Banking

State banks to get another Tk 5,000cr to fix capital deficit

The government has set aside another Tk 5,000 crore in the proposed budget to inject as fresh capital into the increasingly weakening state banks, to cover up the messes largely created by politically appointed boards.

Finance Minister AMA Muhith spoke of the allocation to a group of reporters at his secretariat yesterday.

In the outgoing fiscal year, the state banks were allocated Tk 4,405 crore to meet capital deficits, of which four banks received Tk 4,100 crore.

The boards of the state banks were reconstituted in fiscal 2009, and most of the appointees were picked on politically motivated favouritism. In the last term of the government, various scams, including the one involving Hall-Mark, led to hollowing of the banks' financial bases.

Allegations are rampant that the scams took place due to interference by the politically appointed directors.

Muhith admitted the political appointments, saying; “In some cases there were mistakes in our choices. As a result, some irregularities may have taken place.”

“Some political appointments are made to the board of directors and that will continue in future.” However, regulations will be put in place to avert undue interference, he said.

In September last year, loan defaults of the state banks increased, and the combined capital deficit had risen to Tk 8,863 crore.

After the government had pumped funds into the banks, they showed capital of Tk 11,409 crore by December, with a surplus of Tk 855 crore.

However, the International Monetary Fund projects many of the state banks will require even more capital in 2014, as their loan portfolios will further deteriorate from necessary rescheduling of many of the loans currently adjudged under a relaxed rescheduling policy.

Modhumoti Bank organises green banking workshop

As part of a month-long green banking campaign, Modhumoti Bank Limited organised a workshop on ‘Green Banking’ at the bank’s Motijheel branch in Dhaka on Sunday.

Md. Mizanur Rahman, Managing Director and CEO of the bank inaugurated the workshop. Md. Touhidul Alam Khan, Deputy Managing Director (Business) of the bank was present, said a press release.

Training course on Islamic banking held

The Central Shariah Board for Islamic Banks of Bangladesh organised a six-day-long training programme on “Islamic Banking and Finance” at Exim Bank Training and Research Academy in Dhaka recently.

Total 45 executive officers and officers from different Shariah banks and organisations that operate Shariah banking activities and the Bangladesh Bank participated in the training, said a press release. Dr. Mohammed Haider Ali Miah, Managing Director of Exim Bank attended the function.

Banks ‘highly exposed’ to public borrowing

This leads to a concentration risk, too high a share of assets exposed to a single borrower

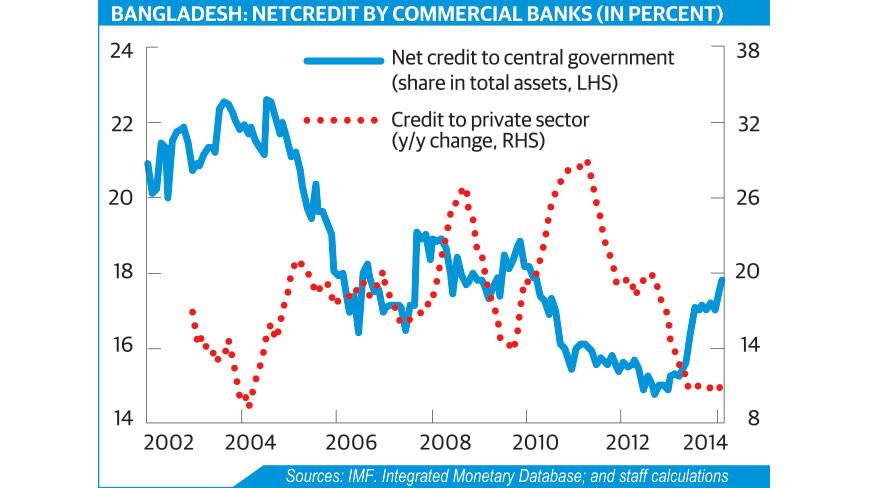

The asset structure of Bangladesh’s commercial banks is highly exposed to the government making the possibility of dearth of the private credit, said an International Monetary Fund report.

“The share of banks’ net credit to the central government in total bank assets, while similar to the average for the South Asian region, is much higher (about three times) than the average for low-income countries, and also considerably higher than the ratios prevailing in the emerging and advanced economies,” IMF’s recent report said.

This leads to a concentration risk, too high a share of assets exposed to a single borrower, said the report titled “Fourth review under the three-year arrangement under the extended credit facility.” The was dispatched to Finance Minister AMA Muhith for examining the matter.

IMF found increases in banks’ exposure to the government have historically been associated with declines in private sector credit growth- a possible indication of financial crowding out in an environment where banks are “often forced to purchase government securities.”

The recently data shows that banks’ exposure to the sovereign has been expanding rapidly since 2013, reversing a trend decline that started in 2007.

“Keeping the fiscal deficit in check is therefore crucial to allow for an increase in private sector credit and, with it, an increase in private investment and growth,” the Fund report said.

The overall budget deficit of next fiscal year is Tk67,552 crore, which is 5% of GDP. Of the amount, Tk24,275 crore will be financed from external sources and Tk43,277 crore from 26 domestic sources.

Of the domestic financing, Tk31,221 crore will come from the banking system and Tk12,056 crore from savings certificates and other non-banking sources.

As per the central bank data, the private investment went down to 21.3% this year from 21.7% a year ago.

Private sector credit growth slumped to 11.46% in April this year, significantly lower than the target of 16.5% set in the ongoing monetary policy.

Currently, 2, 5, 10, 15 and 20-year treasury bonds are available in the market with online trading platform.

The government borrows from this type of long-term tools to meet its budget deficit. It also borrows by using short-term bills to meet its urgent financing. However, many economists say the government now wants to borrow less from treasury bills on the ground of availability of liquidity in the public sector.

News:Dhaka Tribune/9-June-2014BRAC Bank signs a Memorandum of Understanding (MoU) to provide nationwide cash management solutions to EEL

Dhaka- BRAC Bank Limited has recently signed a Memorandum of Understanding (MoU) to provide nationwide cash management solutions to Edison Electronics Limited for its Symphony Branded outlets. Mohammad Mamdudur Rashid, Deputy Managing Director, BRAC Bank, Faroq Mohd. Jafrul Alam Khan, Business Director, Edison Electronics, sign the agreement on behalf of their respective organizations.

Dhaka- BRAC Bank Limited has recently signed a Memorandum of Understanding (MoU) to provide nationwide cash management solutions to Edison Electronics Limited for its Symphony Branded outlets. Mohammad Mamdudur Rashid, Deputy Managing Director, BRAC Bank, Faroq Mohd. Jafrul Alam Khan, Business Director, Edison Electronics, sign the agreement on behalf of their respective organizations.

BRAC Bank is one of country’s fastest growing banks. With 157 branches, more than 350 ATMs, 400 SME Unit Offices and over 8,000 human resources, BRAC Bank operation now cuts across all segments and services in financial industry. With more than 1.2 Million Customers, The bank has already proved to be the largest SME Financier in just 12 years of its operation in Bangladesh and continues to broaden its horizon into Retail, Corporate, SME, Probashi and other arenas of banking. In 2013 BRAC Bank has received the prestigious ‘The Asian Banker Best Managed Bank in Bangladesh’. In the year: 2010, BRAC Bank has been recognized as Asia’s most Sustainable Bank in Emerging Markets by the Financial Times and IFC. The Bank is the country’s first founder member of Global Alliance for Banking on Values (GABV) – a network of the world’ leading sustainable banks.