Banking

WB's growth forecast falls below govt target

The World Bank has projected 5.9 percent growth for the country in fiscal 2014-15, far below the government's target of 7.3 percent.

The World Bank has projected 5.9 percent growth for the country in fiscal 2014-15, far below the government's target of 7.3 percent.

The forecast is in line with potential growth, the multilateral lender said in the Global Economic Prospects report released yesterday.

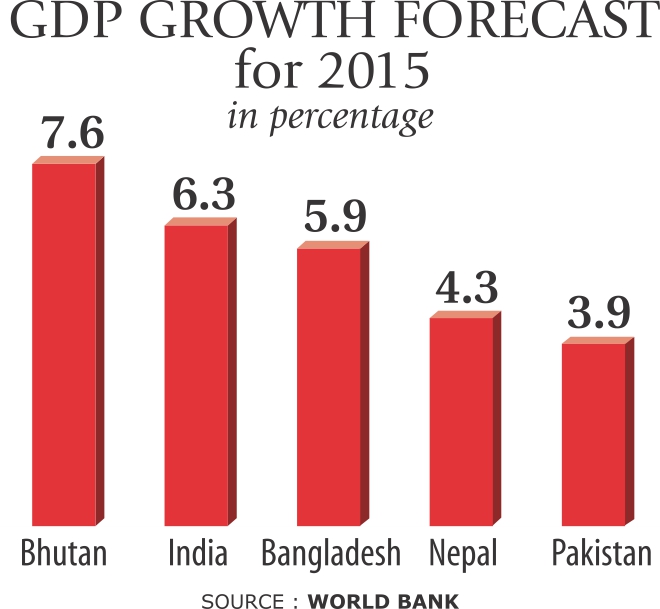

The figure is higher than that forecast for its South Asian neighbours save for India, which is expected to grow at 6.3 percent. The projection for South Asia, excluding India, is 5.1 percent and for developing countries 4.8 percent. “If you compare the global and regional economy, the growth forecast for Bangladesh is good,” said Zahid Hussain, lead economist of WB's Dhaka office.

The global economy is projected to expand by 2.8 percent this year, strengthening to 3.4 percent and 3.5 percent in 2015 and 2016. The Euro area is on target to grow by 1.1 percent this year, while the US economy is expected to grow by 2.1 percent.

China is expected to grow by 7.6 percent this year, but this will depend on the success of rebalancing efforts. If a hard landing occurs, the reverberations across Asia would be widely felt, the report said.

Hussain said an uncertainty has been prevailing among investors over political stability or rather lack of it.

“Investment is slow. The garment sector is going through a transitional period and remittance growth is also sluggish. Considering all these factors, the World Bank's GDP growth forecast is reasonable,” he added.

“I have been seeing for the last five years that the economic forecasts made for us by the World Bank and other multilateral agencies never came true. I think we will achieve high growth next year as well,” said Shamsul Alam, member of the General Economics Division of the planning ministry.

In the country's sixth five year plan, the target was to cross 8 percent in fiscal 2014-15, but due to the overall environment it was brought down to around 7 percent, he added.

“We hope that in the next fiscal year, investment, export and remittance flow will increase as it is expected that the global economy will experience accelerated growth,” Finance Minister AMA Muhith said in his budget speech.

During this period, food and energy prices in the international market are likely to decline slightly. Besides, an investment-friendly monetary policy will be maintained ensuring uninterrupted credit flows to the productive sectors, he added.

The government initiatives for developing physical infrastructure in the power, energy and communication sectors will continue.

Banking on favourable weather and political stability, Muhith is hopeful of achieving the GDP target of 7.3 percent for next fiscal year.

“I will not enter the debate on whether the GDP growth will cross the 6 percent-mark or not,” said Mustafizur Rahman, executive director of the Centre for Policy Dialogue.

The Bangladesh Bureau of Statistics has estimated 6.1 percent growth for the current fiscal year.

GDP growth depends on a number of factors, he said. “How will the political environment be? Will the slow loan growth accelerate? Will the agricultural sector be hit by natural calamity?”

The CPD executive director, however, said the low commodity, fuel and cotton prices in the international market are all favourable for achieving a good GDP growth figure.

World Bank lowers 2014 global economic forecast

WASHINGTON: The World Bank lowered its projection Tuesday for global economic growth this year, as developing countries head for “disappointing growth” while high-income countries gain momentum.

The Washington-based institution forecasts the global economy to grow 2.8 percent this year, down from its January estimate of 3.2 percent, according to its twice-yearly Global Economic Prospects report.

“Developing countries are headed for a year of disappointing growth, as first quarter weakness in 2014 has delayed an expected pick-up in economic activity,” the report said.

Bad weather in the United States, the Ukraine crisis, rebalancing in China and political strife in several middle-income economies slowed progress on structural reform, it said.

The bank lowered its forecasts for developing countries to a growth of 4.8 percent this year from its January estimate of 5.3 percent, the third year in a row of below 5 percent growth. However, growth is forecast to pick up to 5.4 percent in 2015 and 5.5 percent in 2016.

China was expected to grow 7.6 percent this year, slightly down from the January estimate of 7.7 percent, the bank said.

—Xinhua

Big budget offers opportunity for banks

The just announced national budget is expected to offer a good business opportunity for the commercial banks operating in the country, after having a hard time in last couple of years.

Bankers have foreseen the prospect based on the measures proposed in the budget for next fiscal year in enhancing both public and private investments.

They are, however, considering how the banking sector would face challenges like the private investors do not suffer from non-availability of fund due to increased public financing.

The increased demand for fund might also push up the lending rate as well as the inflation – which are also being considered as other major challenges.

“High borrowing target is good for the economy as it reflects the government’s efficiency of implementation the mega project that has been taken in the new budget,” said NCC Bank Managing Director Golam Hafiz Ahmed.

He said more project implementation would raise demand for credit in the private sector as employment and import of raw materials would be increased. “When the demand will increase both in private and public sector, the credit-deposit ratio will increase, which will help the banks to make more profit.”

The existing average credit-deposit ratio of the banks remained at around 70% and there is a chance it would be increased up to 81%. That means the banks now disbursing loans of Tk70 against deposit of Tk100, despite they can disburse up to Tk81, he said. The banks’ have made profit less than expected, as a result.

“The lending rate though remained on the down trend at present, it will climb up in the new fiscal year due to the expected rise in credit demand,” said the senior banker.

He further said the private sector is unlikely to be crowded out if the projects are implemented with foreign financing. Foreign fund inflow would have double effect as it would have to be converted into local currency after entering into the country, and it would enrich the reserve.

He was, however, skeptical about the banking business as all depend on the budget implementation and political stability. “If the projects are implemented efficiently, the banks will get the opportunity of doing good business.”

Though it is a challenge to maintain a balance between public and private credit, “we hope the private investment will not be affected as the government borrowing will remain within the target,” said Pubali Bank Managing Director Helal Ahmed Chowdhury.

“The government cannot not utilise its full space of borrowing target according to our earlier experience. So, if the borrowing reaches even at the ceiling, private sector will not be affected much as the banks have enough liquidity to face the demand.”

The banking business went sluggish for more or less a couple of years due to poor credit demand amid prolonged political unrest, resulting in poor performance particularly in the just concluded year of 2013.

The banks had to take cover of a relaxed loan rescheduling guideline to give some dividend for the year 2013.

“If the government reaches the borrowing target, it would put some pressure on inflation,” said Bangladesh Bank Chief Economist Hassan Zaman.

“We do not think the government will reach the target as it could not reach there as of now. We think it will not be able to utilise the full space of the borrowing target eventually.”

Hassan Zaman foresees the big size budget would not be implemented fully because it is not possible to improve implementation capacity over night.

“We see an implementation gap between actual and revised budget every year, which would be continued in the new fiscal year too. As a result, domestic borrowing target will not be fulfilled. So we do not have concerns about our monetary program.”

However, he said, if the government really reaches the borrowing target anyway, it would then be a risk on inflation, he added.

Bank borrowing from banking system by government remained slow since several months and it stood at Tk23,000 crore at the end of May this year while Tk20,000 crore has already been repaid, according to the Bangladesh Bank data.

The borrowing target for the next fiscal year has been set at Tk31,221 crore, which is 20% higher from Tk25,993 crore set for the outgoing fiscal year.

News:Dhaka Tribune/11-June-2014Trust Bank CEO attends National Seminar

Ishtiaque Ahmed Chowdhury, Managing Director & CEO of Trust Bank Limited attending National Seminar on “International Financial Regulations: Necessity and Implications for Banks in Bangladesh” recently at BIBM Auditorium, Dhaka as an expert speaker opinion organized by BIBM, informed by the authority.

Ishtiaque Ahmed Chowdhury, Managing Director & CEO of Trust Bank Limited attending National Seminar on “International Financial Regulations: Necessity and Implications for Banks in Bangladesh” recently at BIBM Auditorium, Dhaka as an expert speaker opinion organized by BIBM, informed by the authority.

Md. Abul Quasem, Deputy Governor of Bangladesh Bank was Chief Guest; Ex Deputy Governor of Bangladesh Bank Khondokar Ibrahim Khalid, DG of BIBM and others distinguished guests were also present.

Trust Bank vision is build a long-term sustainable financial institution through financial inclusion and deliver optimum value to all stakeholders with the highest level of compliance. And it’s Mission is Long Term Sustainable Growth- diversified business with robust risk management.

Financial Inclusion- bring unbanked population into banking network through low cost and technology based service delivery Accountable to all stakeholders- customers, shareholders, employees & regulators. Highest level of compliance and transparency at all levels of operation.

National Credit and Commerce Bank Ltd. has approved 11% dividend

Dhaka- National Credit and Commerce Bank Ltd. has approved 11% dividend (6% cash & 5% Bonus Share) for the year 2013. The approval was given in the Bank’s 29th Annual General Meeting (AGM) held at the Police Convention Hall, Dhaka on Monday (02/06/2014), reports by the authority.

Chairman of NCC Bank Ltd. Md. Nurun Newaz Salim presided over the meeting while Vice Chairman A. S. M. Mainuddin Monem, Directors, Sponsors, a large number of Shareholders and Managing Director Golam Hafiz Ahmed were also present. The Directors Report and Audited Accounts of the bank for the year ended on December 31, 2013 was placed before the Shareholders at the AGM and was duly approved by them.

Chairman Md. Nurun Newaz Salim in his speech expressed that Deposits, Advances, Profits, Foreign Exchange Business, Recovery of bad loans & Advances & other fields of activities have recorded significant improvement of NCC Bank during the year 2013. He informed the meeting that the Bank is marching ahead with modern technologies and steadily progressing with efficient human resources to safeguard the Bank’s Asset qualities, the bank is taking all required steps.

A large number of Shareholders spoke on the occassion and made various suggestions for continued growth and better performance of the Bank in the coming years.