Sticky

WB report urges policy makers to design pro-poor products

As mobile banking and other technological innovations fuel the expansion of financial services in many developing countries, a new World Bank Group report urged the policy makers to focus on products that benefit the poor, women and other vulnerable groups the most.

No-frills savings and automatic payment accounts, for example, offer a safe place for people to store and transfer money and help them maintain a relatively stable living standard. Evidence, however, is mixed on microcredit and micro-insurance products.

“When well designed, efforts to foster financial inclusion can be an effective way to empower people,” said World Bank Group President Jim Yong Kim on the release of the report mid-night on Monday. “Whether you are a public sector financial regulator or a private sector bank, it is in your interest to get everyone access to financial services. This is good for the world and will help us end poverty.”

“The 2014 Global Financial Development Report: Financial Inclusion” is a comprehensive report yet on the topic. It comes as policy makers are pushing to reach the world’s unbanked – 2.5 billion people who make up about half of the world’s adult population.

More than 50 countries recently set targets to improve financial inclusion. Last month, Kim announced a new initiative to provide universal financial access to all working-age adults by 2020 – with the help of technological innovations such as e-money accounts and e-mobile wallets.

The report released at a time when mobile banking in Bangladesh was growing fast - the number of customers in the country exceeded five million, according to latest Bangladesh Bank figures.

Mobile financial services began in the country in 2010 to spread banking services among poor people, and to help villagers receive remittances from expatriate relatives securely and without trouble, Bangladesh Bank Governor Atiur Rahman said earlier, marking the milestone of 5m customers.

The number of clients reached 5.25m in April this year with a total transaction of Tk1.2bn daily through mobile banking. The total number of transactions by mobile banking was more than 15m in April, compared to about 14m in March. The total transaction value stood at Tk36.4bn in April, which was Tk33.3bn in March.

The central bank has so far approved 26 banks to provide mobile banking while 17 of them have already started the service.

Meanwhile, BB has plans to bring garment workers under the mobile banking system, and is discussing the issue with trade bodies like the BGMEA and BTMEA.

Progress in financial inclusion

According to the World Bank report, mobile banking has played a key role in expanding financial inclusion among low-income populations in countries such as Kenya, the Philippines and Tanzania. Brazil increased financial access to people living in remote areas by promoting technology-based “correspondent banking” – financial services provided on behalf of banks by retails stores, gas stations, and agents on motorcycles and boats on the Amazon River.

The poor benefit the most from technological innovations, which make financial services cheaper and easier to access, the report says. Low-income economies, especially those with remote, sparsely populated areas, have much to gain from allowing the provision of financial services outside of established bank branches.

Many countries have made progress in expanding account use among the poor, women, youth, and rural residents, even without tapping into advanced technology. Some policies have proven to be especially effective, such as requiring banks to offer low-fee accounts, waiving onerous documentation requirements and using electronic payments to deposit government assistance into bank accounts. South Africa, with a public-private framework, increased the number of bank accounts by six million in four years. Brazil’s regulatory reforms led to a dramatic expansion of places offering financial services – now in every municipality in the country.

Challenges in expanding financial inclusion

But challenges remain. While several countries have quickly rolled out basic bank accounts for the unbanked, in some cases, millions of those accounts have remained dormant. Even more troubling, without healthy competition and effective regulation, credit is often overextended to people not qualified to receive it.

And promoting credit without regard to cost actually exacerbates financial and economic instability, the report shows low-income countries face particularly daunting challenges. Thirty percent of the adults there saved in 2011, compared with 58% in high-income countries, according to analyses of the World Bank’s Global Findex database included in the report. And 11% of adults there saved using a bank account, compared with 45% in high-income countries.

In addition, about 9% of the adults worldwide originated a loan from a formal financial institution, but those in developing countries are three times more likely to borrow from family and friends than from banks.

“Financial services are out of many people’s reach because market and government failures pushed the costs of these services to prohibitively high levels,” said World Bank Director of Research Asli Demirguc-Kunt, who co-authored the report. “In many cases, the services are unavailable because of regulatory and legal hurdles.”

Addressing market and government failures

To promote financial inclusion responsibly, the report urges policy makers to improve the standards for information disclosure and support innovative, well-designed financial products that address market failures, meet consumer needs and overcome some behavioral hurdles. For example, commitment savings accounts, where access to cash is possible only after a period of time or after a goal has been reached, can promote savings.

And if well designed, index-based insurance, which links payouts to a well-defined index, such as the amount of rainfall or commodity prices, reduces moral-hazard problems, because payouts reflect a measurable index beyond the control of the policyholder.

Policy makers can also improve financial access by embracing new technologies, which not only include mobile banking, but other innovations such as borrower identification based on fingerprinting and iris scans, the report says.

They should, however, strike a balance between providing incentives for the development of new payment platforms and requiring them to be open to competition.

Responsible financial inclusion also requires consumers to better understand finance. The study finds that standard, classroom-based financial education aimed at the general population has little impact. But financial education can be effective during key moments of a person’s life, such as when starting a new job or when applying for a mortgage loan. People also learn better when financial messages are delivered though social networks and engaging channels, such as soap operas, according to evidence highlighted in the study.

The World Bank Group is committed to supporting countries in their efforts to bolster access to finance. It currently conducts financial inclusion projects with public and private partners in more than 70 countries.

News:Dhaka Tribune/12-Nov-2013

Mobile banking crosses milestone

The number of mobile banking subscribers has crossed the one-crore mark, thanks to a rapid expansion of the financial outlets of commercial banks.

The number of mobile banking accounts has nearly doubled to 1.24 crore in seven months from 50 lakh in April, according to Bangladesh Bank.

Mobile banking subscribers increased 11.79 percent to 99.8 lakh in October, rising from 89.3 lakh in September, BB data shows. Transactions through mobile banking stood at Tk 509 crore in October.

As part of the government’s financial inclusion programme, the central bank has allowed 27 banks to provide mobile-banking; to date, 19 have launched the service.

A lot of enthusiasm is centering around mobile banking as BB is promoting commercial banks to develop their mobile-based financial services, the central bank said in a statement.

Launched in 2011 by two private banks, mobile phone-based financial services have became popular in the country, it said.

Using a mobile phone and without making a visit to a bank branch, a customer can transfer money, receive salaries or pay bills from their accounts through mobile banking.

The central bank has allowed mobile banking systems to provide almost all services from disbursement of inward remittances to cash in and out, person to business payments, business to person payments, person to government payments, government to person payments and person to person payments.

Customers are also allowed to make some other payments such as microfinance, overdrawn facility, insurance premiums and deposit schemes.

News:The Daily Star/14-Nov-2013

Default loans rise in Q3 due to tight rules

The extent of default loans increased in the third quarter due to tightening the loan classification guideline, sluggish business activities during the political uncertainty and interruption in energy supplies.

The classified loans increased by Tk44bn or 8% to Tk567bn in the July-September quarter from Tk523bn of the April-June quarter of this year, according to Bangladesh Bank data. The classified loan is about 13% of the total outstanding loan of more than Tk4tn.

The total classified loan was Tk510bn in March this year, which was Tk290bn in June, 2012.

“The classified loans increased due to tightening the guideline,” said a senior executive of Bangladesh Bank. Besides, sluggish business during the political uncertainty and lack of gas and electricity pushed the classified loans up, he said.

Bangladesh Bank Deputy Governor SK Sur Chowdhury said the commercial banks have classified the loans from March quarter following the international standard guideline issued by Bangladesh Bank.

He, however, said the banks have faced some problems to follow the new guideline. “They will overcome the problems gradually.”

According to the new guideline, banks have to classify the loans in three categories, included sub-standard, doubtful and bad or loss.

Of the total classified loans, four state-owned banks have Tk241bn, private commercial banks Tk223bn, specialised banks Tk87bn and foreign banks Tk14bn.

Of the state-owned banks, Agrani Bank’s classified loan stood at Tk51bn, which is 27% of the total outstanding loan; Janata Bank Tk47bn, which is 18% of outstanding loan; Rupali Bank Tk16bn, which is 17% of their outstanding loan; and Sonali Bank Tk125bn, which is 42% of their total outstanding loan.

Under the revised loan classification guideline, the general provision against all unclassified loans of small and medium enterprises (SME) has been set at 0.25% from the existing 1%.

Besides, the base for provisioning has been re-fixed at minimum 15% of the outstanding balance of a loan from 20%.

Under the revised provisions, the down-payment for the first time rescheduling of a term loan has been reduced to minimum 15% from at least 25% previously of the overdue installments or 10% of the total outstanding amount of a loan, whichever is lower.

The application for second time loan rescheduling will be considered upon receipt of cash payment of minimum 30% of the overdue installments or 20% of the total outstanding amount of a loan, whichever is lower.

The application for third time loan rescheduling will be considered upon receiving cash payment of minimum 50% of the overdue installments or 30% of the total outstanding amount of the loan, whichever is lower.

News:Dhaka Tribune/08-Nov-2013

Banks burdened with excess liquidity

The country’s commercial banks are awash with idle money due to poor investment and lower credit demand, with almost all kind of business expansion remained suspended amid political uncertainty ahead of the upcoming general election.

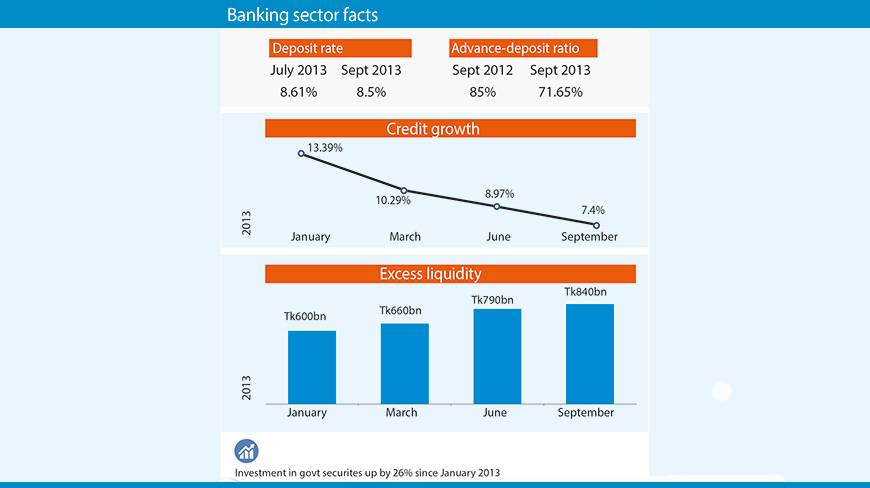

The excess liquidity increased by Tk240bn or 40% during January-September period of the current year and stood at Tk840bn from Tk600bn in January, according to the Bangladesh Bank data.

The amount of surplus liquidity increased rapidly while credit growth dropped continuously.

The credit growth of the banks was 13.39% in January with surplus liquidity of Tk600bn, followed by 10.29% growth in March with Tk660bn in excess liquidity. The growth was 8.97% in June when the liquidity was Tk790bn and 7.40% in September as the liquidity rose to Tk840bn.

The banks burdened with the huge idle money were looking for alternative investment window as reflected from their rising investment in the government securities.

The banks’ investment in government securities increased by 26% to Tk1tn during the 9 months period till September from Tk990bn in January, according to the central bank data.

“The investment opportunities for the banks shrunk due mainly for political unrest, lack of gas and electricity. Besides, they have also barrier to invest in share market according to the amended bank company act,’’ said a senior executive of a private bank.

However, the banks were taking away investment from the capital market instead of reinvesting there as they are bound to keep their exposure limit at 25% of paid up capital and reserves, which also pushed the liquidity to go high, he said.

“As a election year, banks remained shy to disburse big loans throughout the year and in last two months, there will have no possibility to release big loans,” said National Credit and Commerce Bank Managing Director Nurul Amin.

He said credit growth also decreased due to inflow of low cost foreign loans in the private sector as provided by Bangladesh Bank.

“Banks already cut their lending rates slightly to attract the borrowers and the rate will go down further within December,” said Amin, also the President of Association of Bankers Bangladesh (ABB).

The deposit rate dropped to 8.5% in September from 8.61% in July as banks reluctant to take more public funds.

“Banks’ interest income against credit declined due to sluggish disbursement while their interest expenditure against deposit went up, adversely hitting the profit. As a result, banks cut the interest rate on deposits and also moved to reduce lending rates to stimulate credit,” said a senior executive of a private bank.

The advance-deposit ratio (ADR) in the overall banking sector also declined to 71.65% in September against 85% a year back.

The ADR is likely to go down further in the coming months, if the current sluggish trend of credit to the private sector continues and the political situation takes a turn towards further confrontational course again.

News:Dhaka Tribune/07-Nov-2013

Guideline to check online banking forgery next month

Bangladesh Bank (BB) is preparing a guideline to help banks check forgery in online banking.

The new guideline is likely to be issued next month, a central bank official told BSS on Sunday.

The central bank is issuing the guideline against the backdrop of some incidents of credit card forgery and fraudulent transactions at ATMs.

Under the guideline, banks will be advised to follow a set of measures to protect their clients from fraudulent activities in online transactions.

Among the measures, the banks would be asked to develop a system from which their clients would get instant message (SMS) and email immediately after each and every online transaction.

Currently, some banks are providing similar services at their own initiatives to protect the interest of their clients and to ensure secured online banking.

“But, all banks should provide their clients with similar services after issuing the guideline,” the BB official said.

He said SMS and email should be sent to the respective clients against their transactions by using debit or credit cards at the ATMs (automated teller machines) or PoS (Point of Sales).

News:Dhaka Tribune/04-Nov-2013