Banking

Islamic banking coming of age

Ahmad Mohamed Ali, president of Islamic Development Bank, speaks at a seminar on shariah banking at Radisson Hotel in Dhaka yesterday. Atiur Rahman, governor of Bangladesh Bank, was also present.

Ahmad Mohamed Ali, president of Islamic Development Bank, speaks at a seminar on shariah banking at Radisson Hotel in Dhaka yesterday. Atiur Rahman, governor of Bangladesh Bank, was also present.

Islamic banking is now recognised as a mainstream activity not just in Muslim-majority countries but also in global finance, Bangladesh Bank Governor Atiur Rahman said yesterday.In Bangladesh, Islamic banking constitutes about a fifth of the total banking market, Rahman said.He spoke at a seminar on shariah banking, organised by the Islamic Banks Consultative Forum (IBCF), a forum of the Islamic banking industry, at Radisson Hotel in Dhaka.Islamic banking has been gaining ground in the post-global financial crisis period because of its in-built risk sharing, speculation-averseness, value driven features, he said.The Islamic banking industry is one of the fastest growing sectors of the international financial system, said M Azizul Huq, an Islamic banking consultant.Deposits with Islamic banks in the country grew by 25.60 percent in the last five years till 2013 as compared to 22 percent for conventional banks, he said during a keynote presentation.Growth of investment for the same period of conventional banks was 20 percent against 24.60 percent for Islamic banks, he said. Total deposits of the Islamic banks and windows in December 2013 stood at Tk 1.198 trillion, holding market share of 19.3 percent.

In the mid-1990s, the size of the world Islamic finance assets stood at $150 billion, which has reached $1.80 trillion at the end of 2013, he said.The value of Islamic finance assets is estimated to reach $6.5 trillion in 2020, Huq said.Shariah banking is steadily growing in socially responsible financing roles of trade and output activities in the country's economy, including under-served and un-served sectors such as agriculture and micro, small and medium enterprises, Rahman said.The self-regulation and oversight of its shariah compliance practices are delegated to the shariah-based financing community, he said.“This has served well thus far in providing a level playing field for shariah-based financing alongside the conventional options.”“BB acted early on towards introduction of a government Islamic investment bond of six-month tenure to facilitate liquidity management of Islamic banks, introduction of another similar instrument of three-month tenure for further facilitation is at the final stage.”Currently eight full-fledged Islamic banks and 15 conventional local and foreign banks with 825 Islamic branches and windows are operating in the country with a market share of 22 percent in assets and 19 percent in deposits. With the effort of IBCF, the Shariah Board is now successfully functioning in Bangladesh, said Ahmad Mohamed Ali, president of Islamic Development Bank.The issuance of shariah banking and money market guidelines by the central bank will help achieve further economic growth of the country through influx of additional foreign direct investment and employment generation, Ali said.MA Mannan, state minister for finance,, also spoke.

BB tightens screw on state banks

Bangladesh Bank has tightened the screw on the four errant state banks this year, lowering their loan growth ceiling and raising the punitive measures for non-compliance to performance agreements.

The move comes after the International Monetary Fund expressed concern about the below-par improvement in performance in the four banks, an important condition for the Extended Credit Facility (ECF) loan.

The IMF's latest mission, which came early this month, partly blamed the central bank, saying it did not take actions for breach of conditions in the memorandum of understanding, signed with the four banks last year with the singular view of improving their financial health.

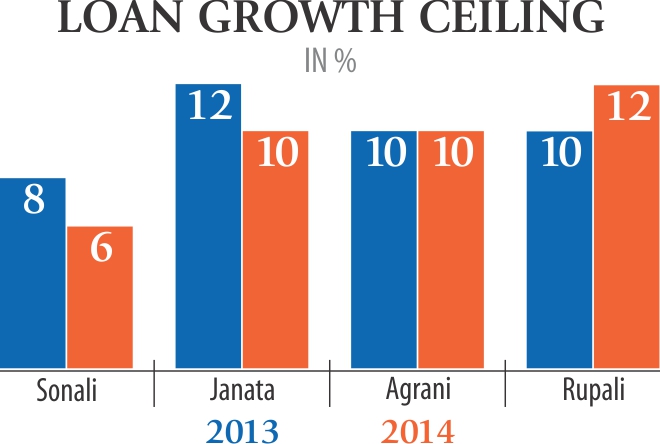

Subsequently, in the new memorandum of understanding finalised last week, the central bank has set the loan growth ceiling for Sonali and Janata at 6 percent and 10 percent respectively, down from 8 percent and 12 percent in 2013.

While Agrani's loan growth ceiling stayed the same as last year at 10 percent, Rupali's increased to 12 percent from 10 percent in 2013.

It has also decided to impose strong sanctions for non-compliance to areas of MoU which are directly under the banks' control such as loan growth ceiling and single borrower exposure limit.

For instance, if any bank breaches the credit growth ceiling, BB will order it to deposit as unremunerated reserves the entire excess amount lent over the credit limit.

The central bank also committed to the IMF that the banks would adopt several policies to improve their operations, develop credit and risk management and strengthen internal control and compliance.

BB will assess in December whether the policies are working effectively or not, and it will continuously monitor loan recovery practices and explore alternative ways of recovering bad loans.

However, most of the banks have appealed to the central bank to raise the credit growth ceiling as it will ensure profitability for them. Pradip Kumar Dutta, managing director of Sonali Bank, told The Daily Star that they have requested the central bank to increase their growth ceiling to 10 percent.

Rupali, too, requested for its loan growth ceiling to be increased, although it was the only bank among the four to see its ceiling be raised this year from 2013's.

M Farid Uddin, managing director of Rupali Bank, said the bank's deposit growth is 30 percent and if the loan growth ceiling set by the central bank is enforced, it would be very difficult to make any profit.

Farid Uddin also said they would have to make Tk 300 crore in profit a year to make up for their accumulated loss.

A BB official said if the banks can realise their classified loans the scope for increasing loan will widen.

Last year, the loan growth of all state banks, except Rupali, was negative, on the back of the government's repayment of Tk 5,900 crore to Sonali, Janata and Agrani for Bangladesh Petroleum Corporation's loans.

FSIBL to sponsor Children Science Congress 2014

First Security Islami Bank will sponsor Children Science Congress 2014 across the country.

The event will be organized in 64 districts of the country with participation of 25,000 students.

This was disclosed at a press conference at Pan Pacific Sonargaon on Saturday, said a press release.

BRAC Bank launches home loan for low, middle-income people

TBT Live update: BRAC Bank has introduced an affordable home loan product ‘Nijer Bari’ for the low and middle- income group people outside Dhaka city.

Sir Fazle Hasan Abed, Chairman, BRAC Bank Limited, formally launched the product at a programme recently at the bank’s headquarters in Dhaka by handing over the Loan Sanction Letter to Suriya Begum, who is the first customer of Nijer Bari, BRAC Bank said in a press release issued here today.

Shib Narayan Kairy and Dr. Hafiz G. A. Siddiqi, Directors, Syed Mahbubur Rahman, Managing Director and CEO, Firoz Ahmed Khan, Head of Retail Banking and senior officials were present on the occasion.

This product is the first of its kind in Bangladesh, which will help low and middle-income group people to have their own home.

The loan will initially be offered in Comilla, Joydebpur, Narshingdi Sadar, Narayanganj City, Savar, Gazipur, Tongi and Bogra.

Salaried, self-employed professional or businessmen and land- owners will be eligible for the loan for purchase of under- construction, completed or second hand flats, apartments, houses or construction and extension of houses. They will get up to Taka 20 lakh for a maximum period of 10 years.

News:Bangladesh Today/27-Apr-2014BRAC Bank launches home loan product ‘Nijer Bari’ for low & middle income people outside Dhaka city

Dhaka, Monday- BRAC Bank Limited has introduced an affordable home loan product ‘Nijer Bari’ for the low and middle income group outside Dhaka city, reports in press release.

Dhaka, Monday- BRAC Bank Limited has introduced an affordable home loan product ‘Nijer Bari’ for the low and middle income group outside Dhaka city, reports in press release.

Sir Fazle Hasan Abed, Chairman, BRAC Bank Limited, formally launched the product at a program in Head Office recently by handing over the Loan Sanction Letter to Ms. Suriya Begum who is the first customer of Nijer Bari.

Mr. Shib Narayan Kairy and Dr. Hafiz G. A. Siddiqi, Directors, Mr. Syed Mahbubur Rahman, Managing Director & CEO, Mr. Firoz Ahmed Khan, Head of Retail Banking, and senior officials were present.

This product is first of its kind in Bangladesh which will realize home owning dream of low and middle income group people come true.

The product will be offered in Comilla, Joydebpur, Narshingdi Sadar, Narayanganj City, Savar, Gazipur, Tongi and Bogra.

Salaried, self-employed professional or businessmen and landlord will be eligible for the loan for purchase of under-construction/completed/second hand flats/apartments/house or construction/ extension of house. They will get up to Tk. 20 lac for a maximum period of 10 years.