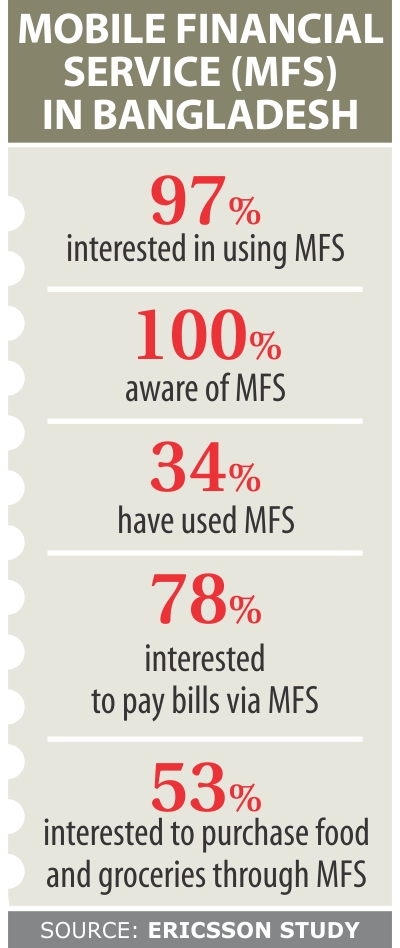

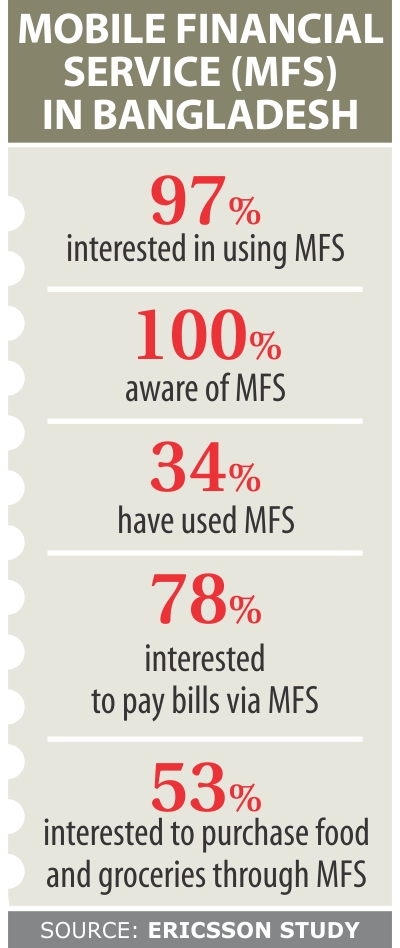

About 97 percent of the country's population are interested in using mobile phones to send and receive money, according to a study by Ericsson, the Swedish communications technology and services company.

The report -- Mobile Commerce in Emerging Asia -- by Ericsson ConsumerLab studied Bangladesh, Indonesia and Vietnam and explored the possibilities of widespread m-commerce adoption in emerging Asia.

The target group for the study was mobile phone users aged 15–59 years in urban and sub-rural areas. Some 6,000 consumers and 900 merchants in total were chosen from approximately six million people in Bangladesh, 24 million in Indonesia and 12 million in Vietnam.

The research reveals that 54 percent of the respondents in Indonesia have used money transfer services, followed by Vietnam at 45 percent and Bangladesh at 34 percent.

When it comes to interest in and awareness of money transfer services using a mobile device, there is great variation across the countries.

In Bangladesh, 97 percent of the respondents showed interest in such services, while all of them were aware of the function.

This is largely due to the popularity of the bKash money transfer service, a joint venture between BRAC Bank of Bangladesh and Money in Motion of the US.

In Indonesia, 49 percent are interested in mobile money transfer services, while 35 percent are aware of them. For Vietnam, 26 percent are keen to use the service and 19 percent are aware of it.

Looking at how many people have actually used mobile money transfer services, the result is on a lower level: 4 percent in Bangladesh and 1 percent in Indonesia and Vietnam respectively.

One key findings of the study is urbanisation, which leads to many people moving to cities to find jobs, stimulating the need for quick and reliable money transfers.

“The reason for this is that while some family members move to the city, others stay in the countryside and remain dependent on those who moved, particularly concerning financial matters,” said Patrik Hedlund, senior advisor of Ericsson ConsumerLab.

“In these developing markets, where the incomes are typically low, there is a need to quickly send and receive money.”

All the studied markets are still, to a large extent, cash economies, meaning they are based on the usage of cash for daily transactions. However, a clear majority of merchants think that offering a mobile payment or other digital money service would be beneficial as they would not need to handle as much cash or run the risk of counterfeit money.

In all three markets, there is a strong savings culture. In Bangladesh, 80 percent of the respondents save on a regular basis, while the figure is 92 percent in Indonesia and 75 percent in Vietnam.

Savings are typically kept at home, usually in a money box, penny bank or clay pot. About half of the consumers in Vietnam save money at home, while for Bangladesh and India it is for 40 percent and 35 percent of the respondents.

However, most would prefer to save in a more formal way rather than keep money at home, since it is not completely safe. The ability to use a mobile device to deposit, withdraw and save money is of interest to consumers because it is perceived safer than handling cash.

The survey also said that 78 percent of the consumers in Bangladesh and 57 percent in Indonesia are interested in using mobile payment for service bills. The figure is 37 percent for Vietnam.

The research findings were disclosed at a roundtable at The Westin hotel in Dhaka.

In Bangladesh, mobile banking now registers more than 20 percent growth in cash transaction a month thanks to the growing popularity of the service, according to the central bank. On average, around Tk 263 crore is transacted a day through mobile banking services, which was only Tk 121 crore in April last year.

As part of the government's financial inclusion programme, the central bank allowed 28 banks to provide mobile banking, but so far 19 of them have launched the service.

BRAC Bank's bKash, Dutch-Bangla Bank's mobile banking, Islamic Bank's MCash, United Commercial Bank's UCash, Trust Bank's mobile money, ONE Bank's OK mobile banking are now the key players in the market.

Last year, mobile banking registered 186 percent growth in cash transactions and 262 percent in the number of subscribers. Smartphones are less common in Bangladesh, but 20 percent of respondents intend to buy a smartphone within the next six months.

Some 42 percent have a bank account but only 11 percent hold a debit or credit card.

Afrizal Abdul Rahim, head of Ericsson ConsumerLab for Southeast Asia and Oceania, presented the research findings. Raj Jain, managing director of Ericsson Bangladesh, was also present.

News:The Daily Star/25-Aug-2014