Banking

State banks see surplus capital on public funds

Rejaul Karim Byron

State banks that had huge deficits earlier now enjoy surplus capital as the government has injected fresh funds into the banks and improved their asset quality.

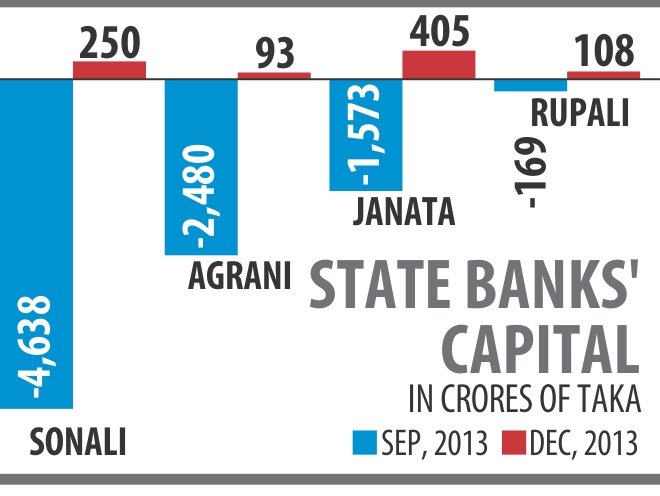

Four state-owned banks had a surplus capital of Tk 855 crore on December 31, 2013, though they had a deficit of Tk 8,863 crore on September 30, according to central bank statistics.

On December 31, the banks' requirement for total capital was Tk 10,554 crore against their risk weighted assets, but they maintained a capital of Tk 11,409 crore.

Their capital became surplus as the government injected money into the banks, an official of a state bank said.

The government provided the banks with Tk 4,100 crore in early December to help them meet their capital shortfall in line with conditions tagged by the International Monetary Fund with its loans under Extended Credit Facility.

Pradip Kumar Dutta, managing director of Sonali Bank, said they got Tk 1,995 crore to strengthen their capital base. Sonali also got some of its big loans rated which eased its capital requirement, Dutta said.

He also said they recovered a higher amount of classified loans in 2013 which has brought down their default loans and provisioning as well.

SM Aminur Rahman, managing director of Janata Bank, said, apart from getting money from the government they made a Tk 1,600 crore operating profit in 2013 which helped them meet their capital shortfall.

Rahman said they have brought down their classified loans to about 10 percent of their total outstanding loans, from 17 percent earlier.

The state banks' default loans rose to more than Tk 24,000 crore in the third quarter last year due to political unrest, irregularities in granting loans in 2012, and new loan classification rules of the central bank.

In early December last year, Bangladesh Bank instructed the banks to relax their loan rescheduling rules to provide some relief to the borrowers affected by political turmoil. The banks took advantage of the scope and reined in their classified loans.

In the last quarter of 2013, the state banks brought down their default loans by around Tk 8,000 crore. Though the banks had a provision shortfall of around Tk 500 crore against their default loans in September, the amount became a Tk 1,500 crore surplus in December.

Sonali Bank's cash recovery against its default loans was 272 percent in 2013 and that of Janata Bank 186 percent compared to those in 2012.

However, officials at the state banks said if the rescheduled loans are not monitored properly, the amount of default loans may increase again.

Dutta of Sonali Bank said they got the capital from the government against a business plan and they have started working to improve their capital situation.

The Janata Bank's MD said, “With the public fund we received we could create assets which will ultimately strengthen the bank's financial health further.”

News:The Daily Star/10-Mar-2014

NBL gets new managing director

AKM Shafiqur Rahman has been appointed managing director of National Bank, the bank said in a statement yesterday.

Prior to his appointment, he served as additional managing director of the bank. Rahman started his career as with Bangladesh Krishi Bank in 1974.

He holds a master's degree in economics and also completed a certificate course on “Programme on Investment Appraisal and Management” from Harvard University, USA.

News:The Daily Star/10-Mar-2014

Islami Bank Shari’ah committee meet

A meeting of the Shari`ah Supervisory Committee of Islami Bank Bangladesh Limited (IBBL) was held at the Islami Bank Tower in Dhaka on Saturday.

Mufti Sayeed Ahmad, Vice-Chairman of the committee and Head Mufti of Al Jamiatus Siddikiah Darul Ulum (Madrasha-e-Furfura Sharif) presided over the meeting, said a press release.

Nurul Islam Khalifa, Deputy Managing Director, Md. Nazrul Islam Khan and Md. Shamsul Huda, Executive Vice Presidents of the bank also attended the meeting.

News:Daily Sun/10-Mar-2014

EXIM Bank relocates Boardbazar branch

Export Import Bank of Bangladesh Limited (EXIM Bank) shifted its Boardbazar Branch to a new location at Haji Fazlul Haque Plaza at Boardbazar in Gazipur on Saturday.

Dr. Mohammed Haider Ali Miah, Managing Director and CEO of the bank inaugurated the branch at new location, said a press release.

Md. Fariduddin Ahmed, Adviser, top executives of the bank and local elites attended the function.

News:Daily Sun/10-Mar-2014

Prime Bank gets ‘Business Award-2013’

Dhaka : Prime Bank Limited has achieved the ‘Business Award-2013′ for its significant contributions to the banking services,reports UNB.

M Ehsan Khasru, Managing Director & CEO of the bank, received the award from Shipping Minister Shajahan Khan at a function organised by Bank Bima Shilpa Digest ma-Shilpa-

Digest/175842835949180&sa=U&ei=KP_5UozxBsHIrQfY-4D4BA&ved=0C BsQFjAA&usg=AFQjCNECcLFq_ybe59TUAKJXcl4-NMStIw> at a city hotel on February 9, said a press release on Thursday.

Former Information Secretary Syed Margub Morshed and leaders of other business organisations were present at the programme veteran language movement hero Abdul Matin in the chair.