Bangladesh Bank

BB likely to approve 8 new banks on Mar 27

A total of eight new commercial banks, including three non-resident Bangladeshi (NRB) banks, may get approval at the next board of directors' meeting of Bangladesh Bank, sources said.

The meeting is likely to be held on March 27 for taking the final decision on allowing new private commercial banks (PCBs).

Sources close to the decision-making level, however, did not mention the names of all the new scheduled banks, but they hinted that the whole thing would be based on the desire of the "high-ups in the government".

Names of the three proposed NRB banks -- NRB Commercial Bank Limited, NRB Bank Limited and NRB Bank Limited -- were placed before the board on March 15 for approval, but no final decision was taken at that meeting.

"The country will receive around US$ 150 million as paid-up capital, in aggregate, from the NRB banks if the board gives them its approval," a source said, speaking in favour of allowing the three NRB banks.

The foreign currency thus obtained will help improve the country's foreign exchange reserve position, he said, adding that the NRB banks would also help in attracting foreign direct investment (FDI), particularly from the NRBs across the world.

"We're now working on holding another board meeting by the end of this month," an executive director of Bangladesh Bank (BB) told the FE, adding that the board would take the final decision on approval of the new banks, both PCBs and those involving NRBs.

The BB executive director did not specify the number of banks to be approved at the board meeting.

Meanwhile, the preliminary scrutiny of all 16 applications selected for establishing the new PCBs was almost completed Monday, another central bank official said.

A four-member technical evaluation committee, headed by general manager of the Foreign Exchange Policy Department of Bangladesh Bank -- Ahmed Jamal, was earlier formed to examine the primarily selected applications from persons seeking to set up new PCBs.

"The technical evaluation committee will submit a report with scores of all applications to the application evaluation committee within a couple of days for giving it a final shape," the central bank official said.

Another four-member separate application evaluation committee, headed by Senior Deputy Governor of BB Abul Quasem, has already been formed to finalise the evaluation report on the applications.

"The report relating to the setting up of new commercial banks will be placed before the next board meeting for final approval," the BB official said without elaborating.

Earlier, 37 applications were submitted with the central bank for setting up new PCBs. Of them, 21 were rejected by a preliminary committee due mainly to the lack of necessary papers and documents.

Currently, a total of 47 commercial banks are in operation in Bangladesh.

Financial Express/Bangladesh/ 20th March 2012

Banks to open more branches in villages than urban areas

Encouraged by Bangladesh Bank (BB) and largely untapped potentials, country’s commercial banks this year will focus more on rural areas to open their branches, bringing in a major and first time switchover in expanding their businesses. Some 19 commercial banks this year got the central bank’s nod to open 168 branches across the country, of which 85 will be in the countryside, leaving lower number of 83 for cities and towns, according to BB.

“More branches in rural areas will offer banking services to a large number of people who have been deprived of institutional financial services for years,” Governor Dr Atirur Rahman told BSS.

The governor, who has been driving the central bank in many ways towards achieving inclusive growth, believes expansion of rural banking will propel growth by bringing in a huge number of people under banking and financial services.

“The rural banking will also help control inflation with injecting more money in the banking system from the people who otherwise invest or keep their savings in mostly non-productive sectors, a major cause of inflation,” he said.

Last December the central bank decided that banks should open equal number of branches in rural and urban areas, which was four urban branches for opening one in villages as per earlier directive of BB, issued in 2006.

“We have changed the ratio of rural and urban branches to make banks going rural instead of concentrating their business and services in cities and towns,” Dr Rahman said.

Defining the rural and urban areas, BB Executive Director for the Banking Regulation and Policy Department Naushad Ali Chowdhury said the areas under city corporations and municipalities are considered as urban areas. So, he said, the branches outside city corporations and municipalities will be treated as rural branches.

Prime Bank got permission for opening the highest 12 branches for 2012 after the Bank got top position in CAMELS rating. The central bank offered the banks open new branches as per their CAMALS rating. Some other performances were also considered for the banks that got three and lower rating under CAMELS.

CAMELS is an international bank-rating system where bank supervisory authorities rate institutions according to six factors including Capital adequacy, Asset quality, Management quality, Earnings, Liquidity and Sensitivity to market risk.

Eleven banks got permission for opening 10 branches each. The banks are Pubali Bank, Islami Bank, National Bank, UCBL, Southeast Bank, Dutch-Bangla Bank, Al- Arafa Islami Bank, Mercantile Bank, Premier Bank, Mutual Trust Bank and Bank Asia.

The Daily Sun/Bangladesh/ 20th March 2012

BB to bring back inflation to single digit Print Edition

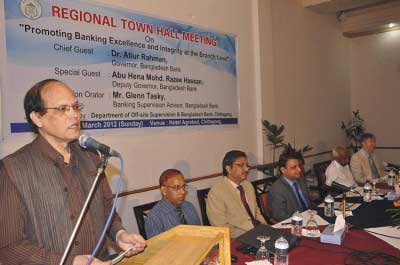

Governor of Bangladesh Bank Dr. Atiur Rahman said that he would pull back inflation to single digit by managing revenue and monetary policies. He was addressing as the chief guest of a meeting on ‘promoting banking excellence and integrity at the branch level’ held at hotel Agrabad in the port city on Sunday.

The meeting was organized jointly by department of off-site supervision, head office, Dhaka and Bangladesh Bank, Chittagong branch. Dr. Atiur said that the implementation of conservative monetary approach policy incorporated in the new monetary policy which would play a vital role in pulling back the inflation. The governor claimed that the market of foreign currency has been quite stable now.

The governor said the central bank has been working hard in supervising the banks at branch levels to maintain the stability in the banking and financial sector of the country. In a bid to improving the supervision activities the central bank has organized the first town hall meeting in Chittagong, out side of the capital, and more meeting will be organized in other parts of the country, he added.

The banking sector around the globe has been going through a transition period and new risks and problems have been evolving in this sector, Dr. Atiur said, adding that “We have to adopt innovative measures to cope with the new risks and problems.”

“We must update ourselves as the supervisor of the banking sector of the country to keep pace with the changing trend of the sector worldwide,” Atiur said. He urged the officials of the central bank involved in supervision to be cautious and tactful while auditing the branches and send the inspection report to the head office immediately after the visit as the authority can take prompt action to stop the any irregularities found.

Chaired by Nowshad Ali Chowdhury, executive director of Bangladesh Bank, the meeting was also addressed by deputy governor Abu Hena Mohammad Razi Hasan and senior consultant Muhammad Allah Malik Kazemi as special guest. Banking Supervisor Advisor of the central bank Glenn Tasky addressed the meeting as a main orator and delivered the main presentation on the banking supervision.

The Independent/Bangladesh/ 19th March 2012

BB chief wants changes in banking supervision

Bangladesh Bank Governor Atiur Rahman speaks at inaugural session of a daylong workshop at the “Regional Town Hall Meeting†for the supervisors of the central bank's Chittagong and Sylhet offices at Hotel Agrabad in Chittagong yesterday.

Bangladesh Bank Governor Atiur Rahman speaks at inaugural session of a daylong workshop at the “Regional Town Hall Meeting†for the supervisors of the central bank's Chittagong and Sylhet offices at Hotel Agrabad in Chittagong yesterday.

The Bangladesh Bank governor yesterday said he expects to see changes in the manner the central bank conducts banking supervision.

The banking regulator will constantly be more and more focused on risk, and less on routine tasks, as most of the supervisors of it are involved in the on-site inspection process, said Atiur Rahman.

"You'll be particularly interested in the changes we have planned in on-site supervision," he said at the inaugural session of a daylong workshop at the “Regional Town Hall Meeting” for the supervisors of the central bank's Chittagong and Sylhet offices.

The Department of Off-site Supervision, Dhaka and Bangladesh Bank, Chittagong jointly organised the workshop at Hotel Agrabad on "Promoting banking excellence and integrity at the branch level".

"Banking has changed and as banking regulators we must also change. The old assumptions, old certainties and old procedures just aren't sufficient anymore," Rahman said.

There are risks and vulnerabilities in the country's banking sector, and the central bank has to work harder and work smarter to uncover these risks and promote best practices in banks, he said.

"This is what we mean by promoting banking excellence."

Above all, best practices mean sound judgment in the granting of credit, lending to legitimate borrowers who have the ability and the intent to repay, he said.

Best practices also mean diligent monitoring of all credits through their life cycles, he said, adding that banks have to maintain an internal risk-rating system for all borrowers and monitor their ability and willingness to repay constantly.

"When you are visiting a bank branch as part of an inspection team, pay close attention to the branch management. Talk to them, listen to them, ask them questions. Assess their qualifications and assess their character," he said to the supervisors.

"In many cases, information about illegal or unethical activity taking place at a bank branch comes from lower-level employees. If you see something that looks wrong, in the loan files or anywhere at the branch, say something. Tell your supervisor."

Very often, illegal or unethical conduct by branch managers or staff is indicative of the same kind of conduct at the head office, Rahman said.

Abu Hena Md Razee Hasan, BB deputy governor; Mohammad Noushad Ali Chowdhury, executive director, and Masum Kamal Bhuiyan, Chittagong general manager, also spoke.

Glenn Tasky, BB banking supervision adviser, and Muhammad Allah Malik Kazemi, senior consultant, conducted the workshop.

The Daily Star/Bangladesh/ 19th March 2012

Making it easier for banks to embrace IT-based operations

Atiur Rahman

Bangladesh Bank is working continuously to develop a modern information technology based efficient and secured banking system with a view to increasing stability in the financial sector. We have already introduced multifarious system including online banking, e-commerce, Automated Clearing House, Bangladesh Electronic Fund Transfer Network (BEFTN), online CIB service, bank-led mobile banking service, new services in the Information Technology (IT) sector especially outsourcing facility and liberalization of foreign exchange transaction system.

Recently, Bangladesh has been identified as the most potential country for IT in a research report of the KPMG, an international organization concerned with financial audit. Due to present increase of business expenditure of the IT developed countries especially in India and Philippines, as an alternative country Bangladesh is considered as the most potential country in this sector in the world. Apart from this, in Bangladesh number of English knowing diligent young people who are expert in information technology is increasing substantially day by day.

Above all, the capacity of Bangladesh to forward through competition with other countries has been increased significantly. Considering all these factors, we have already withdrawn the restrictions which halt expanding IT business.

There is no way to deny that we are very careful to create a business-friendly 'Regulatory Regime'. Due to unprecedented expansion of IT, we have already issued necessary directions and guidelines to facilitate our resident people to bring foreign exchange earned against exporting Business Processes Outsourcing (BPO) services to abroad through using internet. Consequently, any person or institution can bring any amount of foreign exchange earned against exporting BPO services through Authorized Dealers (ADs).

Besides, Online Payment Gateway Service Provider (OPGSP) plays a very significant role as a medium of bringing small amount of foreign exchange earned against services provided by free-lancer. That is why, we have issued necessary directions to the ADs to take help from the OPGSP to bring small amount of foreign exchange at low cost earned against exporting IT services. Initially, at best US$500 can be brought through the OPGSP. But if necessary, we will consider extending this limit on observation of real income flow.

There are other service exports such as business services, professional/ research and advisory services etc., rendered from Bangladesh against which payments in foreign exchange are received through ADs. Along with these services ADs have been given necessary directions to bring foreign exchange earned against exporting non-agency services. Upto fifty per cent (50%) of export proceeds earned from service sector can be preserved in the Exporter's Retention Quota (ERQ) account in foreign exchange.

Foreign exchange reserved in this easily exchangeable ERQ account can be freely sent to abroad to meet business expenditure of the concerned exporter and international credit card may also be accepted against the balance. This credit card can be used to meet other necessary expenses.

All these initiatives of liberalizing foreign exchange transactions will hopefully create opportunity in bringing foreign exchange without any hassle earned against exporting services and help to create business-friendly environment in exporting services. As a result, exporters will be encouraged in exporting other services along with information services.

On the basis of the initiatives by the Bangladesh Bank (BB), Canada-based online money transfer agency 'AlertPay' has recently commenced its operation in Bangladesh. Along with the Government, BB has also already taken necessary steps to involve Bangladesh into activities of 'Pay Pal' the most popular Online-Payment Gateway of the world. Bangladesh, we hope, will be involved into the service of 'Pay Pal' very soon.

It is a great pleasure for us that operation of Canada-based online money transfer agency 'AlertPay' is being introduced in Bangladesh through Bank Asia. Consequently, through this online service our resident people or institutions will be able to bring their export proceeds very easily against exporting non-physical services i.e. data entry, data processing, data digitization and conversion, animation and multimedia, software developing and customization, search engine optimization, social marketing, off-shore IT services, web-design, mobile application developing, and free-lance outsourcing of graphic design.

Bank Asia is launching the service of 'AlertPay' as the first Bank of Bangladesh. We hope that other banks will also be encouraged to follow the step of Bank Asia.

Bank Asia is launching not only the service of Online Payment Gateway 'AlertPay' but also mobile banking service namely ''Express Cash'. It is a kind of remittance service through which Bank Asia will be able to transfer money from one place to another within the country.

By this system, people at any place of Bangladesh can easily make transactions through mobile phone and clients can receive SMS notification and money receipt as the evidence of their transactions. This system provides customers with banking services very swiftly going beyond the banking transaction hours.

We expect that the Bank will open 'Express Cash' service point in the remotest areas of the country to convey mobile banking service to the doorstep of the customers. This financial service of this Bank is consistent with the mobile banking policy of Bangladesh Bank. At the same time, innovative quality has also been reflected in this own platform-based service.

Mobile banking is an alternative to traditional branch banking by which it is possible to provide efficient and swift financial service at a minimum cost to the unbanked people. Through using mobile phone technology, this system makes the disbursement of foreign remittance; transaction through coordination of ATM, VISA & Master Card network; payment of salary, allowance and pension, payment of utility bill, collection of school fees, immediate balance recharge of mobile phone, payment of government allowance etc. more easier.

Mobile banking can play a vital role by providing financial service to the mass population out of banking service. Bangladesh Bank has approved 17 banks to launch mobile banking service to facilitate them to convey banking service to the doorsteps of people with the help of mobile phone operators and 10 banks have already been able to commence their mobile banking activities. We believe that rest of the banks will be able to launch this programme very soon.

Banking service can reduce poverty rate by using information technology. Because common people can get the advantages of modern banking service at low cost with the benediction of technology and easy banking activities increase saving tendency in the common people. We would like to invite all concerned people to increase the financial services by using the utility of modern information technology like mobile banking.

This is an adapted version of the speech, delivered by Dr Atiur Rahman, Governor, Bangladesh Bank, at the launching event of online payment gateway, 'AlertPay' and also of mobile banking service 'Express Cash', by Bank Asia Ltd., in Dhaka last week

Financial Express/Bangladesh/ 18th March 2012