Decline in banks' profit dims corporate tax collection prospects

Tax collections from large corporate taxpayers might trail much behind the projected level in the current fiscal year (FY 2012-13) in view of lower level of profits, now estimated for most of the country's private commercial banks (PCBs).

Tax collections from large corporate taxpayers might trail much behind the projected level in the current fiscal year (FY 2012-13) in view of lower level of profits, now estimated for most of the country's private commercial banks (PCBs).

"The decline in the profit level of commercial banks is now our major concern. We have observed that financial condition of the majority of the banks worsened in the third quarter of this calendar year," said a senior tax official.

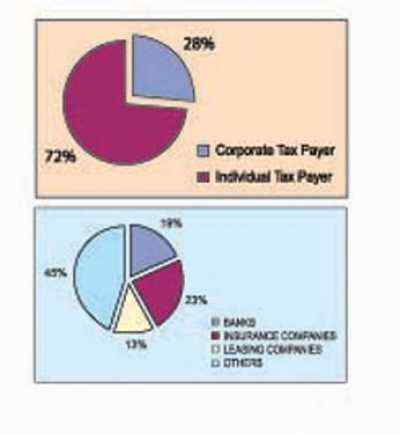

There are a total of 330 large corporate taxpayers including banks and nearly 706 individual taxpayers under the Large Taxpayers' Unit (LTU) of the National Board of Revenue (NBR). Of the corporate taxpayers, banks contribute nearly 60 per cent to the LTU's aggregate revenue income earnings.

The government set a tax collection target of Tk 123.50 billion for the LTU for fiscal 2012-13, up by 33 per cent from the Tk 94 billion target of the previous fiscal.

Last year, the LTU brought 50 merchant banks under its supervision to augment revenue collections.

But the merchant banks were also facing losses due to their financial straits, largely because of the fall-outs from the capital market collapse, the senior tax official said.

Until November 15, the LTU received 279 tax returns from the corporate taxpayers and 356 tax returns from individual taxpayers.

Meanwhile, a total of 192 individual taxpayers submitted applications to the LTU, seeking extension of time for submission of their tax returns.

The LTU received a total of Tk 7.60 billion in tax collections from both corporate and individual taxpayers. Of the amount, the unit collected Tk 7.41 billion as income taxes from 279 corporate taxpayers and Tk 193 million, from individual taxpayers. The tax official said about 1,000 tax-return files of individual taxpayers are lying with the LTU.

Usually, the directors of the companies who are paying taxes under the LTU are the individual taxpayers.

News: The Daily Financial Express/Bangladesh/25-Nov-12

Comments