Bangladesh Bank

PCBs contribute highest to industrial growth

Private Commercial Banks (PCBs) have made the highest contributions to the country’s industrial growth by providing the lions share of loans to the sector in the first quarter of the current fiscal.

Private Commercial Banks (PCBs) have made the highest contributions to the country’s industrial growth by providing the lions share of loans to the sector in the first quarter of the current fiscal.

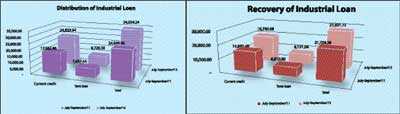

All banks and financial institutions (FIs) have disbursed a total of Tk 345.54 billion in July-September period of FY 2012-13.

The share of PCBs in industrial credit was as high as 76.23 percent while the stake of state-owned commercial banks (SoCBs), foreign commercial banks (FCBs), specialised banks and financial institutions (FIs) were 8.22 percent, 8.57 percent, 2.93 percent and 3.35 percent respectively.

The central bank data also shows a significant 38.22 percent rise in industrial credit in the first quarter of the FY13 over the same period last fiscal.

During the July-September period of FY13, banks and FIs have disbursed a total of Tk 345.54 billion loans while the loan in the same period last fiscal was Tk 249.99 billion.

Out of total loan amount, the current credit was Tk 248.33 billion and the term loan was Tk 97.20 billion, the BB data shows.

Meanwhile, the amount of outstanding industrial loans recovered by all banks and FIs was Tk 279.31 billion, out of which Tk 197.40 billion was current credit and Tk. 81.91 billion term loans.

The recovery of current credit went up by 32.55 percent to 197.40 billion in July-September period of FY13 compared to Tk 148.93 billion in the corresponding of last fiscal.

In case of outstanding term-loan, the recovery moved higher by 20.26 percent to Tk. 81.91 billion in FY13 compared to Tk 68.10 billion in the same period of FY12. Total recovery of industrial credit in July-September FY12 was Tk. 217.04 billion.

The success rate in industrial loan recovery by PCBs was Tk 75.14 percent, FCBs 11.63 percent, SoCBs 5.93 percent, FIs 4.03 percent and specialised banks 3.27 percent.

However, the central bank data shows a remarkable rise in the overdue industrial credit in the first quarter of current fiscal compared to the same period of last fiscal, signaling the risks of generating more bad loans as these amounts will be required to be classified and provisioned by banks.

In July-September 2011-12, overdue industrial credit amounted to Tk. 138.67 billion, which rose by 9.67 percent to Tk 152.09 billion.

According to the data, about 16.85 percent of the industrial term-loan became overdue while the stake of current credit was 2.64 percent.

Out of total overdue loans, the share was 49.61 percent of PCBs, 36.37 percent of SoCBs, 6.06 percent of FIs, 5.57 of specialised banks and 2.39 percent of FCBs.

News: The Daily Sun/Bangladesh/02-Dec-12

Improving governance in state banks

Recently, we heard the finance minister saying in parliament that the impact of the Hall-Mark scam is felt by other banks as well. This statement actually defies claims of many who asserted that the scam was an isolated incident having little implications for the banking sector.

Recently, we heard the finance minister saying in parliament that the impact of the Hall-Mark scam is felt by other banks as well. This statement actually defies claims of many who asserted that the scam was an isolated incident having little implications for the banking sector.

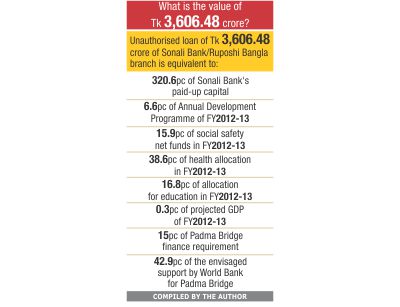

The Centre for Policy Dialogue (CPD) organised a dialogue on governance in the banking sector in the beginning of November where it was highlighted that the amount is rather quite significant for resource-poor Bangladesh.

Some people, including bank officials, told us later that the CPD's dialogue was not helpful for the banking sector as it could affect the reputation of the banking industry. I could not but feel sorry for those who consider constructive discussions harmful and think that our reputation is still upheld after such a proven disgraceful incident.

The think-tank mentioned in its presentation that the Hall-Mark incident is not only a case of financial loss but also a deep dent on the confidence and trust of the customers of Sonali Bank. It is not the loss of the goodwill of a particular bank only, but also of the total banking industry.

Such an erosion of reputation of banks could have multiple chain effects, leading to a reduction in deposit, high interest rate and a fall in share prices of the concerned bank, which in turn can constrain the role of the banking sector in catalysing the growth of the economy.

It is undeniable that the banking sector, the dominant industry in Bangladesh's financial sector, has flourished during the last three decades as a result of increased demand of the growing economy. If one looks at the pace of development of the banking industry, total asset has grown by 324.2 percent, while deposit has increased by 326.9 percent during 2001-11.

Total deposit is currently 51 percent of GDP. The ratios of money supply, total deposits and total domestic credit to GDP have shown a steady increase over the years, indicating an increased financial depth.

Financial inclusion, though still low compared to the developing countries, have expanded since the independence. Population per bank branch has decreased from 57,700 in 1972 to 17,660 in June 2011, though this does not undermine the fact that a large number of people still remain outside the banking services.

Over the last few years, the country's banking sector has made progress in terms of meeting indicators such as capital adequacy, asset quality, management quality, earnings, liquidity and sensitivity to market risks (CAMELS).

However, the seemingly good performance does not capture the reality which raises doubts as regards the real health of banks, particularly of the state-owned ones. The government embarked on a policy of liberalisation, by denationalising the nationalised commercial banks in the 1980s in view of the deteriorated performance and inefficient resource management. The reform process got momentum in the 1990s and continued afterwards.

The latest major reform programme was the corporatisation and restructuring of the state-owned banks in 2007. This led to some improvements initially. For example, the state banks, for the first time, earned profit in 2008; the amount of non-performing loans came down and expenditure-income ratio reduced.

However, the core strength of these banks remained weak. For example, performance in terms of efficient resource allocation through disbursement of credit to productive sectors, prudent risk analysis, supervisory and management quality, improved customer service and the overall governance continue to depict rather disappointing picture. In this context, a set of key recommendations are presented below.

First, the absence of a comprehensive risk management policy in many banks makes it difficult to handle fraud and other extraordinary cases. Core risk management guidelines of Bangladesh Bank are hardly followed by the state banks.

The manual for loans and advances containing policies, procedures, processing and reporting transactions, review of security and collateral and responsibilities at different levels is not followed by many banks due to which it becomes difficult for banks to handle and manage clients with various levels of exposures.

Second, the internal control department which is supposed to be a critically important department is weak in state banks. This is partly due to incentive failure which prevents hiring of qualified persons for this department. As the nature of the job involves patient scrutiny of compliance, people are reluctant to work here, and those who do, are often in a way dumped in this department.

Third, the practice of appointing directors for the board of the state-owned banks based on the political loyalty and affiliation has to be changed. The "Fit and proper test criteria" of the Bangladesh Bank Guidelines 2010 for the nomination of directors should be implemented fully. Due to political baggage, directors of state banks cannot perform their duties independently and remain morally obliged to listen to political instructions.

Fourth, the recent scam has also exposed the total failure of the senior managers of the bank in discharging their duties. In the state banks, the major preoccupation of the CEOs is to "manage" the board to keep their jobs. Unfortunately, it is also difficult for them to do otherwise in a setting where many decisions are influenced by political instructions. As a result, these officials lack creativity and initiatives towards developing good business plan, effective people management programme, regulatory compliance practice and effort towards clients' satisfaction.

The board should only guide and support the CEO to achieve bank's targets and evaluate his performance on the basis of key performance indicators. The general managers should be transferred from one state bank to another not only to help transfer good practices, but also to reduce the possibility of fraudulent and unethical practices.

Fifth, the human resource (HR) departments of state banks remain weak and powerless to take decisions on recruitment and promotion, partly due to a lack of capacity and external influence. The HR policy of banks should not only arrange for appropriate training but should also involve the reward and punishment practices.

Sixth, an issue related to the HR development is the automation and implementation of management information system in banks. It is apprehended by experts with fair amount of certainty that there may be many more Hall-Mark like cases that wait to be uncovered in other banks. The mess may become unmanageable, if these are not dug out through transparent and automated banking practices.

Seventh, the supervisory and monitoring role of the central bank needs to be significantly strengthened and the Banking and Financial Institutions Division should be dismantled to get rid of dualism in the regulatory mechanism for smooth functioning of the banking sector.

Finally, a commission for the financial sector is being planned by the government for its improvement. It is expected that recommendations of the commission will be implemented with due sincerity.

News: The Daily Star/Bangladesh/02-Dec-12

Proposed banks' time extension plea BB to take decision today

The board of directors of the Bangladesh Bank (BB) will discuss today (Tuesday) time extension prayers submitted by two proposed banks, which failed to comply with the letter of intent (LoI) requirements in time, officials said.

"Our board may take final decision in the meeting after discussing the matter," a BB senior official told the FE Monday.

He said the central bank will also submit a status paper on other seven proposed banks in the meeting highlighting their latest situation.

The paper will include ensuring deposit of money for complying with paid-up capital, tax-related issues, and default loan position of the sponsors of the proposed banks, he added.

The BB is now checking the tax-related issues with the National Board of Revenue (NBR) in case of local sponsors to ensure whether the blocked money for maintaining the banks' paid-up capital is taxed or not, according to the BB officials.

"We've sent necessary documents to the Credit Information Bureau (CIB) of the central bank to know about non-performing loan issue of the sponsors of the proposed banks," another BB official said.

Under the existing provisions, the paid-up capital of a new bank will be no less than Tk 4.0 billion, and sponsors of the non-resident Bangladeshi (NRB) banks will deposit their paid-up capital in foreign currency.

As part of the scrutiny, the central bank is now collecting information on blocked money for paid-up capital and default loan of the sponsors from the banks concerned and the CIB.

Seven proposed commercial banks earlier applied to the central bank for licences to start their business after complying with the requirements as per the LoI.

The proposed banks, which have submitted documents to the BB, are - Union Bank Limited, Farmers Bank Limited, Meghna Bank Limited, Midland Bank Limited, South Bangla Agriculture and Commerce Bank Limited, NRB Commercial Bank Limited and NRB Bank Limited.

News: The Daily Financial Express/Bangladesh/27-Nov-12

IMF worried over growth of NPL in banking sector

The International Monetary Fund (IMF) has expressed its deep concern over the recent rise in non-performing loan (NPL) in the banking sector. It wanted to know about the actions the government had taken in realising loans taken fraudulent 14 from different state-owned banks.

The agency also has sought to know about the progress relating to the special 'diagnostic examination' that the Bangladesh Bank (BB) is supposed to conduct on four state-owned commercial banks (SCBs) as was asked by it in September last.

A note containing the concerns of the multilateral lending agency, along with a set of queries made on the entire banking and financial sectors, has been sent to the Ministry of Finance (MoF) and the Bangladesh Bank ahead of the visit of Extended Credit Facility (ECF) team of the Fund.

The ECF mission, headed by David Cowen, is scheduled to arrive in Dhaka today (Tuesday) to review the progress in the pledged reforms in banking and other financial areas as were agreed upon under the credit deal, a senior finance official said.

The BB top officials said they had completed a great deal of tasks towards completing the special 'diagnostic examination' to identify weaknesses of he SCBs in asset quality and liquidity management.

"We are very much operational in conducting an inclusive diagnostic examination of Sonali, Janata, Agrani and Rupali banks," BB's Deputy Governor Abu Hena Mohammed Raji Hasan told the FE on Monday.

The examination, along with identifying other alleged malpractices, irregularities and rise in classified loans in the entire banking sector is being conducted by the central bank, Mr Raji added.

The amount of classified loans increased by Tk 72.82 billion or 1.58 percentage points in the third quarter of 2012.

As of September 30, the total amount of non-performing loans in the banking sector soared to Tk 362.82 billion or 8.75 per cent of the total outstanding loans.

The amount of NPL was Tk 290 billion or 7.17 per cent of total outstanding loans of banks on June 30 last, data of BB shows.

News: The Daily Financial Express/Bangladesh/27-Nov-12

Banks asked to allocate 10pc loans to SMEs

To promote country’s women entrepreneurship, the central bank advised all scheduled banks to disburse at least 10 per cent SME credit out of their total loan portfolio, according to Nazneen Sultana, deputy governor of Bangladesh Bank (BB).

Sultana on Saturday was addressing a seminar organized by Bangladesh Institute Bank Management.

BIBM faculties presented two research papers on “Information System Security in Banks” and “Role of Women Entrepreneurship Develop-ment in Bangladesh” when Sultana made this observation.

She said, “Banks assistance can offer a feasible solution to generate skilled women entrepreneurs for the betterment of the country.”

Addressing as chief guest she said banks have to take more steps to enhance the number of skilled women entrepreneurs in the country.

The deputy governor has underscored the need for more proactive roles so that women entrepreneurs flourish with their projects.

Fahmida Chowdhury, associate Prof. of BIBM presented a key note paper on “Role of Banks in Women entrepreneurship development in Bangladesh”. She observed that interest rate of SME loan was still high and entitlement to it was complicated.

Chowdhury said women in Bangladesh are employed in low income jobs and that most of the entrepreneurs are involved in farm business, forestry, fishery, boutique and beauty parlor business. Therefore, she said, business diversification is essential

and adequate and easy financial facilities can encourage them to diversify their traditional business.

However, Fahmida made some specific recommendations for banks to take the opportunity to work with women who have no previous experiences but want to start a new business.

Considering the growing demand for skilled entrepreneurs, banks can take initiative to provide training to the existing bosses.

She said, “Banks can also provide marketing financial facilities, product development information and define sources of fund at free of cost.

The seminar was also addressed by Prof. Dr. Prashanta Kumar Banerjee, director of BIBM, Dr. Toufic Ahmed Chowdhury, director general of BIBM, Md. Shihab Uddin Khan, associate Prof. of BIBM, A.H.M. Kai Khasru, executive director of the central bank, Zaitun Sayef, deputy managing director of IFIC Bank Ltd. and Mohammad Tazul Islam, Md. Masudul Haque, Md. Mahbubur Rahman Alam, Kaniz Rabbi, assistant professor of BIBM.

News: The Daily Independent/Bangladesh/25-Nov-12