Banks ‘highly exposed’ to public borrowing

This leads to a concentration risk, too high a share of assets exposed to a single borrower

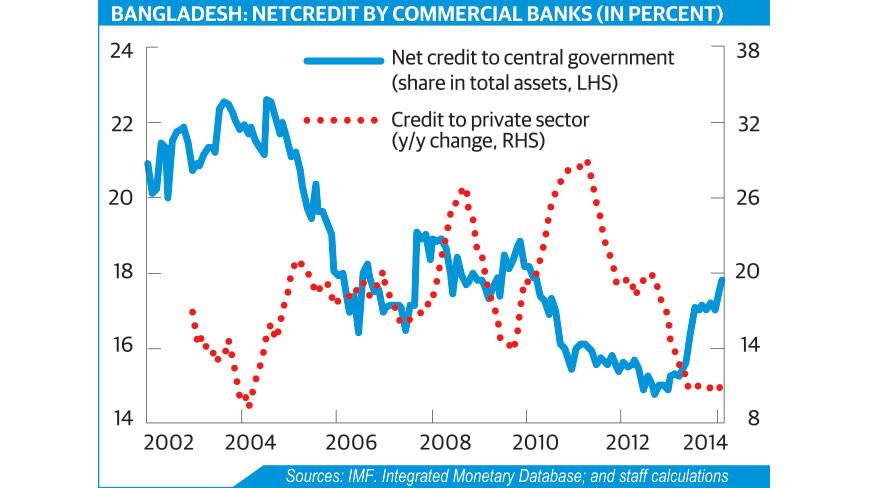

The asset structure of Bangladesh’s commercial banks is highly exposed to the government making the possibility of dearth of the private credit, said an International Monetary Fund report.

“The share of banks’ net credit to the central government in total bank assets, while similar to the average for the South Asian region, is much higher (about three times) than the average for low-income countries, and also considerably higher than the ratios prevailing in the emerging and advanced economies,” IMF’s recent report said.

This leads to a concentration risk, too high a share of assets exposed to a single borrower, said the report titled “Fourth review under the three-year arrangement under the extended credit facility.” The was dispatched to Finance Minister AMA Muhith for examining the matter.

IMF found increases in banks’ exposure to the government have historically been associated with declines in private sector credit growth- a possible indication of financial crowding out in an environment where banks are “often forced to purchase government securities.”

The recently data shows that banks’ exposure to the sovereign has been expanding rapidly since 2013, reversing a trend decline that started in 2007.

“Keeping the fiscal deficit in check is therefore crucial to allow for an increase in private sector credit and, with it, an increase in private investment and growth,” the Fund report said.

The overall budget deficit of next fiscal year is Tk67,552 crore, which is 5% of GDP. Of the amount, Tk24,275 crore will be financed from external sources and Tk43,277 crore from 26 domestic sources.

Of the domestic financing, Tk31,221 crore will come from the banking system and Tk12,056 crore from savings certificates and other non-banking sources.

As per the central bank data, the private investment went down to 21.3% this year from 21.7% a year ago.

Private sector credit growth slumped to 11.46% in April this year, significantly lower than the target of 16.5% set in the ongoing monetary policy.

Currently, 2, 5, 10, 15 and 20-year treasury bonds are available in the market with online trading platform.

The government borrows from this type of long-term tools to meet its budget deficit. It also borrows by using short-term bills to meet its urgent financing. However, many economists say the government now wants to borrow less from treasury bills on the ground of availability of liquidity in the public sector.

News:Dhaka Tribune/9-June-2014Other Posts

- BRAC Bank Limited organises an environmental awareness program

- Pubali Bank to appoint two persons with disability every year

- BRAC Bank signs a Memorandum of Understanding (MoU) to provide nationwide cash management solutions to EEL

- Dhaka Bank gets new MD

- Alam City Bank’s new independent director

- BASIC Bank's loan defaults swelling to Tk 1,700cr

Comments