Banking

BB officials protest new pay scale

Bangladesh Bank officials said the new national pay scale discriminates against them and will discourage efficient people from joining the central bank.

The central bank officials under the banner of BB Officers' Welfare Council demonstrated at their office yesterday and held a press conference.

They said an entry level official or an assistant director at the central bank used to get the eighth grade, along with government cadre officials and public university lecturers, in the previous pay structure.

“Now the assistant directors of the central bank have been pushed down to the ninth grade. But the cadre service officials and public university lecturers have been given the eighth grade,” said Siddiqur Rahman, president of the officers' council.

“We have been downgraded. It is discrimination,” said Shahriar Hossain, general secretary of the platform.

According to the new pay scale approved in September, the basic pay for an eighth grade officer has been set at Tk 23,000, while it is Tk 22,000 for the ninth grade. In the previous pay scale, the amount was Tk 12,000 for an eighth grade officer.

Basic salary of civil servants will almost double under the new national pay scale with the employees in the lower rungs getting the highest percentage of raise.

In the highest level among the 20 grades, basic salary will rise 95 percent to Tk 78,000 (fixed), and in the lowest grade 101 percent to Tk 8,250.

BB officials have long been demanding a separate pay structure as their salaries are poor compared to their counterparts at commercial banks. They said they had earlier been promised a separate pay scale.

News:The Daily Star/23-Dec-20152nd AGM of Union Bank held

The second Annual General Meeting (AGM) of Union Bank Ltd was held at Royal Tulip Sea Pearl Beach in Cox’s Bazar on Saturday.

Chairman of Union Bank Ltd Shahidul Alam presided over the meeting.

Among others Md. Abdul Hamid Miah, Managing Director of the Bank, all the Directors and Shareholders were also present in the meeting. Company Secretary Abdul Hannan Khan hosted the meeting.

News:Daily Sun/21-Dec-2015

Prime Bank launches Business World MasterCard

Ahmed Kamal Khan Chowdhury, managing director of Prime Bank, and Syed Mohammad Kamal, country manager for MasterCard, pose at the launch of Business World MasterCard, by the bank and MasterCard, in Dhaka yesterday.

Ahmed Kamal Khan Chowdhury, managing director of Prime Bank, and Syed Mohammad Kamal, country manager for MasterCard, pose at the launch of Business World MasterCard, by the bank and MasterCard, in Dhaka yesterday.

Prime Bank has launched the first Business World MasterCard in Bangladesh, a new corporate credit card on the World MasterCard platform.

The new card will offer best-in-class customer value for enterprise cardholders in Bangladesh, Prime Bank officials said at a press meet in Dhaka yesterday.

This becomes part of the bank's consumer card offerings that have been available to customers in the market, they said.

“After tireless work it feels great to be the first bank in Bangladesh to launch the very first Business World MasterCard,” said Ahmed Kamal Khan Chowdhury, managing director of the bank.

“The card offers our clients a life of privilege and luxury globally as well as within the country, and the best deals that they could want.”

Prime Bank introduced the new “high-facility” card in partnership with MasterCard, a technology company in the global payment industry.

MasterCard has an ever growing portfolio in Bangladesh and seeks to promote the use of plastic money and usher in wide-spread e-commerce, said MasterCard Country Manager Syed Mohammad Kamal.

Prime Bank World MasterCard comes with unlimited free access to Balaka VIP Lounge at Hazrat Shahjalal International Airport along with Priority Passenger Handling Service, the bank said in a statement.

The card will also bring free membership to Priority Pass Programme offering access to more than 850 airport lounges worldwide along with unlimited free access, annual fee waiver with 20 transactions in a year, and free supplementary card, it said.

Prime Bank's Deputy Managing Director Md Tabarak Hossain Bhuiyan also spoke.

News:The Daily Star/22-Dec-2015

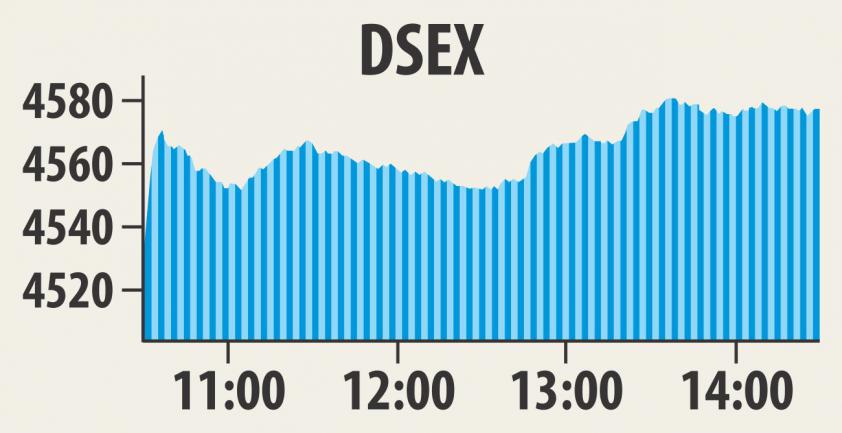

BB move perks up stocks

Stocks bounced back yesterday upon the news of the central bank's relaxation of its rules for banks' capital market exposure.

DSEX, the benchmark index of Dhaka Stock Exchange, jumped up 67.33 points or 1.49 percent, finishing the day at 4,578.87 points.

Optimism resurfaced riding on the news of final resolution on banks' capital market exposure adjustment, said IDLC Investments.

From January, banks' capital given to their stockmarket subsidiaries will not be counted as capital market exposure, Bangladesh Bank said in a notice on Sunday.

The move will increase banks' investment capacity in the stockmarket, the IDLC said.

Relief from the fear of anticipated selling pressure from the institutional end as well as hope for fresh investments rejuvenated the investors' sentiment, it said.

Moreover, the availability of undervalued stocks due to the recent negative momentum in the market attracted the opportunistic investors, IDLC added.

Shares of all the major sectors jumped as investors geared up the buying interest on hopes of eased institutional sell pressure in market, said LankaBangla Securities.

The DSE in a statement also lauded the central bank for the rules relaxation and said the move will have a positive impact on the secondary market.

Turnover, another important indicator of the market, also rose 40.52 percent to Tk 488.87 crore, with 9.68 crore shares and mutual fund units changing hands on the DSE.

Of the traded issues, 247 advanced and 51 declined, with 22 securities closing unchanged on the premier bourse.

Quasem Drycells dominated the turnover chart with transaction of 16.32 lakh shares worth Tk 17.21 crore, followed by Beximco Pharma, Square Pharma, KDS Accessories and BSRM Steel.

Among the major sectors, fuel and power increased 2.2 percent in market capitalisation, followed by cement 2.16 percent, food and allied 1.82 percent, banks 1.66 percent and telecom 0.21 percent. Only the paper and printing sector declined 0.76 percent.

Phoenix Finance and Investments was the day's best performer with its 10 percent gain, while Aziz Pipes was the worst loser, shedding 5.68 percent.

Chittagong stocks also soared yesterday, with the bourse's benchmark index, CSCX, gaining 123.03 points or 1.46 percent to finish the day at 8,507.35 points.

Gainers beat the losers as 188 stocks advanced and 33 declined, while 16 finished unchanged on the Chittagong Stock Exchange. The port city bourse traded 76.11 lakh shares and mutual fund units worth Tk 21.89 crore.

News:The Daily Star/22-Dec-2015EBL launches mobile app Skybanking

Eastern Bank has launched a mobile application for banking services titled ‘EBL Skybanking’ for both EBL and non-EBL customers. The mobile app will help the users to transfer funds, pay bills, receive information about account, loan, card, ATM and branch locations as well as customer benefit programmes of the bank. EBL managing director and chief executive officer Ali Reza Iftekhar launched the application at a ceremony at a city hotel on Sunday, said a press release. Ali Reza said EBL was proud to be the first bank in the country to launch a comprehensive banking app for their customers. ‘We are sure this will help them manage their time and banking efficiently,’ he added. EBL Skybanking app is now available for downloading at Google Playstore for android phones and tabs.

News:New Age/21-Dec-2015