executive committee, the lender sanctioned Tk 20 crore to MS International that had assets worth only Tk 1.15 crore and equity of Tk 69.56 lakh.

Chisty also gave Tk 17 crore to Emerald Foods against collateral of Tk 3.51 crore.

Shyampur branch of the bank disbursed Tk 30 crore to Laila Bonospoti taking Tk 8.15 crore as collateral securities and Tk 30 crore to Global Trading Corporation without adequate mortgage.

The branch disbursed Tk 17 crore to Al-Ferdous Re-Rolling Mills and Sami Enterprise violating the banking rules, the report said.

The companies repaid the non-performing loans of Tk 2.3 crore to Sonali Bank from the credit and diverted a big amount of the fund to other projects, said the report.

The branch sanctioned Tk 19 crore for Barek Ware Industries and Engineering Works, over Tk 10 crore to East Way Fashion and Tk 3 crore to Safa Community Centre without following due diligence.

On the irregularities, Muhiuddin Khan Alamgir, chairman of the Farmers Bank, said: “We are examining the BB reports. We have time until the 12th of next month to take actions against the officials responsible for the irregularities.”

He said it is not just his bank that is under the BB scanner: a total of 17 banks were investigated.

News:The Daily Star/19-Jan-2016NBL holds meeting on credit management

AFM Shariful Islam, Managing Director (Current Charge) of National Bank Limited presiding over a discussion meeting on credit management at NBTI in the city on Saturday.

Economic Reporter :National bank Limited on Saturday organised a meeting with a view to expediting the approval and distribution process of loan.CRM, Divisional Heads, Regional Heads selected Branch Managers with top management of National Bank Limited took part the meeting at NBTI in the city on Saturday.A F M Shariful Islam, Managing Director (Current Charge) of the bank presided over the meeting. Syed Mohammad Bariqullah, M A Wadud, A S M Bulbul and Wasif Ali Khan, Deputy Managing Directors, all divisional heads, regional heads, executives and officers of CRM of the bank were presented their views on various issues.A F M Shariful Islam, Managing Director (Current Charge) of the Bank in his speech expressed to Managers, Executives and Officers of the Bank for concerted and proactive efforts for improvement of asset quality and risk management for enhancement of sustainable profitability of the Bank. For upholding the top as well as strong position in the Banking Sector, NBL will continue to upgrade quality of customer services further and ensure proper use of human resources. NBL has been embarking on a higher level of operational and service delivery platform integrating world-class core banking technology solution, which will lead the bank to a challenging positioning in the banking sector, he also added

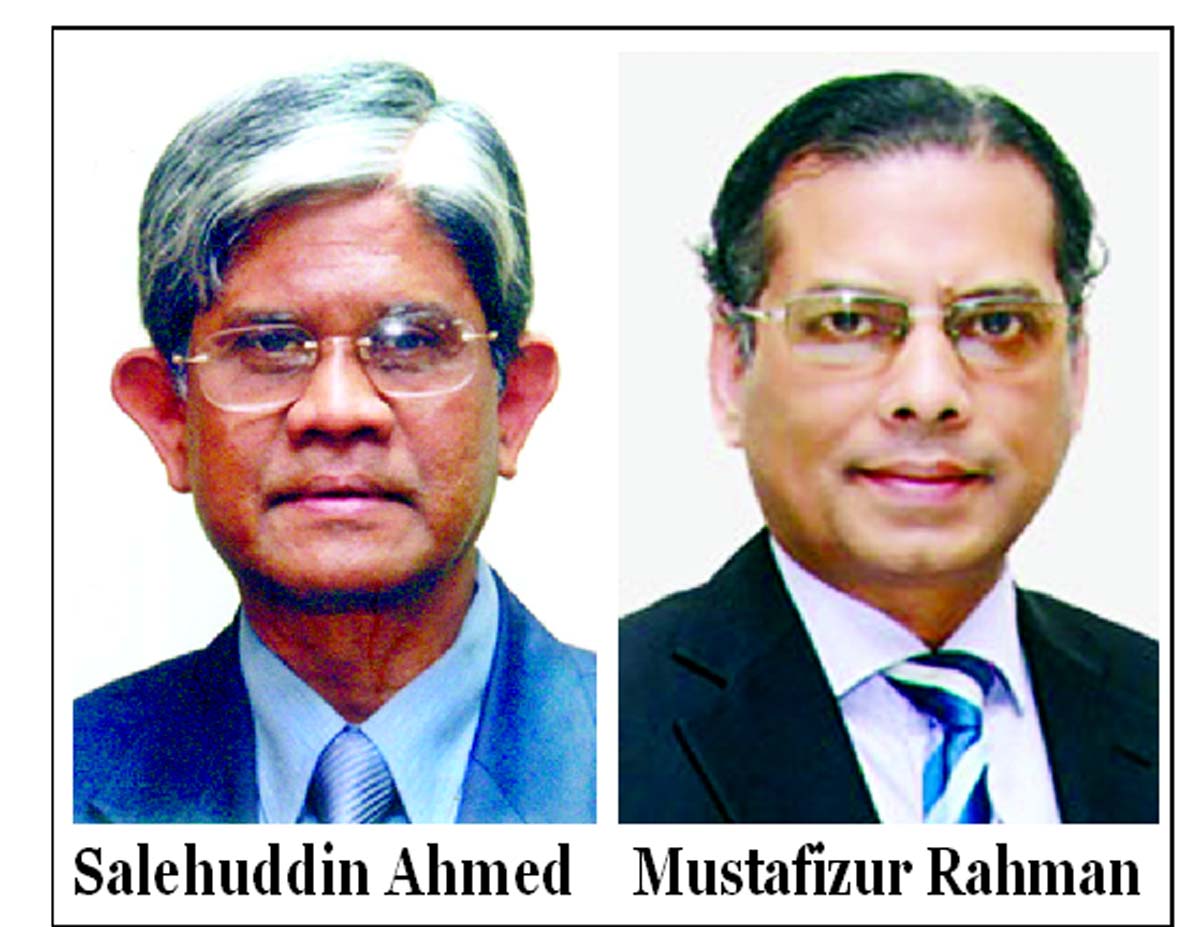

News:New Nation/17-Jan-2016Banks need to free from political pressure

Political stability essential to ensure governance and accountability in the banking sector

Economic Reporter :Former Bangladesh Bank Governor Salehuddin Ahmed said, banks need to be free of political pressure for ensuring good governance and accountability in the banking sector.Banking sector reforms will not be beneficial unless banks are freed of political influence and pressure, said the former governor.Salehuddin Ahmed made the comment at a roundtable on 'banking sector reforms and governance' in Bangladesh in Dhaka recently.Political stability is essential to ensure governance and accountability in the banking sector; otherwise all initiatives for reforms will not be effective.He said, the initiatives of Bangladesh Bank in this regard are fairly good and that have to be complied to get better results in the banking sector.He called upon the central bank to play pivotal role for ensuring development of the sector and enhancing monitoring the activities of the commercial banks."Governance and accountability should be increased further in Bangladesh's banking sector. For this political will is required. Politicians should bear in mind that a sector like banking should always be free of political influence," he said.He said even if appointments were made on the basis of political affiliations in the banks, the appointees should be clearly told not to discuss their political ideologies in the banking sector.CPD Executive Director Mustafizur Rahman has underscored the need for ensuring political stability and institutional reform with a view to establishing good governance in the banking sector as well as boosting the economy of the country.The establishment of good governance in the financial sector and the institutions would help attaining sustainable economic growth, said the CPD Executive to The New Nation recently."It is not possible to ensure proper development without strengthening the country's institutional capacity and good governance", he said.The unresolved political uncertainty is hurting the growth prospects by hindering confidence rebuilding, leading to a stagnation of private investment, claimed Mustafizur Rahman.The domestic risks including political uncertainty, constraints in infrastructure and institutional reforms, and financial sector vulnerability are hampering the investment and productivity, he mentioned.There is s close relation between financial stability and political stability. Both things are crucial for investor and smooth trade to sustain the growth momentum and the impressive feat in lowing poverty, pointed the CPD Executive.

News:New Nation/18-Jan-2016Dr. Zaid Bakht, Chairman of Agrani Bank poses at Zonal Heads and Corporate Branch Heads Conference-2016 in the city on Saturday.

Dr. Zaid Bakht, Chairman of Agrani Bank poses at Zonal Heads and Corporate Branch Heads Conference-2016 in the city on Saturday.

Dr. Zaid Bakht, Chairman of Agrani Bank poses at Zonal Heads and Corporate Branch Heads Conference-2016 in the city on Saturday.

FSIBL & Transfast signes Remittance agreement

A Remittance Agreement has been signed between First Security Islami Bank Limited (FSIBL) & TRANSFAST on 14 January, 2016 at the Head Office of FSIBL.

Quazi Osman Ali, Managing Director (Current Charge) of FSIBL & Samir Vidhate, Director-EMEAA, of TRANSFAST exchanged the agreement in this regard.

Among others, Syed Habib Hasnat, Additional Managing Director, Md. Mustafa Khair, Deputy Managing Director, Foiz Ahmed, Head of International Division, Azam Khan, Head of Marketing & Development Division, Mosharraf Hossain Chowdhury, SAVP, International Division, Md. Farhad Reza, In-charge, Remittance Operation, FSIBL and Mohammad Khairuzzaman, Country Head, Bangladesh of TRANSFAST were also present in the occasion.

News:Daily Sun/17-Jan-2016