Banking

BB governor to visit Dohola Khagrabari

RANGPUR: Bangladesh Bank (BB) Governor Dr Atiur Rahman will visit erstwhile Dohola Khagrabari enclave under Debiganj upazila in Panchagarh on Sunday next to observe socio-economic condition and life standard of local people.

The BB Governor will take part in various programmes at Dohola Khagrabari on the day during his 3-day visit to Rangpur, Panchagarh and Joypurhat from October 24 to 26 next, official sources said, reports BSS.

The BB Governor will arrive at Rangpur on October 24 in the afternoon, launch various development programmes, E-Library at BB’s Rangpur Branch and attend a meeting with its officials and employees there in the evening.

Later, he will be accorded reception by Bankers’ Club, Rangpur at Rangpur Army Medical College cafeteria premises at night on October 24 for becoming the Best Central Bank Governor of the Year 2015 for the Asia and the Pacific region, BB sources said.

After arriving at Dohola Khagrabari at 10 am on Sunday, the BB Government will attend a meeting and inaugurate 40 stalls to be set up there by 40 public and private sector banks displaying banking services being provided to the people.

Dr Atiur Rahman will distribute various assistance among the erstwhile enclave people under the Corporate Social Responsibility (CSR) programmes of different banks with a view to accelerate their socio-economic uplift and improving life standard.

On the occasion, the BB Governor will give necessary directions to the banks authorities for inclusive financial involvement of erstwhile enclave people and distribute agriculture loans among them to improve their socio-economic conditions. He will distribute sewing machines, tube wells, solar panels, agriculture inputs, bicycles among female students, sanitary latrines, van carts, computers, school bags, corrugated tin sheets, blankets, loud speakers and cash money for constructing educational institutions under the CSR programmes of different banks.

State banks pass hard times as loan growth stalls

State-owned commercial banks are struggling to get new business in a market that is becoming increasingly competitive, data from Bangladesh Bank shows.

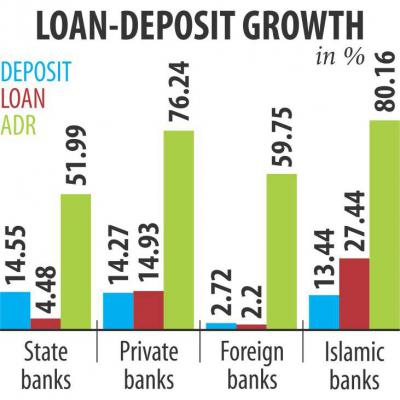

The advance-to-deposit ratio (ADR), which compares all loans to all deposits, of Agrani, BASIC, BDBL, Janata, Rupali and Sonali banks, has gone down below 52 percent indicating that these banks will not be able to earn as much as they could.

By contrast, the average ADR of 39 private commercial banks stood at over 76 percent on August 27, while it is nearly 60 percent for nine foreign banks and over 80 percent for Islamic banks, data shows.

The gap between deposit and credit growth of these six banks has also widened and crossed over 10 percentage points on August 27.

Deposit grew by 14.55 percent and credit by only 4.48 percent year-on-year in August.

“We are not getting good clients who prefer quality services provided by the private and foreign banks,” said a senior official of Sonali.

Sonali's loan growth has almost stalled at 0.46 percent against the industry's (56 banks) average growth of 11.62 percent.

“We have a difficult time persuading potential customers to get loans from us,” said an official of Sonali's corporate branch in Motijheel.

Although the situation of Agrani, Janata and Rupali is better than Sonali, they are also struggling to make business.

Agrani's credit grew by 7.73 percent and deposit by 20.63 percent. Janata's credit growth was 9.41 percent against deposit growth of over 14 percent.

Rupali looks different among these six banks as its credit growth -- 20 percent -- was higher than deposit growth -- 13 percent.

On the other hand, troubled BASIC Bank has witnessed over 18 percent negative credit growth.

Also, the bank's deposits grew by less than 1 percent.

“Overall investment is yet to pick up. When the implementation of mega projects will get momentum, demand for credit will go up,” said Zaid Bakht, chairman of Agrani Bank.

State banks have some disadvantages compared to private banks that can grab customers from state banks by offering low rates, he said.

“State banks cannot cut lending rates to the level of private banks as their nonperforming loans are higher,” said Bakht, also an economist.

On Agrani's higher deposit growth than credit, Bakht said they are trying to get low-cost deposit instead of high-cost fixed deposits.

News:The Daily Star/23-Oct-2015

AIBL opens its 127th branch

Economic Reporter :Al-Arafah Islami Bank Ltd opens its 127th branch at Jhaudanga, Satkhira on Sunday. Director of the Bank Abdul Malek Mollah inaugurated the branch as Chief Guest while Managing Director Md Habibur Rahman presided over the ceremony. Head of AIBL Khulna Zone Md Manjurul Alam delivered the welcome speech. Prominent businessman Abdul Hai, journalist Md. Yarob Hossain, Jamal Naser, Chairman of Jhaudanga Union Parisad Md. Rafiqul Islam and Alhajj Bashir Uddin, addressed the occasion. Among others Senior Vice President Engr. Md. Habib Ullah, Vice President CGM Asaduzzaman and Assistant Vice President Jalal Ahmed were present in the inauguration. A large number of local peoples, businessmen, clients and well-wishers participated on the program. Manager of the branch Salahuddin Ahammed thanked the audience.Chief Guest Director Alhajj Abdul Malek Mollah, in his speech, said Al-Arafah Islami Bank Ltd. was established not for making profit by doing business but for the welfare of the society. Managing Director Md. Habibur Rahman, in his speech, invited all to have the blessings of Islamic banking service. He also said, only Islamic banking system can boost-up the economy of the country.

News:New Nation/21-Oct-2015Brac Bank makes account opening easy

Syed Mahbubur Rahman, centre, managing director of Brac Bank, and Taskin Ahmed, second from right, a national cricketer and the bank's brand ambassador, launch Smart Opener service of the bank at a programme in Dhaka yesterday. Photo: Brac Bank

Syed Mahbubur Rahman, centre, managing director of Brac Bank, and Taskin Ahmed, second from right, a national cricketer and the bank's brand ambassador, launch Smart Opener service of the bank at a programme in Dhaka yesterday. Photo: Brac Bank

Opening a bank account was not so easy even a few years ago. But with the advancement of technology and the central bank's emphasis on financial inclusion, the scenario is fast changing in favour of the customers.

Clients will not need to visit the bank branches to open accounts anymore as Brac Bank's Smart Opener will provide this service at home.

Brac Bank employees will visit customers' homes or offices to open accounts.

Syed Mahbubur Rahman, managing director of Brac Bank, and Taskin Ahmed, a national cricketer and the bank's brand ambassador, launched the service at a programme in Dhaka yesterday.

Equipped with tablets, bank employees will take customers' photographs and necessary documents to open accounts and complete other regulatory requirements.

Individuals can set appointments for the service by calling Brac Bank's 24-hour call centre at 16221, by typing 'SO' and sending an SMS to 16221 or by emailing smart.opener@bracbank.com.

The service will initially be available in Dhaka City Corporation areas, and it will be expanded to other regions of the country, said Rahman.

he bank also launched a mobile application for banking services yesterday.

With Brac Bank Mobile, customers can access banking services from their smartphones anytime.

The app allows customers to carry out transactions such as fund transfers, bill payments, mobile top-ups, credit card bill payments and also view account information, and both mini and detailed statements.

Rahman said Brac Bank Mobile is fully secure as per Bangladesh Bank's instructions.

Both the initiatives were taken to bring more people under the financial system using the latest technologies, Rahman said. “The bank will continue to bring in more IT-enabled and innovative services for the comfort and convenience of customers.” The bank has more than 1.7 million customers and it is the largest SME financier in Bangladesh.

Firoz Ahmed Khan, head of retail banking, Zara Jabeen Mahbub, head of communication and service quality, and Mosleh Saad Mahmud, head of customer experience and retail products, were also present at the launching ceremony at the bank's head office.

Despite a number of steps aimed at financial inclusion in Bangladesh, only 31 percent of Bangladesh's adults have bank accounts, according to World Bank data of 2014.

The rate is higher than the average of the low-income countries, standing at 27.5 percent, but lower than the South Asian average of 46.4 percent.

News:The Daily Star/21-Oct-2015

Brac Bank launches smart phone based services

Economic Reporter :BRAC Bank on Tuesday launched two state-of-the-art technologies to provide people with smart phone based banking and account opening services at their door steps. One of the new services named Smart Opener will offer people a faster and smoother account opening service when the other one - Bank Mobile Application - will offer major banking services on smart phone. Brac Bank managing director and chief operating officer Syed Mahbubur Rahman and brand ambassador Taskin Ahmed launched the two IT-based services at a press conference at the bank's Head Office in Dhaka.Smart Opener is the first of its kind account opening service where bank officials will visit customer's home or office to open account. Equipped with a tablet, bank officials will click customer photograph and necessary documents to open a BRAC Bank Account and complete other regulatory requirements. Interested individuals can set an appointment for this service by calling BRAC Bank's 24-Hour Call Center 16221 or by typing 'SO' and sending sms to 16221 or by sending an email to smart.opener@bracbank.com.Initially the accounting opening facility will be available for Dhaka City Corporation area. Soon BRAC Bank will start the facility in other regions of the country. With BRAC Bank Mobile, customers of BRAC Bank can avail banking services from their Smart Phone anytime, anywhere. The services include fund transfer, bill payments, mobile top-up, credit card bill payment mini statement, detail statement, transaction history and many other services."With the launch of Smart Opener and BRAC Bank Mobile, we now take account opening services to your home and all banking services to your fingertips. We will continue to bring in more IT-enabled and innovative services for the comfort and convenience of our customers", Syed Mahbubur Rahman said.He said BRAC Bank Mobile is fully secured with Bangladesh Bank instructed Two-Factor Authentication (2FA). The apps can be downloaded from Google Play. Customers can login to BRAC Bank Mobile with their BRAC Bank Internet Banking User ID, Password and One-Time-Password (OTP). Soon it will be available on AppStore.

News:New Nation/21-Oct-2015