Banking

Decline in banks' profit dims corporate tax collection prospects

Tax collections from large corporate taxpayers might trail much behind the projected level in the current fiscal year (FY 2012-13) in view of lower level of profits, now estimated for most of the country's private commercial banks (PCBs).

Tax collections from large corporate taxpayers might trail much behind the projected level in the current fiscal year (FY 2012-13) in view of lower level of profits, now estimated for most of the country's private commercial banks (PCBs).

"The decline in the profit level of commercial banks is now our major concern. We have observed that financial condition of the majority of the banks worsened in the third quarter of this calendar year," said a senior tax official.

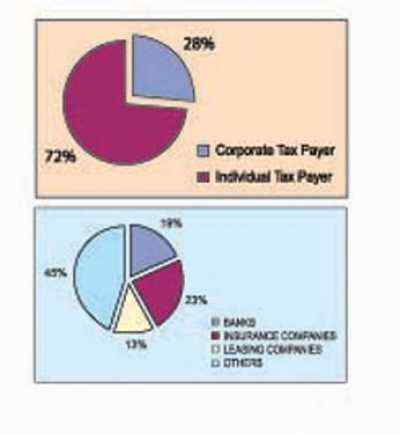

There are a total of 330 large corporate taxpayers including banks and nearly 706 individual taxpayers under the Large Taxpayers' Unit (LTU) of the National Board of Revenue (NBR). Of the corporate taxpayers, banks contribute nearly 60 per cent to the LTU's aggregate revenue income earnings.

The government set a tax collection target of Tk 123.50 billion for the LTU for fiscal 2012-13, up by 33 per cent from the Tk 94 billion target of the previous fiscal.

Last year, the LTU brought 50 merchant banks under its supervision to augment revenue collections.

But the merchant banks were also facing losses due to their financial straits, largely because of the fall-outs from the capital market collapse, the senior tax official said.

Until November 15, the LTU received 279 tax returns from the corporate taxpayers and 356 tax returns from individual taxpayers.

Meanwhile, a total of 192 individual taxpayers submitted applications to the LTU, seeking extension of time for submission of their tax returns.

The LTU received a total of Tk 7.60 billion in tax collections from both corporate and individual taxpayers. Of the amount, the unit collected Tk 7.41 billion as income taxes from 279 corporate taxpayers and Tk 193 million, from individual taxpayers. The tax official said about 1,000 tax-return files of individual taxpayers are lying with the LTU.

Usually, the directors of the companies who are paying taxes under the LTU are the individual taxpayers.

News: The Daily Financial Express/Bangladesh/25-Nov-12

Banks asked to allocate 10pc loans to SMEs

To promote country’s women entrepreneurship, the central bank advised all scheduled banks to disburse at least 10 per cent SME credit out of their total loan portfolio, according to Nazneen Sultana, deputy governor of Bangladesh Bank (BB).

Sultana on Saturday was addressing a seminar organized by Bangladesh Institute Bank Management.

BIBM faculties presented two research papers on “Information System Security in Banks” and “Role of Women Entrepreneurship Develop-ment in Bangladesh” when Sultana made this observation.

She said, “Banks assistance can offer a feasible solution to generate skilled women entrepreneurs for the betterment of the country.”

Addressing as chief guest she said banks have to take more steps to enhance the number of skilled women entrepreneurs in the country.

The deputy governor has underscored the need for more proactive roles so that women entrepreneurs flourish with their projects.

Fahmida Chowdhury, associate Prof. of BIBM presented a key note paper on “Role of Banks in Women entrepreneurship development in Bangladesh”. She observed that interest rate of SME loan was still high and entitlement to it was complicated.

Chowdhury said women in Bangladesh are employed in low income jobs and that most of the entrepreneurs are involved in farm business, forestry, fishery, boutique and beauty parlor business. Therefore, she said, business diversification is essential

and adequate and easy financial facilities can encourage them to diversify their traditional business.

However, Fahmida made some specific recommendations for banks to take the opportunity to work with women who have no previous experiences but want to start a new business.

Considering the growing demand for skilled entrepreneurs, banks can take initiative to provide training to the existing bosses.

She said, “Banks can also provide marketing financial facilities, product development information and define sources of fund at free of cost.

The seminar was also addressed by Prof. Dr. Prashanta Kumar Banerjee, director of BIBM, Dr. Toufic Ahmed Chowdhury, director general of BIBM, Md. Shihab Uddin Khan, associate Prof. of BIBM, A.H.M. Kai Khasru, executive director of the central bank, Zaitun Sayef, deputy managing director of IFIC Bank Ltd. and Mohammad Tazul Islam, Md. Masudul Haque, Md. Mahbubur Rahman Alam, Kaniz Rabbi, assistant professor of BIBM.

News: The Daily Independent/Bangladesh/25-Nov-12

Job seekers in Malaysia offered easy bank loan

The people who want to go to Malaysia on work visa can have financial assistance from a bank to meet their cost of migration.

The state-owned banks and Expatriate Welfare Bank already made arrangement to provide the potential migrants with easy loan to cover their all expenses including air passages, visa fee, training fee, medical bill, travel taxes and other related expenditure.

The bank initially estimated that the cost of migration for a person would be around Taka 40,000 and the bank would offer people the entire amount as loan at only 9 percent annual rate of interest.

The bank will recover the loan on installments from the salary or wages of the migrants under agreements with their employers. The persons, authorized by the migrants, can also pay back the loans on installments.

“A total of 5,00,000 workers from Bangladesh will get jobs in Malaysia in the next five years. Each of the migrants can have loan from the Expatriate Welfare Bank,” the Bank’s Managing Director CM Koyes Sami told BSS.

News: The Daily Sun/Bangladesh/25-Nov-12

FSIBL opens ATM booth in Dhaka

AAM Zakaria, Managing Director of First Security Islami Bank Limited, inaugurates an ATM booth of the bank at Banasree in Dhaka recently.

AAM Zakaria, Managing Director of First Security Islami Bank Limited, inaugurates an ATM booth of the bank at Banasree in Dhaka recently.

First Security Islami Bank Limited opened an ATM booth at Banasree in Dhaka recently.

AAM Zakaria, Managing Director of First Security Islami Bank opened the booth, said a press release.

Among others, Deputy Managing Directors of the bank Md. Abdul Quddus and Syed Waseque Md. Ali, SEVPs Kazi Osman Ali and Syed Habib Hasnat, Head of Divisions were also present on the occasion.

It may be noted that in the first phase 30 ATM booths of the bank will be established by December 2012 in various location of the country and 50 more ATM booths will be opened in the second phase across the country.

News: The Daily Sun/Bangladesh/25-Nov-12

Banks' investment in stocks to remain high despite amendment to Companies Act

Banks' scope to invest in the stockmarket will remain high despite a proposed amendment to the Banking Companies Act, as the banks have a strong capital base now.

The amendment will allow the banks to invest 40 percent of their capital in stocks though the present law allows them to invest 10 percent of their total liabilities in the stockmarket.

After the amendment, banks will be able to raise their stock investment up to Tk 23,000 crore from Tk 16,000 crore recorded in September.

According to Bangladesh Bank statistics, the amount of total capital in the banks was Tk 56,201 crore in June.

When the stockmarket was booming in 2010, the banks' investment in stocks was below Tk 20,000 crore.

Though as per the draft amendment, the scope for banks' investment in the stockmarket will decrease, the remaining scope is still much higher than the global standard, said a BB official.

The International Monetary Fund also suggested that banks' investment in the stockmarket should be 25 percent of their capital.

The central bank official said the banks' capital has grown much in the recent time as per the Basel-II requirements, but their capital will increase further when Basel-III will take effect soon.

According to the central bank statistics, the total capital of the banks was Tk 20,578 crore in 2008.

The banking sector has witnessed an increase of Tk 35,623 crore in their capital in the last four years.

It means the overall capital growth has been 173 percent over the last four years with an annual average growth of about 49 percent.

As per Basel-II requirements, banks need to maintain their capital at 10 percent of their risk weighted assets. But in reality, the banks have been able to maintain their capital at 11.31 percent, which is more than the required level.

The BB official said, this was mainly due to the transfer of a large portion of their profit to capital. As a result, the base of the banking system has become stronger, he added.

News: The Daily Star/Bangladesh/25-Nov-12