Eminent citizens worried about Grameen Bank future 405 university teachers say the govt's stance tarnishes Bangladesh's image abroad

Three separate platforms of more than 650 persons from different professions yesterday expressed their grave concerns about the future and autonomy of the Grameen Bank.

In a statement, 405 teachers under the banner of University Teachers' Association of Bangladesh said: "We are deeply worried at the present government's ploy in the appointment of managing director of internationally renowned and Nobel winning Grameen Bank out of vendetta and animosity."

"We are also surprised at the amendment to the Grameen Bank Ordinance to prevent the impoverished, neglected and the poor women member-borrowers of the bank from exercising their rights and to halt empowerment of the poor women."

They said the international community is worried about the government's hostile attitude to Nobel Peace Prize laureate Dr Muhammad Yunus.

"Bangladesh's image has been tarnished due to the government's naked interference in Grameen Bank, politics of secret killing and the Padma bridge corruption," said the statement.

The signatories to the statement of the association include its President Prof AFM Yusuf Haider and Secretary General Prof Tahmina Akhter, and Abdul Aziz, Khalilur Rahman, M Farid Ahmed and Ashraful Islam Chowdhury.

In another statement, 65 eminent citizens said: "The government and the head of the government have taken steps to destroy the Grameen Bank in the name of controlling it, which is worrisome."

They said Prof Yunus has shown the dream of activating the country's disadvantaged poor womenfolk, which has injected life into the women awakening.

"The countrymen have started to reap its benefit slowly. We request the government not to destroy the bank that is enabling women awakening," said the statement.

The platform also urged the government to refrain from curbing the authority of the board of directors of the bank in the name of amending the ordinance.

The signatories to the statement include former vice chancellors of Dhaka University Emajuddin Ahmed and Moniruzzaman Miah, former VC of Jahangirnagar University Mustahidur Rahman, former deputy VC of Agriculture University Shah Mohammad Faruque, vice-president of Bangladesh Bar Council Khandokar Mahabub Hossain and former general secretary of Bangladesh Supreme Court Lawyers Association Badruddoza Badal.

Under the banner of "Shato Nagorik", 219 eminent citizens urged the countrymen to be alert about any ploy that could harm the Grameen Bank.

"We are deeply worried that the present government is desperate to establish its control over the country's only Nobel winning organisation Grameen Bank and destroy it through steps taken one after another," they said in a joint statement.

"Besides, the government is spreading vices to vilify and tarnish the image of microcredit and social business pioneer Prof Yunus," it said.

The signatories to the statement include Prof Sadrul Amin, Prof Tajmeri SA Islam, Prof Abu Ahmed, poet Abdul Hye Shikder, Prof ZM Tahmida Begum, Prof Mohammad Golam Rabbani, Borhan Uddin Khan, Mosharraf Hossain Mia and Prof Mokhlesur Rahman.

News: Daily Star/Bangladesh/28-Aug-12

Black money amnesty draws poor responses

Scope for legalising black money last fiscal year brought the government only Tk 38 crore in taxes, the lowest in four years.

"It is a very negligible figure. The collection of such an amount is just an hour's business for the National Board of Revenue (NBR)," said Ahsan H Mansur, the executive director of Policy Research Institute.

Only Tk 382 crore was legalised in fiscal 2011-12, and that too after a mere 82 people decided to do so by parking money in stocks.

"[The provision to legalise black money] creates moral hazard. Honest and regular taxpayers will be discouraged to comply with the law," said Mansur, a former economist of the International Monetary Fund.

"The whole thing is unjustified on the economic ground. It also has no revenue justification," he said, stressing the need for stricter governance.

The revenue authority incorporated a provision in the law, under which a person will be able to legalise undisclosed money by paying 10 percent penalty in addition to paying normal tax.

The provision has been added in the Income Tax Ordinance 1984, widening areas for investment for undeclared money-holders, said a senior official of NBR, requesting not to be named.

In the past the NBR used to give the scope through statutory regulatory orders.

The areas where black money can be legalised via investment include the stockmarket, real estate, industry and BMRE (Balancing, Modernisation, Rehabilitation and Expansion).

The rationale behind the inclusion of the clause, the official said, is that a provision in law would encourage more people to come forward to declare their undisclosed wealth.

"Stability of law gives confidence to people. Anyone can disclose undeclared income anytime," said the official.

Towfiqul Islam Khan, a senior research associate at the Centre for Policy Dialogue, however, is sceptical of the success of the NBR provision.

"It fails to have a special impact if the opportunity is given every year.”

He feels the past low responses suggest the inclusion of a permanent provision in the law would hardly lead to better outcomes.

In recent memory, the NBR logged in Tk 803 crore as taxes in fiscal 2007-08 after 16,664 people legalised a staggering Tk 8,895 crore fearing anti-corruption crackdown by the then caretaker government.

The number of people declaring their undisclosed incomes since then has been on the wane, with the figures being 14,258 and 1,923 in the successive fiscal years of 2008-09 and 2009-10.

The tax receipts registered for fiscal years 2008-09 and 2009-10 were Tk 108 crore and Tk 121 crore respectively.

"Rather, the NBR should improve its law enforcement and increase administrative reach to net more taxpayers," said Khan.

News: Daily Star/Bangladesh/28-Aug-12

Tk 2b UCB bonds get SEC nod

The Securities and Exchange Commission (SEC) has given consent to United Commercial Bank (UCB) to issue floating rate subordinated bonds worth Tk 2 billion, only through private placement.

The consent of issuing bonds came under the provisions of the Securities and Exchange Commission (Issue of Capital) rules, 2001.

The approval was given on condition that the company shall comply with relevant laws and regulatory requirements, and shall also adhere to the conditions imposed

by the SEC under Section-2CC of the Securities

and Exchange Ordinance, 1969.

News: Daily Sun/Bangladesh/27-Aug-12

Agrani Bank Sadullapur branch goes to new building

GAIBANDHA: Sadullapur branch of Agrani Bank Limited was shifted to a new building in front of Sadullapur police station Sunday.

Haradhan Chandra Das, General Manager of loan division of the Bank inaugurated the new branch office as chief guest.

Selina Akter, Deputy General Manager, Rangpur circle and Arajit Kumar Das, DGM, Rangpur zone attended the function as special guests.

M Tozammel Haque, Assistant General Manager and Gaibandha zonal head presided over the function.

Haradhan Chandra Das said that the officials and the employees of the Bank should ensure innovative banking services to the customers in fastest possible time.

He also urged the employees to be more professional and dedicated in providing services to the clients to enhance the image of the Bank.

Golam Mowla, UNO, AKM Hamidur Rahman and M Saifur Rahman, senior principal officers, Jahangir Alam Tonu, principal officer, Abdul Khaleque, senior officer, Abu Sayeed Mondal, CBA leader and local elite including journalists were present in the function.

The programme was followed by a milad and doa mahfil seeking blessings from the Almighty.

News: Daily Sun/Bangladesh/27-Aug-12

PBL holds training programme

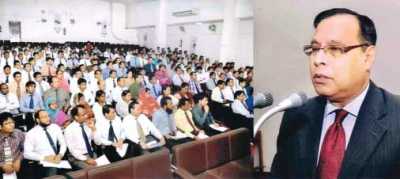

Helal Ahmed Chowdhury, Managing Director of Pubali Bank Limited, speaks at inaugural of a daylong training programme at the Bank’s head office recently.

Helal Ahmed Chowdhury, Managing Director of Pubali Bank Limited, speaks at inaugural of a daylong training programme at the Bank’s head office recently.

Pubali Bank organised a daylong training programme on “Internet Banking, Remittances, CIB Reporting and Customer Registration” at its Head Office recently.

The programme was organised by Information Technology Division of the Pubali Bank Limited (PBL), said a press release.

Helal Ahmed Chowdhury, Managing Director of the Bank attended the programme as chief guest, while Safiul Alam Khan Chowdhury, Deputy Managing Director was present as special guest.

Mohammad Ali, General Manager and Chief Technical Officer of the Bank presided over the programme.

Helal Ahmed Chowdhury said Pubali Bank has been providing better services to its customer by giving access to their accounts, transfer of funds. The Bank operates realtime centralised online banking by using a dedicated software through 326 branches.

Pubali Bank Limited is one of the largest online networks in Bangladesh, he added.

He emphasised to explore and expand foreign remittance business by maintaining regular contacts with the importers and exporters and applying modern IT solutions in order to keep pace with the advancement of business in the present competitive market.

News: Daily Sun/Bangladesh/27-Aug-12