Sticky

Most banks report profit in Q3

Most of the country’s commercial banks have showed positive earnings for the third quarter (July-September) of this year, but their cumulative earnings in three preceeding quarters (January-September) were negative.

Out of 30 listed banks, 28 have so far declared their third quarter earnings – 15 showing positive earnings, few of them even recovering from heavy losses of the same quarter previous year, according to published earnings statements.

Nine of them made a profit this quarter, but this was dlown from the same quarter of the previous year while the remaining four incurred net losses.

During the nine month period of this year, the cumulative earnings of 21 companies, however, still remained in the negative territory with only seven showing very marginal profits.

The banks continued to wrestle with the rising non-performing loans stemming mainly from the country’s ongoing political uncertainty, bankers said.

Political uncertainty, which discouraged private investment, and higher provisioning against non-performing loans (NPL) hit profitability, they said.

NPL is a loan on which the borrower is not making interest payments or repaying any principal. Banks normally set aside money to cover potential losses on loans (loan loss provisions) and write off bad debt in their profit and loss account.

Spillover effects of bad loans, which started to shoot up from last year following a series of financial scams, continued this year too, bankers said. The situation might turn worse in the coming months because of deepening political chaos they warned.

National Bank Ltd (NBL) was the worst performer posting a net loss of almost Tk4bn for the nine months ending September 30, down from the Tk1.3bn profit in the same period of 2012.

NBL was followed by Mutual Trust Bank, Exim Bank and One Bank.

“Political uncertainty holds back overall businesses, bringing down the banks earnings,” said Helal Ahmed Chowdhury, managing director of Pubali Bank. “Though economic growth remained positive over the last several years credit growth was not encouraging.”

On bank to bank varying profit, he said the banks that had to keep aside smaller amounts of money for loan provisioning or recovering previous bad loans posted higher profits. “The banks with higher non-performing loans made less profit.”

He said the banks awash with huge liquidity had to face the increased cost of funding, which also brought adverse impact on net profit.

The banks’ income mainly comes from two areas, core banking and capital market investment.

According to the Bangladesh Bank data, defaults on loans in the banking sector increased by more than 19% to Tk510bn as of March 31, 2013 from December last year.

Private borrowing grew by over 11% in August this year compared to about 20% in the corresponding month of last year.

Ali Reza Iftekhar, managing director of Eastern Bank, said higher provisioning due to rising NPL is the main reason behind the fall in net profits. “The business was very bad, so the profit was not satisfactory. Some even recorded higher profits. But the large provisioning has eaten up all the profits.”

He said: “This, coupled with the bearish trend of the stock market, has forced the banks to provision a substantial amount, which has cut the profit.”

Iftekhar sees more difficult days ahead in the run up to the general election. “Banks might see worse days in the coming months because of intensified political chaos.”

Banks that saw decline in their profits are First Security Bank, Al-Arafah Bank, AB Bank, Social Islami Bank, Eastern Bank, Trust Bank, Dhaka Bank and Islami Bank.

Banks that saw positive in their profits are United Commercial Bank, NCC Bank, Premier Bank, Jamuna Bank, City Bank, Bank Asia, Uttara Bank, Rupali Bank, Pubali Bank, Dutch-Bangla Bank, Mercantile Bank, Southeast Bank, IFIC Bank, Prime Bank and Shahjalal Bank.

News:Dhaka Tribune/03-Nov-2013

Grameen Bank Act gets passage

The parliament yesterday passed the much talked-about Grameen Bank Act, 2013, one that elevated the government roles in the running of the microcredit organisation without any increment of its ownership stakes.

“As the Grameen Bank has been running under an ordinance, it was necessary to enact a law,” Finance Minister AMA Muhith said in parliament yesterday.

The government has not brought any changes to the organogram of the organisation out of respect for Prof Yunus, who, Muhith said, has brought much pride to the country by way of his Nobel Peace Prize.

Meanwhile, Jatiya Party lawmaker Mujibul Haque Chunnu questioned why such an important bill was being passed when the national election is knocking on the door. He suggested taking public opinion before the passage of the bill as “interests of many people have been featured in it”.

But the parliament rejected Chunnu’s proposal and passed the bill with voice vote.

The new act, which would replace the Grameen Bank Ordinance, 1983, authorises the government to make rules for any aspect of the running of the bank.

The government, however, had the authority in the Grameen Bank Ordinance, 1983 but it relinquished them through an amendment in 1990 and only retained the power to make rules for the election of borrower-directors.

Furthermore, the government added a provision which allows it to take steps to remove barriers to the implementation of the new law. The government’s share in Grameen Bank, however, remains the same at 25 percent and the remaining 75 percent belong to the bank’s borrower-shareholders.

The managing director of the bank will be appointed following approval from the central bank and the MD will hold office until the age of 60 years, according to the new law.

In a major change, the bank will have to be audited by at least two chartered accountant firms, instead of two auditors each year, to ensure international standards. The bank will then submit the audited report and statement of accounts to the government within three months of the year’s end.

A new addition stipulates the bank will also have to submit the return, the audited report and the statement of accounts as per Bangladesh Bank’s demand.

The Grameen Bank Ordinance, 1983 superseded any other law, due to which the microcredit organisation enjoyed various tax exemptions. This feature was left out in the new act, meaning Grameen Bank will now get only income tax exemption and that too for the period stipulated by the government.

The new act increased Grameen Bank’s authorised capital to Tk 1,000 crore from Tk 350 crore to prevent the need for changing the law in future. The paid-up capital, too, has been increased to Tk 300 crore from Tk 50 crore.

In case of vacancy of all nine elected directors, three government-appointed directors including the chairman will be enough to meet the quorum obligation and sit for a meeting.

According to the law, the GB’s zonal manager or an official of equal status will retain the power to file cases under the Public Demands Recovery (PDR) Act to realise un-repaid loans from borrowers.

Under the ordinance, any GB official would have been able to exercise the power. But now the scope has been limited to senior officials of the bank in order to prevent abuse of power.

The law also extended financial fine from Tk 2,000 to Tk 10,000 for individuals who wilfully provide false statement, documents or information to the bank in obtaining loans or other advantages. The imprisonment term remains the same, of one year. The individuals may even face both the financial fine and the imprisonment term.

The new act also said if anybody uses the bank’s name in prospectus or advertisement without any written permission from Grameen Bank, he or she would face at least one year of imprisonment or Tk 1 lakh as financial fine or both.

Following a Supreme Court order, the government is turning the Grameen Bank Ordinance 1983 into the Grameen Bank Act 2013, along with more than 500 ordinances promulgated during the military rule between 1982 and 1986.

Nine elected directors of the bank and its 26,000-strong employees’ union have protested the new law, saying the changes will only help the government establish control over the bank.

“The objective of the law is to expand the services of the Grameen Bank to the larger group of people in rural areas while keeping the ownership of the government and state-owned agencies intact,” Finance Minister AMA Muhith said while placing the bill in the parliament last month.

The move will also help loan recipients become the bank’s shareholders, he added.

News:The Daily Star/07-Nov-2013

Agri-loan disbursement up by 24.82pc in Q1

Credit disbursement to the agriculture sector shot up by 24.82 per cent in the first quarter (July-September) of the current fiscal year 2013-14 compared to the same corresponding period of the previous FY 2012-13. According to the data of Agricultural Credit and Financial Inclusion Department of Bangladesh Bank, both the public and private commercial banks have disbursed Tk 2,861.58 crore in the period of July-September of FY 2013-14 while they credited Tk 2,292.52 crore in that period of the previous fiscal year, a 24.82 per cent more than the first three-month of the FY 2012-13.

The BB data also shows that the loan disbursement to the agriculture sector in the Q1 of FY 2013-14 was 19.61 per cent of the credit target of Tk 14,595 crore for the agriculture sector.

Besides, the rate of credit realisation in the agriculture sector was also higher in the July-Sept of 2013-14 than the same corresponding period of the previous fiscal year 2012-13.

As per the central bank’s data, the banks have realised Tk 11,000 crore credit from the agriculture sector in the first three-month of FY

2013-14 while the amount of credit realisation in this sector was Tk 9290.56 crore in the same corresponding period of FY 2012-13.

Provash Chandra Mallick, general manager of Agricultural Credit and Financial Inclusion Department of BB, said the amount of agriculture loan has been increased in recent time due to mainly strong supervision and keeping an eye to the agriculture development by the central bank.

Moreover, at the outset of the current fiscal year the demand for agriculture loan was high during ‘aman season,’ he said.

“The risk in the agriculture loan is very low as most of the agro-loan is small in size. Thus, the loan recovery rate is very sound,” Mallick said.

Analysing the central bank’s data, it has been found that in the July-September period of 2013-14, the state-owned commercial banks have distributed Tk 1,699.43 crore agro-loan among farmers and the private commercial banks along with foreign banks disbursed Tk 1162.15 crore credit to the agriculture sector.

Among them, Bangladesh Krishi Bank have allowed highest amount of agriculture loan to the farmers which was Tk 110.24 crore.

And, the Rajshahi Krishi Unnayan bank disbursed Tk 237.77 crore agro-loan securing second position in terms of agro-loan disbursement.

Among the state-owned commercial banks, Sonali Bank has disbursed Tk 113.12 crore agro-loan.

News:The Independent/07-Nov-2013

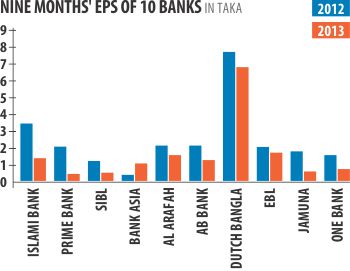

Banks see sharp drop in profits

Sajjadur Rahman

Islami Bank Bangladesh Ltd, a leading private sector bank, has made a profit of a mere Tk 20 lakh in the third quarter this year, down from more than Tk 83 crore during the same period last year.

Its nine-month profit (after tax) slid to Tk 194 crore this fiscal year against Tk 505 crore a year ago.

Prime Bank’s nine-month profit went down to Tk 43 crore this year from Tk 212 crore at the same time last year.

Almost all banks — from Mutual Trust to Dhaka Bank, SIBL, Eastern Bank and AB Bank — saw their net profits fall drastically during the first nine months this year compared to the same period last year.

However, data from third quarter and first nine months of the fiscal year show that Bank Asia, United Commercial Bank, Southeast Bank and IFIC Bank performed well compared to the same time last year.

Bankers attributed the erosion in profit to new loan classification and rescheduling rules by the central bank and the presiding anti-business climate in the run-up to national elections.

“Increased loan-loss provisions based on the central bank’s new rules have eroded our profits,” MA Mannan, managing director of Islami Bank, told The Daily Star.

Islami Bank had to set aside more than Tk 500 crore from its nine months’ profits to provision against possible loan losses.

“We are feeling extreme pressures at the moment, but things may improve in the next quarter,” said Mannan.

Despite good business in the third quarter this year, the nine months’ profit figure for Jamuna Bank brought down its earnings per share to Tk 0.59 from Tk 1.73 at this time a year ago.

“Our business growth was excellent in the third quarter, but we had to make provisions for some bad loans in past years,” Shafiqul Alam, managing director of Jamuna Bank, said.

Alam said his banks’ provisioning requirement doubled to Tk 100 crore for the nine months this year from Tk 50 crore in the corresponding period a year ago.

The nine-month net profit for EBL also witnessed a sharp fall to Tk 104 crore this year from Tk 123 crore a year ago. For the third quarter, the bank’s net profit stood at Tk 6.56 crore and earnings per share at Tk 0.11 against Tk 34.42 crore and Tk 0.56 respectively for the same period last year.

“Overall, the banking sector is not in a good condition. Non-performing loans have been increasing and may be, banks will not be able to give good dividends for this year,” said Ali Reza Iftekhar, managing director of EBL.

News:The Daily Star/02-Nov-2013

No scope for rescheduling Hall-Mark loans: Sonali

Rejaul Karim Byron

Sonali Bank board has rejected any possibility of rescheduling Hall-Mark Group’s loans worth Tk 2,554 crore that were taken out through fraudulent means despite the Group’s inability to repay the amount.

The decision, taken on Monday, was arrived at after assessing Hall-Mark Group’s total asset, their repayment capacity and their lawyers’ opinion, and was conveyed to the finance ministry’s banking division on Wednesday.

The state-owned bank also concluded that the Group does not have the capacity to repay the loans and therefore proposed filing several cases against the disgraced company, said a finance ministry official upon condition of anonymity.

The move comes after the finance ministry in March asked Sonali Bank to evaluate the Group’s assets and send a proposal to the ministry such that the company’s operations can be resumed.

In the letter to the finance ministry, Sonali Bank said the Group’s assets are worth about Tk 1,170 crore but it has a shortfall of Tk 1,000 crore in collateral against its total loans.

As of June 30, Hall-Mark Group’s outstanding amount to Sonali Bank stood at Tk 2,554 crore. Around Tk 200 crore was taken out as loan and the rest through various irregularities.

The official cited the withdrawal of Tk 1,000 crore against a “mere slip” as an example of the irregularities that took place.

According to the six lawyers that Sonali Bank consulted, the cases have to be filed within three years of detection of the irregularities.

Bangladesh Bank in May last year unearthed the wrongdoings in the state-run bank, which ended up being the biggest banking fraud in the country’s history. The offences took place between 2010 and 2012.

The Anti-Corruption Commission has already lodged 11 cases against several officials of Hall-Mark Group and Sonali Bank, but there has been none by Sonali Bank yet.

According to Sonali Bank’s latest data, Hall-Mark Group took loans of Tk 2,964 crore, of which it has already adjusted Tk 410 crore. As a result, the company still owes the state-run bank Tk 2,554 crore.

News:The Daily Star/02-Nov-2013