Bangladesh's banks remain vulnerable to cyber threats as hackers continue to target financial institutions exploiting modern technology, analysts said yesterday.

Hackers attack computers worldwide every 39 seconds, according to Rubaiyyaat Aakbar, an IT expert.

“Banks and financial institutions are the prime targets of hackers and Bangladesh is not immune from this threat,” he said.

Aakbar made the comments at a workshop styled 'Cyber threat readiness for bankers' jointly organised by the Bangladesh Institute of Bank Management (BIBM) and Trans IT Solution, a local information technology firm, at the BIBM headquarters in Dhaka.

Ransomware alone caused financial losses to the tune of $1 billion last year, he said quoting a report published by Cybersecurity Ventures, the world's leading researcher and publisher covering the global cyber economy.

Damages would be far higher in the days to come due to malware, which infects computers and restricts their access to files and often threatens permanent data destruction unless a ransom is paid, Aakbar said.

“So, banks must take robust preparations now to face the emerging challenge. Otherwise, depositors' money will be at stake.”

Fazle Kabir, governor of Bangladesh Bank, said: “Cybersecurity has become a concern worldwide.” He said the central bank has taken a number of steps including appointing a chief IT officer and formulating a cybersecurity guideline.

“Banks have to be aware and take necessary measures to face this emerging challenge,” he added.

Bankers have to have the knowledge on cybersecurity, said Anis A Khan, managing director of Mutual Trust Bank and chairman of the Association of Bankers Bangladesh.

A big attack can severely hamper Bangladesh's banking services, said Abul Kashem Md Shirin, managing director of Dutch-Bangla Bank.

“We have to improve the security of our data centre,” he added.

Toufi¬c Ahmad Choudhury, director-general of the BIBM, Shah Md Ahsan Habib, a director of the institute, and Amirul I Chowdhury, CEO of Trans IT Solution, also spoke.

News:Daily Star/24-jul-2017

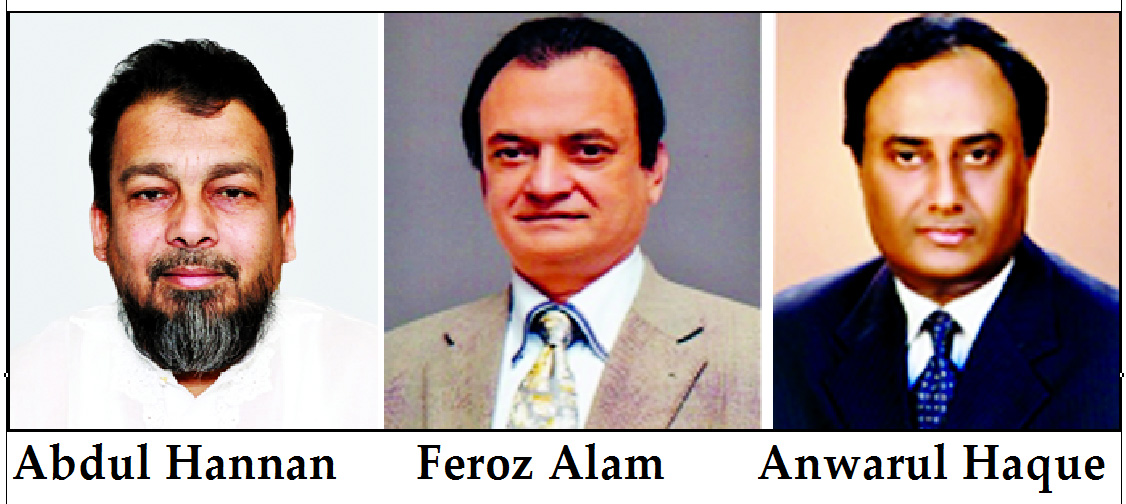

Md. Abdul Hannan and ASM Feroz Alam have been elected as Vice-Chairmen and Md. Anwarul Haque as Chairman of Executive Committee of the Board of Directors of

Md. Abdul Hannan and ASM Feroz Alam have been elected as Vice-Chairmen and Md. Anwarul Haque as Chairman of Executive Committee of the Board of Directors of  Mohammed Shams-Ul Islam, Managing Director of

Mohammed Shams-Ul Islam, Managing Director of