Banking

Most banks at high cyber risks

Economic Reporter :

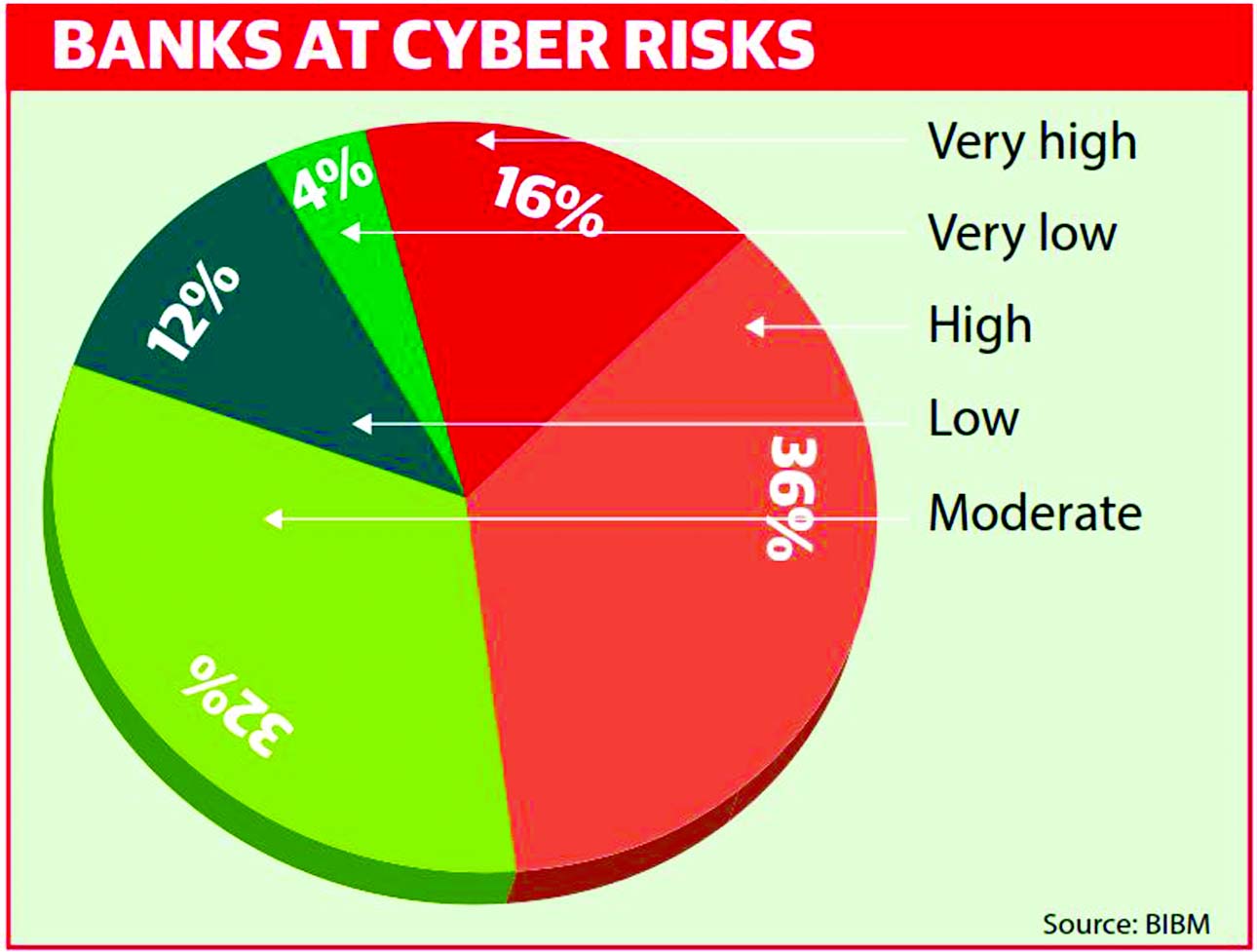

A total of 52pc banks in the country are at high risk of cyber security, said Bangladesh Institute of Bank Management in its study.

Of the banks, 16pc are at a very high risk and 36pc at high risk.

The information was unveiled at a workshop of BIBM styled as "IT operations of Bank" held at its auditorium on Thursday.

Cyber security has become the country's most-talked-about issue in the recent time, especially after Bangladesh Bank lost $81 million from its reserves to international hackers last year.

In his research report titled "Review of IT Operations of Banks in Bangladesh 2016," Shihab Uddin Khan, associate professor at BIBM, said: "Some 16pc banks mentioned that the current situation of cyber security is not enough to prevent any virtual or physical damage to information management system, perceiving the highest risk."

He said: "Around 36pc of the surveyed banks believe that they are at high risk of information loss at any moment. 32pc banks reported that they are under moderate risks whereas 12pc and 4pc banks are low and very low risks respectively."

Deputy Governor of Bangladesh Bank Abu Hena Mohd Razee Hassan while inaugurating the workshop said: "Though the banks are using different costly foreign software, they are not free from information security risk. If, all the Bangladeshi banks use the same software, it would lessen both cyber security risk and financial loss."

He said some banks are at cyber security risk as their budget for IT security as well as operation system are poor.

The banks will have to increase cyber security measures along with awareness programme to avert untoward incident, Hassan said, adding that "Bangladesh Bank is formulating an IT security guideline to ensure cyber security for all banks and financial institutions."

According to BIBM research, in 2012, approximately, Tk1467 crore was invested for IT operations in the banking sector, excluding the central bank.

The total investment up to 2016 was estimated at Tk30,430 crore since 1968 (considering the installation of computer at Agrani Bank in 1968 which was the first installation of computer in the banking sector of Bangladesh).

In 2016, approximately, Tk1,793 crore was invested in IT System in the banking sector, excluding the central bank, said the study.

The report said a major portion of the IT budget was used to procure hardware and it was 40.4pc of the total budget in 2016, which was slightly decreased compared to previous year (41.9pc in 2015). The fund for network sector was also decreased compared to 2015. The second highest budget went to software sector.

It was also found that the budget for security, training and audit was very poor in the last six years though there is a little increase in security, audit and training in 2016 compared to previous years.

Syed Waseque Md Ali, Managing Director of First Security Islami Bank Ltd, inaugurating its relocated Banani Branch in the city on Tuesday. Quazi Osman Ali, Additional Managing Director, Abdul Aziz, Md Mustafa Khair, DMDs of the bank, local elites and busi

Syed Waseque Md Ali, Managing Director of First Security Islami Bank Ltd, inaugurating its relocated Banani Branch in the city on Tuesday. Quazi Osman Ali, Additional Managing Director, Abdul Aziz, Md Mustafa Khair, DMDs of the bank, local elites and busi

Syed Waseque Md Ali, Managing Director of First Security Islami Bank Ltd, inaugurating its relocated Banani Branch in the city on Tuesday. Quazi Osman Ali, Additional Managing Director, Abdul Aziz, Md Mustafa Khair, DMDs of the bank, local elites and busi

India passes new law to tackle bad debt

India on Friday gave greater powers to the central bank to intervene in cases of bad loans, seeking to tackle a mountain of debt that experts say is holding back the economy.

The move authorises the Reserve Bank of India to order banks to take specific measures to deal with bad debts under the provisions of the existing bankruptcy laws.

In its executive order, it said the "stressed assets in the banking system have reached unacceptably high levels and urgent measures are required for their resolution."

India remains the world's fastest-growing major economy, but its banks are saddled with some of the highest levels of bad debt in the emerging markets according to the International Monetary Fund.

That means banks are stretched too thin to lend for fresh investments.

The problem received national attention last year in March when beer and airline tycoon Vijay Mallya fled to the UK to avoid paying nearly $1 billion in loans that he owed banks.

According to Credit Suisse, some 12 trillion rupees ($185 billion) have soured, the bulk of it at public-sector banks.

The 10 largest corporates in the country are also the most burdened with debt and owe a collective 7.5 trillion rupees.

HSBC pre-tax profit slides but hails 'good result'

AFP, Hong Kong :

HSBC said Thursday that pre-tax profit fell 19 percent in the first quarter but the bank's chief described them as "a good set of results" after a turbulent 2016.

The Asia-focused giant has been on a recovery drive over the past two years to streamline the business and slash costs, and has laid off tens of thousands of staff.

London-based HSBC blamed the drop in reported profit to US$4.96 billion on a change in accounting the fair value of its debt, while the results from a year ago had included proceeds from the sale of its Brazil business.

The lender also posted a 19.5 percent fall in year-on-year net profit to $3.13 billion from $3.89 billion.

However, adjusted pre-tax profit excluding one-time items rose to $5.94 billion from $5.3 billion a year earlier. Analysts had forecast $5.3 billion in a survey by Bloomberg News.

"This is a good set of results," chief executive Stuart Gulliver said in a results statement.

He added that the adjusted pre-tax figure was boosted by a $1 billion share buy-back and cost-cutting.

In reaction, the group's London-listed shares rallied 3.87 percent to 670.20 pence around midday on the capital's rising FTSE 100 index.

"The bank's Asian focus has proved to be a key driver of returns so far in 2017," noted analyst Laith Khalaf at stockbroker Hargreaves Lansdown.

Shaikh Md Wahid-Uz-Zaman, Chairman of Janata Bank Limited, presiding over its Board of Directors Meeting at its head office in the city recently. The meeting approved its Financial Statement-2016. Md Abdus Salam, Managing Director, Manik Chandra Dey, Khon

Shaikh Md Wahid-Uz-Zaman, Chairman of Janata Bank Limited, presiding over its Board of Directors Meeting at its head office in the city recently. The meeting approved its Financial Statement-2016. Md Abdus Salam, Managing Director, Manik Chandra Dey, Khon

news:new nation/6-may-2017