Banking

NCC Bank opens branch in Barisal

NCC Bank Limited has opened its 81st branch in Barisal recently.

Md. Harunur Rashid MP, vice chairman of the bank, formally inaugurated the branch as chief guest, said a press release.

Mohammed Nurul Amin, managing director and CEO of the bank, presided over the function while Barisal Sadar Upazila Chairman Azizul Haque Akkas, Bakergonj Upazila Chairman Shamsul Alam Chunnu and GM of Bangladesh Bank Golam Mostafa attended the function as special guests.

Golam Hafiz Ahmed, additional managing director of NCC Bank, gave the vote of thanks on the occasion.

Md Harunur Rashid MP in his speech said Barial is playing an important role in the country’s agro based economy. The area is popular for coconut, paddy and other grains. Besides, small and medium enterprises are expanding in the district. NCC Bank is giving priority to this sector to encourage entrepreneurs.

News: Daily Sun/ Bangladesh/ May-19-2011

The race for skilled resources is on

The banking sector in Bangladesh is thriving. It hires a large number of people every year to serve its growing customer base. Nowadays, a large number of job aspirants want to build a career in banking as it offers structural learning options as well as competitive pay packages.

Job seekers are always trying to find the secret to becoming a successful banker. Human resources (HR) experts in the banking sector say theoretical knowledge, computing ability, excellent communication skills, the right customer service attitude and an ability to work in a team are the keys to success here.

“A person aspiring for a banking career should have sufficient theoretical knowledge on finance and accounting as well as excellent communication skills, coupled with good computing ability because it is the most essential competence for a successful banker,” says Monjurul Alam, senior HR manager at Eastern Bank Ltd.

The person should also be customer oriented, possess a high standard of discipline, and always strive to add value to the bottom line of business, he adds.

Alam, who has over 12 years of experience in different HR roles, says, “Bankers have to possess these skills because they act as a development agent between different groups of people and also facilitate the reparation of other sectors of an economy like exports and imports.”

A bank is a financial intermediary. A commercial bank accepts deposits and channels the deposits into lending activities by segmenting their customers into different categories like consumer, corporate and SME.

Banks provide a huge range of services to its customers, including ATM; debit and credit cards; locker services; special deposit plans; loans for house building, purchasing cars, study and even marriage.

Recent market trends show that financial service providing companies, especially the banking institutions, hire over 2,000 employees a year for entry level positions to reach out to the rural areas.

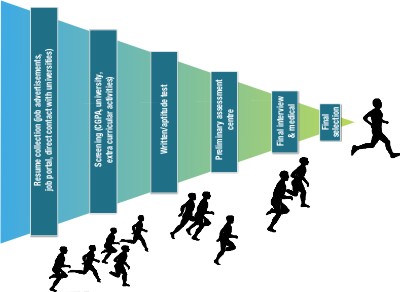

For an entry-level position, banks generally hire employees from external sources. They start the recruitment process by publishing job advertisements in newspapers and online job portals.

Next, they shortlist potential employees based on the qualities they are looking for and described on the job advertisement. Later, they take written tests and a couple of interviews to evaluate the candidates' skills.

Md Tabarak Hossain Bhuiyan, executive vice president and head of HR at Prime Bank Ltd, says, “We hire around 150 management trainee officers (MTO) a year for entry level positions by pursuing a structured recruitment procedure.”

Prime Bank recruits MTOs through a third party. Bhuiyan says Institute of Business Administration of Dhaka University generally performs the recruitment procedure -- from setting questions for the written test to sorting candidates for the final interview.

“We usually recruit business graduates for the MTO position as their curriculums match the banking related subjects; so they can learn quickly.”

“But, we do not discriminate against any public or private university because our written test is open for all universities,” Bhuiyan says.

In the interviews, Prime Bank tries to judge the candidate's aptitude skills and passion for pursuing a career in the banking sector.

“We try to judge the candidate's passion for this profession. Many want to pursue a banking career as a last resort because they do not have a job in his or her desired field,” says the head of HR at Prime Bank. “But, we prefer to hire those who have great passion for banking.”

Mujib A Siddiqui, senior vice president and head of HR at Dhaka Bank Ltd, says, “We hire around 50-70 management trainees a year through a structured procedure and the bank usually takes written test in a GMAT format.”

In the last batch, Dhaka Bank hired around 70 management trainees from 17,000 applicants through rigorous assessment, said Siddiqui.

The Dhaka Bank HR head urges future banking leaders to focus on developing communication skills to serve customers effectively.

Siddiqui says, “We nurture and develop our talent pool in a systematic way. The bank has a career development tool for each employee, to assess one's strength and weakness.”

Based on the assessment, the bank provides different types of training, such as technical, general management, general mathematics and computing skills, through its own training institute, he adds.

Eastern Bank also has strong learning and development programmes for the young talents and they receive extra attention from management, says Alam.

“We just do not give them a job, we shape their career,” says Alam. “Training is an area where we give extra effort to create future leaders.”

Alam says, “Eastern Bank has excellent performance management programmes as its pay benefits are linked to performance.”

Industry insiders say the banking sector has been facing a few challenges in recruiting human resources.

“One of the greatest challenges for sourcing human resources in the banking sector is a scarcity of skilled people,” says Alam. “We have a huge supply of degree holders with very high grades. But in the interview sessions, they can't prove their potential.”

This is because today's students are working on only CGPA (cumulative grade point average); they do not understand the importance of real learning, says Alam. “Good grades are important, of course. But it would be better if the candidates could sell the degree before an interview board.”

The scarcity of resources results in another big issue -- high attrition rates.

Because of the huge gap in demand for good resources in the banking sector and supply, the large banks compete against one another to attract promising candidates, says Alam.

So, they are just poaching people from one place to another, he adds.

It is difficult to design a retention policy where the industry is in an unfair race to take away other's resources, Alam says.

suman.saha@thedailystar.net

News: The Daily Star/ Bangladesh/ May-18-2011

Bangladesh Bank's new GM

Kazi Sayedur Rahman has been promoted as general manager for the foreign exchange reserve and treasury management department of Bangladesh Bank.

Rahman started his career with the central bank in 1988 as an assistant director.

Prior to this promotion, he served as deputy general manager for the same department. He is an accounting graduate of Dhaka University.

News: The Daily Star/ Bangladesh/ May-18-2011

BRAC Bank, SEDF workshop on SME held

BRAC Bank and SouthAsia Enterprise Development Facility (SEDF) managed by IFC, in partnership with DFID and NORAD have organised a workshop on ‘Import and Export Management’ for SME customers.

Managing Director and Chief Executive Officer of BRAC Bank Syed Mahbubur Rahman inaugurated the two-day workshop on Saturday at Westin Hotel in Dhaka. A total of 100 SME customers took part in the workshop.

As SME sector makes remarkable contribution to national economy, the workshop was organised to provide uninterrupted support to entrepreneurs in SME sector.

Expert resource persons made deliberations on issues of import-export management, business initiative, development and growth at the inaugural function.

News: Daily Sun/ Bangladesh/ May-18-2011

Pubali Bank opens branch in Pirojpur

Pubali Bank Limited has opened a branch at Mathbaria in Pirojpur recently.

Syed Moazzem Hussain, executive committee chairman of the board of directors of the bank, formally inaugurated the branch as chief guest, said a press release.

Helal Ahmed Chowdhury, managing director of the bank, presided over the inauguration function while PBL’s Director Ahmed Shafi Choudhury attended as special guest.

Syed Moazzem Hussain in his speech said Pubali Bank is committed to provide the best banking services in the fastest possible time. As part of providing better services and client’s increasing demand, the bank has opened the branch at Mathbaria, he added.

He expressed hope that Pubali Bank would serve its customers with utmost satisfaction by applying modern technology through this branch.

Bank’s MD Helal Ahmed Chowdhury said Pubali Bank has been providing services with a promise to keep up its original tradition. He also said PBL gives priority to provide opportunity and advantage to the customers through application of modern technologies.

Deputy Managing Director of Pubali Bank Safiul Alam Khan Chowdhury, Regional Manager of Barisal Region Syed Abdul Mazid and renowned businessmen also attended the function.

News: Daily Sun/ Bangladesh/ May-18-2011