Stocks swing to the black in choppy trade

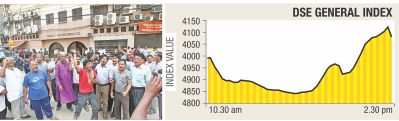

Investors take to the streets to protest a huge fall in early trading on the Dhaka Stock Exchange in Motijheel in the capital yesterday. The benchmark index closed higher later in the day.

Investors take to the streets to protest a huge fall in early trading on the Dhaka Stock Exchange in Motijheel in the capital yesterday. The benchmark index closed higher later in the day.

Stocks bounced back yesterday, breaking a losing streak of seven days, on the back of a buying pressure from institutional investors.

DGEN, the main gauge of the Dhaka Stock Exchange, dropped around 150 points by midday, only to recover enough to pull the index back in the black by the close of the trading session.

The price-earnings ratio fell below 13 -- meaning it was a good time to buy -- which persuaded institutional investors to get in the act, market insiders said.

The DGEN eventually finished with 4,077 points, after gaining 88 points from the previous day.

IDLC, City Brokerage, ICB Securities, Salta Capital and NCCB Securities topped the list of net buy, their figures being Tk 8.75 crore, Tk 6.32 crore, Tk 4.12 crore, Tk 3.56 crore and Tk 1.84 crore respectively.

“Opportunist investors, who have reduced their portfolio exposure earlier and waited for favourable conditions, became active as prices looked rewarding for most of the investment grade stocks,” IDLC Investments Ltd said.

The merchant bank's Managing Director Md Moniruzzaman said an investment opportunity was created when the market fell below the 4,000-level, which, the investors grabbed with both hands.

Akter Hossain Sannamat, managing director and chief executive officer of Union Capital, said investors' low confidence led the market to fluctuate dramatically.

The market made a dramatic u-turn, thanks to the institutional investors, said Sannamat.

“They went on a buying spree as most of the good stocks became lucrative for long-term investments.”

He asked institutional investors to continue to be active in the market as it will enhance the confidence of small investors.

He also urged the government to take stockmarket-friendly actions to increase the flow of money.

Turnover, volume and trade were up by 8.81 percent, 12.51 percent and 18.31 percent respectively.

A total of 5.1 crore shares were traded, generating a turnover of Tk 201 crore.

On the DSE, 228 shares gained, 28 declined and 10 remained unchanged.

The Daily Star/Bangladesh/ 12th July 2012

Other Posts

- Western Union sets 12,000 agents

- Prime Bank holds workshop on anti-money laundering

- EC of SIBL meets

- HSBC water programme launched

- 50pc fall in fake note circulationBB survey shows

- Dilip assures of hassle-free SME credits

- BB steps up fight against LC frauds

- Migrant remittances resist crisis: World Bank

- Private sector to get credit boost The central bank announces monetary policy next week

- Pubali Bank to invest Tk 500cr in capital market

- SBL holds business assessment meet in Rangpur

- Economic growth to fall in Asia: ADB

- BKB gears up agri-loan drives

- IFIC Bank okays 25pc stock, 5pc cash dividends

- No additional tax on small bank account holders

- Authority of bank branches to pay LC bills cancelled

- BB to announce Tk 141b agro-credit policy July 24

Comments