Scam-hit BASIC Bank is set to get Tk 1,000 crore of taxpayers' money to once again meet its capital deficit despite criticism from economists.

With the sum BASIC will have gotten a total of Tk 3,390 crore from the government so far to bolster its capital base, which has been ravaged by corrupt lending practices by the bank's previous management led by Abdul Hye Bacchu.

One of the best performing banks until 2009, things took a turn for the worst when the present government came to power and appointed Bacchu as the chairman of BASIC.

Under Bacchu's tutelage, about Tk 4,500 crore was embezzled from the bank until the finance ministry dissolved the board in July 2014. No legal action is yet to be taken against Bacchu. A BASIC Bank official said another Tk 1,500 crore is needed to fully make up for the capital deficit, due to which they are facing difficulties in conducting export-import business.

Besides BASIC, the finance division will give Sonali Tk 300 crore, Bangladesh Krishi Bank Tk 165 crore, Rupali Tk 100 crore and Rajshahi Krishi Unnayan Bank Tk 100 crore.

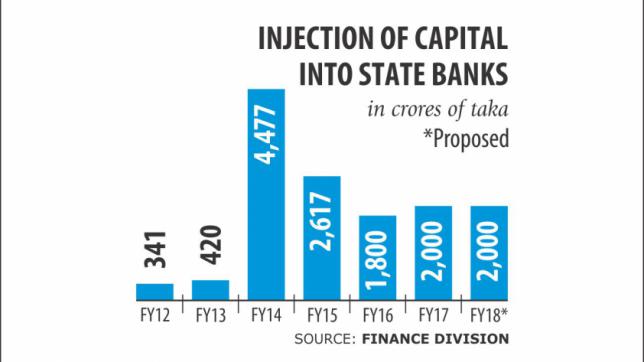

The government has been providing money to state-owned banks in the same manner year after year in spite of their irresponsible lending practices.

Between fiscal 2011-12 and fiscal 2016-17, the government has provided the state-owned banks a total of Tk 11,655 crore.

And next fiscal year too, the government has earmarked Tk 2,000 crore for state banks' recapitalisation.

“The continuation of unconditional recapitalisation of badly managed banks does not send the right signal about the use of taxpayers' money at a time when the government is introducing significant reforms in the form of the new VAT law to raise additional revenue,” said Zahid Hussain, lead economist of the World Bank's Dhaka office.

The government is set to implement the new VAT law that prescribes a flat 15 percent VAT rate on most goods and services available in the country from July 1, doing away with existing multiple VAT rates and packaged VAT, much to the discontentment of the business community and the general public.

“It gives opponents of this reform an extra point to argue that the additional revenue is unlikely to be put to good use,” he added.

Finance Minister AMA Muhith said nothing on the banking sector reforms in his budget speech in parliament on June 1.

A few years back, he said a commission would be formed for the purpose, but that is yet to be done. The International Monetary Fund last week released a report in which it identified the banking sector as a potential menace for Bangladesh.

The state banks have high non-performing loans, low profitability and sizeable capital shortfalls, and further deterioration in their balance sheets would potentially have a negative impact on fiscal balance, it said.

At the end of March 31, the eight state banks -- six commercial and two specialised -- ran a total deficit of Tk 13,977 crore.

Sonali has a shortfall of Tk 2,557 crore, BASIC Tk 2,961 crore, Rupali Tk 637 crore, Krishi Tk 7,252 crore and Rajshahi Krishi Unnayan Bank Tk 778 crore.

The banks, which represent about a quarter of the total banking system's assets, should be held strictly accountable to numerical targets agreed with the authorities to improve their financial condition, the IMF added.

The cheques that will be issued to the five state banks now will come with conditions attached, one being not investing the sum in risky ventures, said a finance ministry official. If anybody does so, he will be held responsible.

The BASIC Bank official said the fresh capital injection from the government will not be used for lending purposes; rather, it will be put in treasury bill bonds.

news:daily star/16-jun-2017

Mohammed Shoeb, Chairman of

Mohammed Shoeb, Chairman of  M Nazeem Anwar Choudhury, Head of Consumer Banking,

M Nazeem Anwar Choudhury, Head of Consumer Banking,