BB governor for cost effective mobile banking

DHAKA, SEPT 4: Bangladesh Bank (BB) governor Dr Atiur Rahman on Tuesday called upon all Mobile Banking Financial Institutions for implementing cost effective and flexible banking services for unbanked people aiming to expand the journey of financial inclusion. The BB governor was addressing at the inauguration of the mobile credit card “Swosti” in a city hotel, organised by Bdjobs.com.

Addressing as chief guest, the governor said Swosti formulated one step ahead for banking services among

the unbanked and underprivileged people.

Swosti is a project of Bdjobs.com. It offers mobile banking card for the underpriviledged rural people through which customer can enjoy loan facilities.

Meanwhile the governor said, “We need to raise awareness among the unbanked people regarding the mobile banking services for the development of the country.”

He has underscored the need for decreasing the cost of mobile banking service to encourage more people for accepting the services.

The governor said that BB has taken many initiatives for expanding the banking services such as the moderation of cheque clearing services so that people can easily make their transaction within a day.

He appreciated Bdjobs , Dutch- Bangla Bank and Dushtha Shasthya Kendra (DSK) for their initiative to introduce country’s first mobile banking card services through which the underprivileged rural people can receive loan facilities in a very short time.

In 2011, the mobile banking service introduces to expand the banking services to the unbanked people, said the governor and added that in this regards, BB approved twenty seven banks for corresponding mobile banking services. Currently eighteen banks are operating the mobile banking services which have already got a tremendous popularity among the rural people.

He warned the Mobile Banking Financial Institutions to maintain the BB guidelines in order to prevent false and illegal transactions.

In this regards, he suggested mobile banking agents to fill up KYC (Know Your Customer) form for their customer.

Governor said currently the mobile banking customers are almost seventy two lakhs, so it is important to know the customer profile for avoiding any financial irregularities.

By using modern technology, it is possible to decrease the rate of poverty which is ultimately support for sustainable development.

Presiding the inaugural session, Quazi Kholiquzzaman Ahmad, chairman of Palli Karma-Sahayak Foundation (PKSF), suggested the Mobile Banking Financial Institutions for strong monitoring of the loan beneficiaries in order to smooth financial transactions.

“We need to increase productivity for sustainable development,” he said and added that we need to implement large scale project instead of small project for real development.

The inauguration ceremony was also addressed among others by Ahmed Islam Muksit, chairman of Bdjobs.com and Abul Kashem Md. Shirin, deputy director of Dutch-Bangla Bank.

StanChart donates Tk 29 lakh to CRP for Rana Plaza victims

Abrar A Anwar, acting CEO of Standard Chartered Bangladesh, hands over a cheque worth Tk 2,900,000 to Md. Shafiq-ul Islam, Executive Director of CRP for the rehabilitation of the victims of Rana Plaza collapse at CRP at Savar recently.

Abrar A Anwar, acting CEO of Standard Chartered Bangladesh, hands over a cheque worth Tk 2,900,000 to Md. Shafiq-ul Islam, Executive Director of CRP for the rehabilitation of the victims of Rana Plaza collapse at CRP at Savar recently.

Standard Chartered Bank, Bangladesh handed over a cheque worth Tk 2,900,000 to Centre for the Rehabilitation of the Paralysed (CRP) for the victim’s of Savar Rana Plaza tragedy.

Abrar A Anwar, acting CEO of Standard Chartered Bangladesh along with Bitopi Das Chowdhury, Head of Corporate Affairs recently handed over a cheque to Md. Shafiq-ul-Islam, Executive Director of CRP.

Al-Arafah Islami Bank holds workshop

Al-Arafah Islami Bank Limited organised a day-long workshop on 'Shariah Implementation in AIBL' at Zindabazaar in Sylhet recently.

Md Habibur Rahman, Managing Director of the bank, presided over the workshop, said a press release. Md Golam Mohi- uddin Chowdhury, coordinator of the workshop, spoke at the inaugural ceremony.

Mawlana Abdul Basit Barkatpuri, Member of AIBL Shariah Supervisory Committee, Md Harunoor Rashid, Vice President and Zonal Head, Md Zahid Hasan, Principal of AIBTRA, and Md Abdur Rahim Khan, Secretary of AIBL Shariah Supervisory Committee, attended

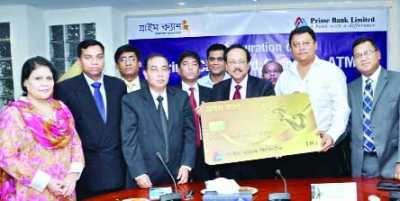

Prime Cash Card services launched

Md. Ehsan Khasru, Managing Director and CEO of Prime Bank Limited, launches "Prime Cash Card Services at Prime Bank ATM Booths" at the bank's head office on Wednesday.

Md. Ehsan Khasru, Managing Director and CEO of Prime Bank Limited, launches "Prime Cash Card Services at Prime Bank ATM Booths" at the bank's head office on Wednesday.

Prime Bank Limited has launched "Prime Cash Card Services at Prime Bank ATM Booths" at the head office of the bank on Wednesday.

Md. Ehsan Khasru, Managing Director and CEO of Prime Bank Limited inaugurated the booth, said a press release.

Habibur Rahman, SEVP and Head of Retail Banking, Md. Iqbal Hossain, SEVP and Head of IT Infrastructure and Development, Md. Shahadat Hossain, EVP and Head of IT Operations, Ferdousi Sultana, EVP and Head of Public Relations, Salahuddin Ahmed, SVP and Head of ADC, Amir Hossain Majumdar, SVP and Head of Cards, and Md. Tofazzul Hossain, Head of Marketing of the bank, Rashed Mahmud, CEO of Dipon Consultancy Services and Md. Shafquat Matin, Director were present at the function.

From now on, Prime Cash Card holders will be able to withdraw cash from all ATM booths of Prime Bank Limited.

Prime Bank has launched 'Prime Cash', the first-ever Biometric Smart Card in Bangladesh to provide secured banking services to the unbanked people of the country.