Bangladesh Bank

Banks invest Tk 1.7tn in three quartersDeposit stands at Tk 2.12tn; Prime Bank leads PCBs

Some 20 local Private Commercial Banks (PCBs) have invested an amount of Tk 1.70 trillion till September ofthe current calendar year against the deposits these banks have collected from clients worth Tk 2.12 trillion by the period since inception of respective operations, according to data available from quarterly report of banks.

Some 20 local Private Commercial Banks (PCBs) have invested an amount of Tk 1.70 trillion till September ofthe current calendar year against the deposits these banks have collected from clients worth Tk 2.12 trillion by the period since inception of respective operations, according to data available from quarterly report of banks.

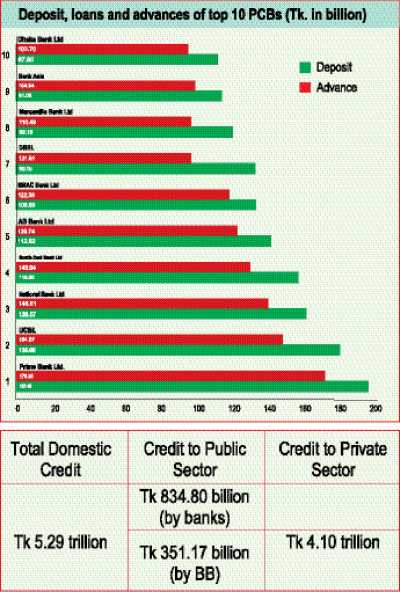

Of the PCBs, the Prime Bank Ltd (PBL) has become the market leader by holding major stake in deposit mobilisation and disbursement of credit followed by UCBL, National Bank Ltd, South East Bank Ltd and AB Bank Ltd.

The PBL has collected total deposits amounting to Tk 185 billion till the end of November while its investment stood at Tk 157.49 billion by third quarter of 2012, according to the report.

While commenting on performance of the PBL, its managing director Md Ehsan Khasru told daily sun that around 80 percent of his total loans goes to productive persuades which is contributing to the industrial expansion.

“So far, I knew PCBs have invested maximum percentage of respective loans in the industrial sector, which called term loan or current credit, as my bank does,” Khasru said.

The head of the PBL management said the strategy of the management of his bank is keeping deposits safe by not investing in unviable projects.

Khasru said his bank is experiencing a significant rise in deposit mobilisation though the rate of interest has been curtailed to 12 percent from 12.5 percent recently.

“The question is how I have obtained the trust of depositors? —-Simply I have reduced my cost of doing business and providing improved, efficient and some ‘no cost’ services to clients,” he said.

He said his bank now does not charge for maintaining any current and savings accounts in PBL branches. “In the west, the easy way usually applied to reduce cost of doing business is ‘job cut’. But, here I don’t think it as best practice. I have reduced the rate of interests for both the deposit and lending,” he said.

He said the lending rate of his bank is now 15 percent for term loan which is above 16 percent in the market. “My bank is a strong bank now,” Khasru said.

According to the quarterly report, 10 PCBs having strong deposit base are— UCBL (Tk. 164.87 billion), National Bank Ltd (Tk. 148.01 billion), South East Bank Ltd (Tk. 143.94 billion), AB Bank Ltd (Tk. 129.74 billion), BRAC Bank Ltd (Tk. 122.38 billion), DBBL (Tk. 121.81 billion), Mercantile Bank Ltd (Tk. 110.49 billion), Bank Asia (Tk. 104.84 billion) and Dhaka Bank Ltd (Tk. 102.70 billion).

Respective assets of these 10 PCBs are UCBL (Tk. 135.68 billion), National Bank Ltd (Tk. 128.57 billion), South East Bank Ltd (Tk. 119.36 billion), AB Bank Ltd (Tk. 112.82 billion), BRAC Bank Ltd (Tk. 108.93 billion), DBBL (Tk. 89.15 billion), Mercantile Bank Ltd (Tk. 89.16 billion), Bank Asia (Tk. 91.09 billion) and Dhaka Bank Ltd (Tk. 87.90 billion).

However, the quarterly report implies conventional banking of PCBs and it has dropped the Islami Bank Bangladesh Ltd (IBBL) as the latter is providing completely Islamic banking services to clients.

The IBBL has been a single highest stakeholder as private bank in terms of deposit mobilisation, investment and earning profit in the country’s banking sector.

Meanwhile, total domestic credit stood at Tk 5.29 trillion. Out of the amount, credit to private sector stood at Tk. 4.10 trillion by banks (without financial institutions) while that of the public sector rose to Tk. 834.80 billion by banks till September 2012.

According to Bangladesh Bank's (BB) statistics, broad money (m2) circulation at present is slightly above Tk. 5.36 trillion.

News: The Daily Sun/Bangladesh/17th-Dec-12

Boards of state banks inactive for 3 months IMF asks govt to appoint directors as per Bangladesh Bank criteria

The boards of state banks have remained dysfunctional for more than three months as the government has been unable to appoint directors to the banks' highest policymaking panels.

Officials of these banks said they cannot take important decisions, including those for approving private sector loans and rescheduling loan proposals, in absence of the boards.

Finance ministry officials said the reconstitution of the boards is getting delayed as the finance minister finds it difficult to choose the right people for the posts after the recent scams and the allegation of involvement of their directors in the frauds.

The International Monetary Fund has also asked the government to appoint directors who meet the 'fit and proper' criteria of the central bank.

An IMF mission during its recent visit to Dhaka made the suggestion and the government also committed to go by the recommendation, a finance ministry official said.

Since the first week of September, about 40 posts of directors in different government-owned banks and financial institutions have been vacant. Of the posts, 26 are with Sonali, Janata and Agrani banks.

The managing director of a state bank said the amount of default loan may increase much this year in absence of their boards.

He said loan rescheduling is not possible without the board's decision and for loan recovery, rescheduling is necessary.

The managing director of another bank said they contact the finance ministry almost every week, and the officials at the ministry assure them that the boards will be reconstituted next week but it does not happen.

The finance minister has contacted some eligible people and offered them directorship in the boards but they have rejected the proposals, the ministry officials told The Daily Star.

The officials said the finance minister has been talking unofficially with the central bank on whether some of his choices can be appointed as directors.

They said many of the vested quarters are still lobbying for the posts of directors at the state banks.

There have been allegations that some of the directors take commission from businesses as well as individuals in helping them get loans from the banks.

After coming to power in 2009, the present government appointed some former leaders of Jubo League and Chhatra League, the youth and student wings of the ruling Awami League, as the directors of the banks.

The state banks had made some progress as a result of the implementation of the World Bank's financial sector reform programme but it was hampered in the recent times due to the interference by some directors with political affiliation.

The central bank also warned the boards of the banks and the finance minister several times about such interference.

In December 2010, the central bank's board also discussed the issue of interference by the state banks' directors. The board expressed concern over the matter and decided to convey the concern to the government in writing.

Later in early 2011, Bangladesh Bank Governor Atiur Rahman wrote a letter to the finance minister, saying: “In the day-to-day activities of the banks viz loan approval activities, transfer and promotion, direct interference by the boards and incidences of exerting influence have come to our knowledge.”

The letter also said the issues were very important and needed immediate steps.

But no action was taken. Later the finance minister organised a face-to-face meeting between the BB officials and the directors of the state banks where the directors severely criticised the central bank officials.

News: The Daily Star/Bangladesh/17th-Dec-12

BB asks public banks to give interest-free loan to Aila-Sidr hit farmers

Bangladesh Bank (BB) has instructed all state-owned commercial banks (SCB) to give interest-free loan to the marginal farmers and poor women of Aila-Sidr and monga affected region under their Social Corporate Responsibility (CSR).

The central bank dispatched the order following the successful implementation of a credit programme by Janata Bank in those regions, sources said. During a recent meeting with SCBs and specialised banks, the central bank asked all SCBs to follow the model of Janata Bank in this regard.

“Marginal farmers of the Aila and Sidr are leaving farming as they are failing to maintain this profession through borrowing from rural lenders at high interest rate. Janata Bank has set a rare example by giving these farmers interest free loan under its CSR programme,” said BB’s Executive Director SM Moniruzzaman.

“As BB wants to effectively implement the programme of Janata Bank, we have asked all SCBs to implement this programme in a limited scale,” he said, adding, “If all the SCBs come forward, this interest free loan programme would help these poor farmers stay in their areas and involve in farming.”

Janata Bank launched interest free loan scheme under its CSR programme in the financial year 2009-10 and it disbursed Tk 3.0 crore among 3,120 marginal farmers in the financial year 2011-12.

Janata Bank has targeted to disburse Tk 5.0 crore in the current fiscal year (2012-2013). Talking to BSS, Md Zikrul Haq, Deputy General Manager of the Department concerned of Janata Bank, said the bank initially constituted a revolving fund to give farmers interest free loan.

News: The Daily Sun/Bangladesh/16th-Dec-12

Bond market goes online tomorrow

The central bank will launch an online trading platform for government treasury bonds and bills tomorrow, opening up an easy market for both institutional and individual investors.

The launch of the platform -- Trader Work Station -- will meet a long-pending demand, as the existing secondary bond market in the stock exchanges is still inactive, especially for government treasury bonds and bills. A bond is a debt instrument.

Bangladesh Bank issued a guideline last week for the sales of Bangladesh Government Treasury Bond (BGTB) and bills in the secondary market.

BB Governor Atiur Rahman will inaugurate the platform, a central bank official said yesterday.

Anis A Khan, managing director of Mutual Trust Bank, said Bangladesh lags far behind the advanced and regional countries where the secondary bond market is vibrant.

“However, we appreciate the introduction of the platform,” he said.

The secondary bond market may not be lucrative for investors right now due to the present economic condition of the country. “But it will be lucrative in the long run."

Online trading will expand the bond market at the secondary level, bring innovations in market-based rate and smooth participation of investors -- both individual and institutional, according to the BB guideline .

The guideline said individual or institutional investors can participate in trading in the platform through primary dealer or scheduled banks and financial institutions having current accounts with the BB.

The market value of all treasury bills and bonds, yield, amount, date of issuance and date of expiry will be shown on the ticker screen of the website.

Any buyer or seller can place orders on the platform through his bank for buying or selling all government treasury bills on the price or yield shown on the ticker screen, the guideline said.

It said T+0 trading system will be followed in settlement of purchase and sale of BGTB or treasury bills through the platform. The T+0 means, the trading will be settled on the same day.

The ticker screen will show the total sales of securities, highest and lowest market rates, yield and the total value of securities purchased and sold in a day.

If necessary, the central bank will impose circuit breaker to prevent any abnormal fall or rise in the market price. The market watch screen of the platform has the option of monitoring market-related information and data.

Detailed information of all orders, sale and purchase of securities can be seen on the market watch screen.

The members can get detailed information of each of their orders from the order book of the platform and, if necessary, cancel or change their orders, according to the guideline.

News: The Daily Star/Bangladesh/16th-Dec-12

Power sector imports eat up 1/3 of remittance

The central bank of Bangladesh projected the payment obligation in the dollar currency against imports in the power sector at $1.0 billion for the four-month period from November last, official sources said.

The payment obligation has been set against import of capital machinery, and petroleum oil and the purchase of electricity from rental power plants, which are joint ventures with foreign companies.

Experts fear a negative impact of it on the dollar rate in the local money market, if such big payments coincide with other payments in the greenback.

The government has to pay $1.014 billion for a period of four months, as is projected by the import monitoring section of Bangladesh Bank's (BB) Foreign Exchange Policy Department (FEPD).

The expected payment obligation for the months of November, December, January and February is as follows: $ 124.18 million for importing capital machinery, $ 743.31 million for importing petroleum oil and $ 147.12 million for purchasing electricity from rental power plants run on joint venture with foreign companies, according to the BB statistics.

The annual import costs in the power sector are equivalent to about one-third of the hard-earned remittances expatriate Bangladeshis send home, official sources said.

The total remittance inflows stood at $12.85 billion in the last financial year (2011-12) against $11.65 billion received in the 2010-2011 fiscal year. But a large portion of it or about one-third was spent on imports in the power sector, especially for the rental power plants, they also said.

The government needs more or less $ 5 billion a year against the payment obligation for imports in the power sector to generate electricity, a BB official said.

But the power supply in the country did not improve to any significant level, though the government raised power tariff several times in the country.

A former BB official said the higher payment obligation or import payments might push up the demand for dollar widening its gap with the greenback's supply and thus it might raise the dollar price in the local money market.

News: The Daily Financial Express/Bangladesh/15th-Dec-12