Bangladesh Bank

BB strengthens banking supervision to check fraud

The central bank has strengthened its supervision on banks to check fraud in the banking system in settling bill purchases following the Hall-Mark scam.

In a notice yesterday, Bangladesh Bank asked banks to turn in applications in 15 days for settling import payment against back-to-back letters of credit using local sources -- fully or partially.

"It has come to the notice of Bangladesh Bank that authorised dealers are making inordinate delay in forwarding the applications for approval."

The banks are advised to submit the applications to the offices of Bangladesh Bank for approval within 15 days of the following month of effecting the payment, the central bank said.

In another circular, the regulator said starting from January 1 next year, ADs would have to report all types of their foreign exchange transactions through its web portal on daily basis.

Bangladesh Bank has taken initiative to receive online statement through its web portal. As part of the programme, its Foreign Exchange Operation Department has already started monitoring export transactions through online reports submitted by authorised dealers.

The central bank has developed online reporting system for all types of cross border foreign exchange transactions, including foreign exchange transactions, through inland back to back letters of credit.

The measures came as Bangladesh Bank tries to strengthen its supervision on banks following unmasking of the Hall-Mark scam, which unfolded that a number of state-run banks settled local LCs on forged documents.

News: The Daily Star/Bangladesh/11th-Dec-12

Trust Bank holds training on green banking

Trust Bank Limited organised a training session on Green Banking and Environmental Risk Management at the Training Academy for its executives.

The session was inaugurated by Deputy Managing Director of Trust Bank Limited, MM Haikal Hashmi.

The training course was conducted by specialist resource person in the arena of bank Khondkar Morshed Millat, Deputy General Manager of Bangladesh Bank.

The training course has enriched the bank to be more skilled professionally to achieve goal on Green Banking and Environmental Risk Management.

The participants of Trust Bank Limited have acquired clear conceptual knowledge and direction to achieve green banking objectives form this session.

News: The Daily Sun/Bangladesh/10th-Dec-12

Road Blockade Hampers BusinessBanks see low turnout

The commercial banks experienced a relatively low turnout of clients during the blockade enforced by the main opposition BNP (Bangladesh Nationalist Party) Sunday.

Branches of different banks in the city run their operations under additional security measures for their safety.

According to witnessing account, only a few clients of different bank branches went to respective bank due to unavoidable needs for depositing money under savings schemes, withdrawal of cash and trade and commerce purposes.

“Clients’ turnout is very low today. However, we are providing online services regarding deposit, withdrawal of cash and services to facilitate trade and commerce,” said an official of Motijheel branch of the Premier Bank Ltd, seeking anonymity.

The bank branch has provided services to clients by keeping shut down the front-side entrance and opened an inside entrance for use of clients by deploying security guards outside and at the entrance.

The similar situation prevailed at the Motijheel branch of NCC bank Ltd, another commercial private bank, where the management took out extra-caution to cover security aspects.

Meanwhile, an official of Bangladesh Bank (BB) said the currency department of the central bank was not as busy as other normal days.

“The demand for cash was low from the side of the commercial banks due to the blockade,” said an official, of the department, seeking anonymity.

The central bank official said people have become traumatised because of the arson attack to public buses and other vehicles during the blockade that refrain them from coming outside, specially to the banks.

Commenting on the adverse affect of political programmes like blockade and hartal, President of Exporters Association of Bangladesh, Abdus Salam Murshedy said such programmes always act against the spirit of economic activities.

News: The Daily Sun/Bangladesh/10th-Dec-12

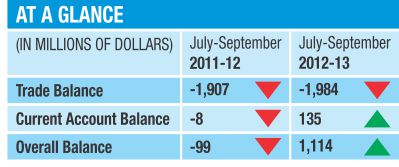

High remittance, low imports widen BoP surplus

The first quarter of the current fiscal year saw the country consolidate its balance of payment surplus on the back of high inward remittance and low import bills.

The first quarter of the current fiscal year saw the country consolidate its balance of payment surplus on the back of high inward remittance and low import bills.

The surplus stood at $1.11 billion in the first quarter of fiscal 2012, according to data from Bangladesh Bank.

A deficit of $99 million was recorded in the same period last fiscal year.

Import spending in the first three months of the current fiscal year increased by only 1.98 percent, while remittance increased by more than 19 percent.

As per a BB official, the decrease in export growth accounts for the fall in import bills, as a big chunk of import spending is earmarked for the export-oriented garment factories.

Exports grew by 1.34 percent in the first three months, due to the slowdown in the Eurozone and the US.

Another reason for the lower import spending is the decrease in food imports, the official said.

Since both of export and import growth fell, there was more or less no year-on-year change in trade deficit.

The current account balance in the first quarter was $135 million surplus, while it stood at $8 million deficit in the same period last fiscal year.

The BB official further said there is no pressure on the balance of payment this fiscal year as the foreign exchange reserve has been hovering around $11 to $12 billion, equivalent to four months' import bill.

As per global standards, foreign exchange reserve equal to three months' import bill is adequate.

News: The Daily Star/Bangladesh/10th-Dec-12

Women-led SMEs promise faster economic growth Melanne S Verveer says at South Asia Women's Entrepreneurship Symposium

US Assistant Secretary of State Robert O Blake speaks at a symposium on South Asia women's entrepreneurship, at Ruposhi Bangla Hotel in the capital yesterday. Bangladesh's Foreign Minister Dipu Moni, seated left, was also present.

US Assistant Secretary of State Robert O Blake speaks at a symposium on South Asia women's entrepreneurship, at Ruposhi Bangla Hotel in the capital yesterday. Bangladesh's Foreign Minister Dipu Moni, seated left, was also present.

The small and medium enterprises that are run by women guarantee faster economic growth, but access to finance remains a major barrier to women entrepreneurship, said Melanne S Verveer, US ambassador-at-large for global women's issues.

Verveer spoke at South Asia Women's Entrepreneurship Symposium that began yesterday in Dhaka to create cross-border linkages among women entrepreneurs in the region.

Some 120 participants from 11 South and Central Asian countries attended the event to discuss the challenges and opportunities faced by women-owned SMEs.

"SMEs are the engines of economic growth. It is a fact that women-run SMEs drive economic growth and create jobs. This is true in my country and it is true around the world," Verveer said at the event at Ruposhi Bangla Hotel.

The US Department of State organised the symposium attended by participants from Bangladesh, India, Pakistan, Nepal, Bhutan, the Maldives, Sri Lanka, Myanmar, Afghanistan, Kyrgyzstan and Kazakhstan.

"If you want to drive GDP, the best investments that can be made are women-run SMEs," Verveer said.

But access to finance acts as a major challenge for women entrepreneurs to grow, she said.

She also said microcredit has lifted millions of poor women around the world out of poverty and enabled them to earn, support families and pay back the loans.

"Yet the significant gender gap to finance remains painfully acute as it affects what we might call the missing middle of the small and medium enterprise sector, which is mostly women-run and has the best growth and job creation potential," said Verveer.

In addition, barriers like a lack of access to markets, training, mentors and technology act as impediments to women entrepreneurship.

Women also often confront discriminatory regulations and a lack of inheritance and property rights, she said.

Verveer also stressed investing in girls' education and favoured women's representation at the policymaking level.

"As your businesses grow, we are confident you will speak out against corruption when you see it. As leaders in businesses, we know that you will also work to strengthen democratic institutions and civil society," said Verveer.

Foreign Minister Dipu Moni said the government has enacted a number of new laws for women and children and adopted a gender-responsive budget.

The government has framed 'women development policy' to ensure equal opportunity for men and women.

The government also took various initiatives to promote women entrepreneurship.

The government has kept 10 percent of small enterprises' fund for women entrepreneurs at Bangladesh Bank and ensured preferential treatment to them at commercial banks, she said.

"Strong networks among women entrepreneurs will certainly enhance their ability," said the foreign minister.

She said Prime Minister Sheikh Hasina has joined a global initiative by US Secretary of State Hillary Rodham Clinton.

Under the initiative, women's representation in Bangladesh's parliament will be raised to 30 percent from present 20 percent, said Dipu Moni.

US Assistant Secretary of State Robert O Blake said the summit will help women entrepreneurs foster cross-regional collaboration and build multilateral connections.

News: The Daily Star/Bangladesh/10th-Dec-12