Dhaka Stock Exchange

Standard Bank plans to park Tk 100cr in stocks

Standard Bank Ltd has decided to invest an additional Tk 100 crore in the capital market in the next two months, the Bank said in a statement yesterday.

The decision came from the 195th board meeting of the Bank held at its Gulshan office in Dhaka on Sunday.

Kazi Akram Uddin Ahmed, chairman of the Bank, presided over the meeting.

The Daily Star/Bangladesh/ 17th July 2012

IFIC Bank okays 25pc stock, 5pc cash dividends

Salman F Rahman, Chairman of IFIC Bank, presides over the Bank's 35th AGM at the Bashundhara Convention Centre in Dhaka Wednesday.

Salman F Rahman, Chairman of IFIC Bank, presides over the Bank's 35th AGM at the Bashundhara Convention Centre in Dhaka Wednesday.

IFIC Bank Limited approved 25 percent stock and 5 percent cash dividends for its shareholder for the year 2011.

The approval came at the 35th Annual General Meeting (AGM) of the Bank held at the Bashundhara Convention Centre in Dhaka Wednesday, said a press release.

Salman F Rahman, Chairman of the Bank, presided over the meeting.

The Daily Sun/Bangladesh/ 12th July 2012

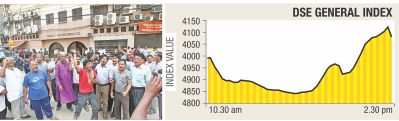

Stocks swing to the black in choppy trade

Investors take to the streets to protest a huge fall in early trading on the Dhaka Stock Exchange in Motijheel in the capital yesterday. The benchmark index closed higher later in the day.

Investors take to the streets to protest a huge fall in early trading on the Dhaka Stock Exchange in Motijheel in the capital yesterday. The benchmark index closed higher later in the day.

Stocks bounced back yesterday, breaking a losing streak of seven days, on the back of a buying pressure from institutional investors.

DGEN, the main gauge of the Dhaka Stock Exchange, dropped around 150 points by midday, only to recover enough to pull the index back in the black by the close of the trading session.

The price-earnings ratio fell below 13 -- meaning it was a good time to buy -- which persuaded institutional investors to get in the act, market insiders said.

The DGEN eventually finished with 4,077 points, after gaining 88 points from the previous day.

IDLC, City Brokerage, ICB Securities, Salta Capital and NCCB Securities topped the list of net buy, their figures being Tk 8.75 crore, Tk 6.32 crore, Tk 4.12 crore, Tk 3.56 crore and Tk 1.84 crore respectively.

“Opportunist investors, who have reduced their portfolio exposure earlier and waited for favourable conditions, became active as prices looked rewarding for most of the investment grade stocks,” IDLC Investments Ltd said.

The merchant bank's Managing Director Md Moniruzzaman said an investment opportunity was created when the market fell below the 4,000-level, which, the investors grabbed with both hands.

Akter Hossain Sannamat, managing director and chief executive officer of Union Capital, said investors' low confidence led the market to fluctuate dramatically.

The market made a dramatic u-turn, thanks to the institutional investors, said Sannamat.

“They went on a buying spree as most of the good stocks became lucrative for long-term investments.”

He asked institutional investors to continue to be active in the market as it will enhance the confidence of small investors.

He also urged the government to take stockmarket-friendly actions to increase the flow of money.

Turnover, volume and trade were up by 8.81 percent, 12.51 percent and 18.31 percent respectively.

A total of 5.1 crore shares were traded, generating a turnover of Tk 201 crore.

On the DSE, 228 shares gained, 28 declined and 10 remained unchanged.

The Daily Star/Bangladesh/ 12th July 2012

Merchant banks, brokerage firms asked to compensate

The Securities and Exchange Commission (SEC) has asked all the merchant banks, brokerage

firms and other related institutions to give compensation to the small investors affected in the last year’s stock market debacle.

The commission ordered to Dhaka Stock Exchange, Chittagong Stock Exchange and Bangladesh Merchant Bank Association to submit implementation report on compensation package to the SEC by August, said a statement Tuesday. Some 209 brokerage firms under DSE, 79 under CSE and 28 merchant banks have been asked to take immediate steps regarding compensation.

Earlier, the commission approved a set of recommendations forwarded by the scheme committee assigned to implement the package.

As per the compensation package, the retailers who had investment of below Tk 10 lakh at the crash time will get a waiver of up to 50 per cent of the interest on margin loans.

The adversely affected investors will have the scope to pay the remaining interest payment through quarterly installments in three years.

The affected people are also entitled to a 20 per cent quota in all initial public offerings -- public and private -- to be from July, 2012 to June, 2014.

In April, the scheme committee, led by Md Fayekuzzaman, managing director of the Investment Corporation of Bangladesh (ICB), submitted its recommendations to the SEC for approval. The government in October last year announced a stimulus package for stock market investors to restore stability in the market.

As part of the package, the government formed a seven-member special scheme committee on November 27 to identify small investors who incurred losses, and the amount they lost.

The Daily Independent/Bangladesh/ 11th July 2012

BRAC Bank okays 50pc rights share

Muhammad A Rumee Ali, Chairman of BRAC Bank Limited, presides over the Bank's 9th EGM at Army Golf Garden in Dhaka Thursday.

Muhammad A Rumee Ali, Chairman of BRAC Bank Limited, presides over the Bank's 9th EGM at Army Golf Garden in Dhaka Thursday.

BRAC Bank Limited approved 50 percent rights share or one rights share against two shares at the rate of Tk 25 each including premium of Tk 15 for raising paid-up capital of the Bank.

The approval came at the 9th Extra-ordinary General Meeting (EGM) of the Bank held at Army Golf Garden in Dhaka Thursday, said a press release. Muhammad A Rumee Ali, Chairman of the Bank, presided over the meeting.

Shib Narayan Kairy and Dr Hafiz G A Siddiqi, Directors, Syed Mahbubur Rahman, Managing Director and CEO of the Bank and Rais Uddin Ahmad, Company Secretary and a large number of shareholders attended the EGM.

Addressing the EGM, Rumee Ali expressed his gratitude to the shareholders, stakeholders and management for their continuous support to the company.

The Daily Sun/Bangladesh/ 29th June 2012