What’s going on at the Islami Bank?

Some IBBL directors expressed their concern that if the situation continues, the bank will face the same fate as the state-run BASIC Bank

The termination of Syed Ahsanul Alam as Islami Bank Bangladesh Limited (IBBL) vice-chairman on Tuesday is the latest in a series of events which point to major turmoil within the nation’s largest private bank.

Starting with the abrupt resignation of its top three officials – the chairman, vice-chairman and managing director on January 5 – Islami Bank saw several major shifts in policy and operations that some insiders claim were rife with irregularities and benefited interests that have been gaining control of the bank.

Sources within the bank claimed that Ahsanul’s removal was not a result of his difference of opinions with IBBL Chairman Arastoo Khan, but a part of these policy changes.

The sources alleged that there had been irregularities in recent appointments, in the granting of loans and in the lowering of the dividend. They also claimed that the board was planning to sanction a loan worth hundreds of crore to a big business conglomerate for an energy project without maintaining proper procedure.

Ahsanul Alam wrote a Facebook post on May 11 claiming that some high-level officials of the bank, backed by some corrupt officials, were involved in a “plus-minus conspiracy” in the bank’s board.

“Due to the conspiracy, it’s only a matter of time before I am forced to resign from the board,” he wrote.

This prophecy came true on Tuesday when the IBBL board removed Ahsanul from his post, saying he had spread negative propaganda about the bank.

In the last five months, the board has appointed around 150 people to different departments, including 35 to the IT department alone.

It is alleged that regulations were violated in each of these appointments and that most of them were only made in exchange for bribes.

Lowered dividends and dropping share price

Some directors expressed their dismay at the declaration of a 10% dividend for shareholders for 2016 against a net profit of Tk450 crore.

The directors believe the low dividend was an effort to push down the bank’s share price. In March, the share price of IBBL was around Tk45 and by May it had dropped to as low as Tk31.

The sharp drop has pulled down the share price index of the whole banking sector.

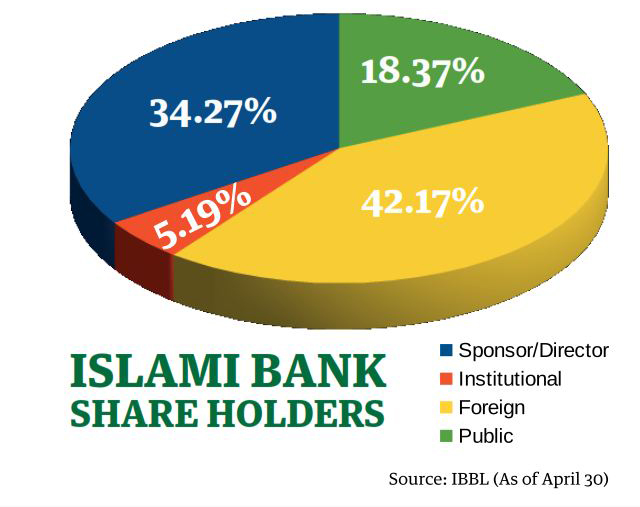

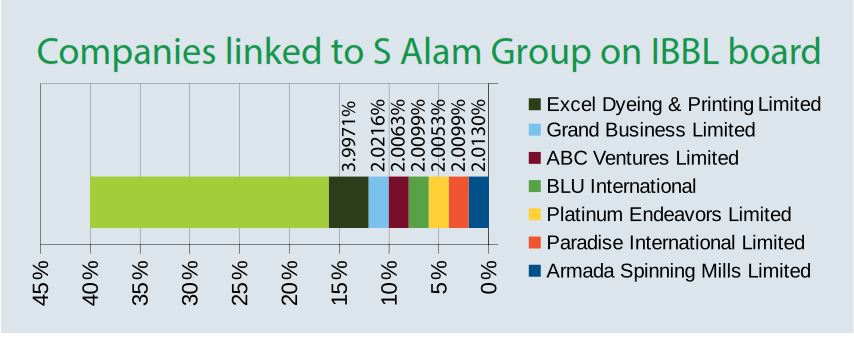

IBBL’s records show that over the last year, seven companies linked to the Chittagong-based S Alam Group have gradually been buying the bank’s shares and entering directorship, leading to a strong position on the board.

The seven companies were registered with the joint stock companies last year.

They are: Excel Dyeing and Printing Limited, Armada Spinning Mills Limited, ABC Ventures Limited, Grand Business Limited, Platinum Endeavors, Paradise International Limited, and Blu International.

IBBL Chairman Arastoo Khan is the representative-director from Armada Spinning Mills.

The same day that Ahsanul was terminated, the Islamic Development Bank (IDB), one of the corporate directors, expressed its intention to sell 87 million of its total holding of 121 million shares at the prevailing market price. This is 5.4% of the bank’s shares. Excel Dyeing and Printing Limited expressed its intention to buy 32 million shares.

On Wednesday, 32 million of IDB’s shares were bought out by Excel Dyeing, which is 1.9899% of the bank’s shares. The rest, 3.41% of total shares, was bought by JMC Builders and Excelsure Impex, two companies also believed to be linked to S Alam Group.

The entire transaction was handled by the brokerage house Reliance, which is owned by the group.

Altogether, these new companies now own about one-fifth of the bank.

Irregularities in loan disbursement

The current board, formed in January, disbursed over Tk1,400 crore in loans in the last three months. A central bank report says that most of the loans were sanctioned by breaching relevant rules and regulations.

For example, the board approved a loan worth Tk132.60 crore to Infinit CR Strips Industries, a company formed in February, against a loan proposal that came from the bank’s Khatunganj branch in Chittagong. An IBBL director claimed that the client is a sister concern of Armada Spinning Mills.

Infinit’s loan proposal for constructing a steel-sheet manufacturing plant did not have information about the company’s banking activities, said the Bangladesh Bank report.

The central bank also found that the board had raised the loan ceiling for Sister Denim Composite, an affiliate of Thermax Group, to about Tk200 crore from the previous limit of Tk135 crore, in violation of investment risk grading rules.

It also found that the new board had issued loans totalling over Tk800 crore to six companies of Nassa Group without taking the required collateral.

The group has provided collateral worth Tk268.63 crore against the requisite amount of Tk338.59 crore. Some subsidiaries of Nassa are defaulters but the issue was overlooked when the loans were approved, the report said.

Some IBBL directors expressed their concern that if the situation continues, the bank will face the same fate as the state-run BASIC Bank.

Asked about allegations of recent irregularities, IBBL Chairman Arastoo Khan told the Dhaka Tribune: “These allegations are baseless and false.

“None were appointed in the bank violating rules and we are disbursing loans maintaining the central bank’s rules and regulations.”

“All borrower companies have clearance on their banking activities and we have taken required collaterals,” he said, when asked about the issue of collaterals.

“But in case of some renowned companies it is different, as their collateral of Tk10 is equivalent to Tk100 from an average company,” he said.

While asked about giving lower dividend to the shareholders, Arastoo said: “We have given 10% dividend to make the bank’s reserve strong. There is no other reason behind this.”

Islami Bank has been accused of close ties to the Islamist party Jamaat-e-Islami since its inception. The Awami League government has been manoeuvring to remove Jamaat from the bank’s management for some time.

news:dhaka tribune/26-may-2017Other Posts

- Islami Bank crisis deepens as two directors quit

- Nazeem A Choudhury, Head of Consumer Banking of Eastern Bank Ltd. (EBL) and Pradip Kar Chowdhury, Executive Director of ACI Ltd. exchanging documents after signing an agreement on EBL Commercial Payment Solutions (CPS), powered by MasterCard at the banks

- State banks to get Tk 1,700cr to plug capital shortfall

- Mashrur Arefin, Additional Managing Director of City Bank Ltd. and Engr. Jahangir Alam Patwary, Managing Director of Anwar Landmark Ltd. exchanging an agreement signing documents at the bank's head office in the city recently. Under the deal, customers of

- Two independent directors of Islami Bank resign

- Md. Obayed Ullah Al Masud, Managing Director of Sonali Bank Limited, presiding over its Management Committee Meeting at the bank’s head office in the city recently. Aminuddin Ahmed, Tariqul Islam Chowdhury, DMDs, GM's of head office and local office were

- Ahsanul, Mabud resign as IBBL directors

- Banks not prepared against cyber attacks

- Sheikh Moulana Mohammad Qutubuddin, presiding over a meeting of Shariah Supervisory Committee of Islami Bank Bangladesh Limited as Chairman at its head office in the city recently. Md. Abdul Hamid Miah, Managing Director of the bank, Dr. Mohammad Abdus Sa

- Excel Dyeing rushes to buy 3.20cr shares of Islami Bank

- Offshore banking units’ NPLs rise fourfold in Q1

- Islami Bank’s Ahsanul Alam loses vice-chairman post

Comments