Finance

Islamic banking on a roll - IDB chief shares his views on Islamic finance with The Daily Star

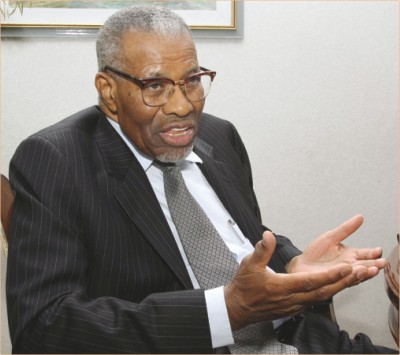

Ahmad Mohamed Ali - IDB Chief

Bangladesh's commercial banks following Shariah-based principles will continue their phenomenal growth as elsewhere in the world as the system deals with 'real economy and real commodity', the head of Islamic Development Bank (IDB) Group said.

In Bangladesh, there are now seven Islamic banks that provide full-fledged Shariah-based financial services through 622 branches. Besides, a number of conventional banks have set up branches to grab a pie of the market.

“The IDB is a shareholder of Islami Bank Bangladesh, the largest Islamic bank in the country. It is doing very well. Buoyed by its success, Bangladesh has now a number of Islamic banks,” said Ahmad Mohamed Ali, president of Jeddah-based IDB.

“A number of commercial banks have also opened wings for Islamic banking. It is growing and we expect the growth will continue in future,” he told The Daily Star on Monday in an interview.

He said the Islamic banks in Bangladesh are growing faster with high profit margin, due to the preference of people. “This is the choice of the people.”

“There is an indication that they expect to earn more,” he said, when asked about the reason why many commercial banks are opening Islamic banking wings or totally converting to Shariah-based banking.

Ali said the growth of Islamic banking in Bangladesh is part of the phenomenal growth of Shariah-based financial system across the world, particularly after the global financial crisis.

He said Islamic banking is spreading across the world, not only in the Muslim countries, but also in the non-Muslim countries.

“Islamic banks have proved more resilient to the crisis. There is a demand for it, especially after the financial crisis in countries such as England, France and Italy,” he said.

Although the head of the development bank could not give an exact estimation of the growth of Islamic banking, he said: “Many experts and observers say Islamic banking is a fast-growing industry. Some of them put the annual growth at 15 percent and higher.”

“The industry will definitely grow more and more in the future.”

He said, when the IDB was established in 1975, there was only one Islamic bank in the world. “Now, there are hundreds of such banks managing billions of dollars.”

There are Islamic banks in 40 countries, and those are handling business worth $22 trillion, according to analysts. In Bangladesh, private banks control about 62 percent of the economy, and Islamic banks account for a significant part of that.

During the global financial crisis, a number of big banks in the developed world collapsed and had to be bailed out by taxpayers' money, while banks complying with Shariah principles continued outstanding growth.

“The reason is very simple: Islamic banking deals with real economy. There is no speculation,” he said.

In Bangladesh, critics have serious misperception and doubt about the religion-based banking system, but Ali defended, saying: “There are Shariah committees; the central bank audits them regularly and they publish their accounts. So I don't understand why there should be any misperception.”

Ali said he does not think there is any need for a separate regulatory system to police Islamic banking. “In my opinion, Islamic banks should be regulated by the normal authorities. But there are some necessities of the Islamic banking that should be taken into consideration by the central bank.”

He said, for every Islamic financial institution there is a Shariah board to ensure that the operations of that institution are in accordance with Islamic principles.

Critics say Islamic banks cash in on people's sentiment -- a thing Ali has not denied completely. “In any business, you have to market it and cash in on the sentiment or the feelings of the customers.”

“You need to use all ways and means to convince the potential customers to come and buy your products.”

He said Islamic banks respond to the demand from individuals either because of their belief or nature of the business. There are some businesses that are appropriate for the market.

“In Malaysia, for example, there are Chinese businessmen who are dealing with Islamic banks although they are not Muslims. They found Islamic banking as more appropriate for their business.”

This week Ali was in Dhaka to facilitate signing of an agreement to finance shelter, water supply and sanitation projects in the cyclone Sidr-affected areas under IDB's $130 million philanthropic “Fael Khair” programme.

The donation was made to the bank by an anonymous philanthropist to support the victims of cyclone Sidr, which hit the coastal areas of Bangladesh in 2007, killing thousands and rendering millions homeless.

On Monday, Ali, the former deputy education minister of Saudi Arabia, visited Sidr-affected Sharankhola upazila in Bagerhat to lay the foundation stone of a school-cum cyclone shelter.

Of the total grant, $110 million will be spent for constructing about 440 cyclone shelters-cum-primary schools. Each building, equipped with solar energy, will be used as schools in the normal time and as shelters during any natural disaster.

The IDB is providing $140 million to the government to help construct the much-talked Padma Multipurpose Bridge.

“This is the largest participation of the development bank in any single project in Bangladesh,” he said.

- By

Source: The Daily Star/Bangladesh/May-25-2011

IDB selects four NGOs for philanthropic programme

Islamic Development Bank has selected four nongovernmental organisations to implement the $130 million (more than Tk 900 crore) Fael Khair programme for victims of Cyclone Sidr, IDB President Ahmad Mohamed Ali said yesterday.

The NGOs are: Islami Bank Foundation, Muslim Aid, Voluntary Organisation for Social Development (VOSD) and BRAC.

“The fund is being utilised for the construction of several hundred school-cum-cyclone shelters in the coastal belt and provision of urgent relief in the form of agro inputs to the victims,” said Ali while speaking on the global financial crisis and Islamic banking at an international seminar at Sonargaon Hotel in Dhaka.

Islamic Banks Consultative Forum organised the seminar with its chairman Abu Nasser Muhammad Abduz Zaher in the chair.

Ali, the former deputy education minister of Saudi Arabia, yesterday visited the cyclone Sidr affected Sharankhola upazila in Bagerhat to lay the foundation stone of the first such school-cum-cyclone shelter.

Under the Fael Khair project, Abdul Monem Ltd and DCL-PCCL will build shelter buildings in Khulna, Satkhira, Bagerhat, Barisal and Patuakhali districts.

The IDB chief, however, has refused to name the philanthropist who donated $130 million for the welfare of Sidr victims.

On the global financial crisis and Islamic banking, Ali said Islamic banks remained resilient through the first wave of crisis during 2008-09, but they were partly affected by the second wave in 2009.

He said the increased severity of the crisis also led to an increase in customer defaults and rescheduling of dues.

“Islamic banks suffered because of severe price devaluations in some other asset classes like equities and Sukuk and managed funds, which were adversely affected by the crisis,” said Ali.

He also said though the Islamic financial sector now appears to be recovering, the growth rates are expected to be less aggressive compared to the recent past.

He said the IDB has formed a financial services board and a research and training centre recently.

Ali said the IDB has raised $750 million recently from the market, which will be spent in the member countries.

Some 275 officials from Islamic banks and conventional banks that run Islamic banking will attend the seminar to be addressed by renowned national and international speakers.

Source: The Daily Star/Bangladesh/May-25-2011

BB chief urges Islamic banks to avoid terror financing

Bangladesh Bank governor, Dr Atiur Rahman, on Tuesday urged the managements of banks engaged in Islamic banking in the country to remain alert against terrorism financing. "I would like to remind you all about the need of due alertness against aiding extremists and abetting terrorism," Dr Atiur told bankers at an international seminar on "The Global Crisis and the Strength of Islamic Banking System", organized jointly by Islamic Bank Bangladesh Ltd. (IBBL) and Islamic Banks Consultative Forum (IBCF), at a hotel in the city.

The central bank governor also hailed the role of Islamic banking by saying, "Its ethos serves well to check laundering money that is associated with crime."

He said the profit and loss sharing nature of liabilities of Islamic banks is a good safeguard against solvency risk.

He said Islamic banking constituted 18.5 per cent of deposits and 19.7 percent of advances of the banking system in 2010, in Bangladesh. He said, recently, the central bank has circulated a comprehensive guideline to the banks for proper growth of Islamic banking in the country.

He said the country still lacks a secondary market for Islamic financing products for which a portion of the money deposited in the central bank by Islamic banks remains idle.

Speaking on the occasion, IDB (Islamic Development Bank) president Dr Ahmed Mohamed Ali said Islamic banking provides a relatively stable Shari'ah compliant alternative to the financial needs of the society.

"This stability demonstrated by Islamic banks during the recent financial crisis in comparison with their conventional counterparts, has already been recognised," he said. The IDB president said the Islamic financial service industry is also expanding its scope by including microfinance namely micro-Takaful.

As Bangladesh pioneered the idea of microfinance, the micro-Takaful system has been designed to give low-income individuals in communities quick and easy access to socio-economic services, opportunities for self-employment and thus the chance to uplift themselves out of poverty, he said.

IBCF chairman Prof Abu Nasser Mohammad Abdul Zaher said that the Islamic banks are working to free the people of Bangladesh from the curse of interest. The first day of the seminar was participated by some 275 officials of 11 banks those have been operating Islamic banking in the country completely or by opening a separate branch or a window. Former IDB research head, Dr Ausaf Ahmed has presented a key-note paper at the seminar.

Among others, IBCF vice chairman Nazrul Islam Mojumder spoke at the seminar.

Past and present presidents of Federation of Bangladesh Chambers of Commerce and Industry, Salman F Rahman and AK Azad attended the first day's concluding session of the seminar. Organisers said several business sessions linked to Islamic banking will be held on the second day, on May 25, of the seminar which will be open for bankers and traders.

Source: The Independent/Bangladesh/May-25-2011

Asian Development Bank (ADB) pledges to provide $3.715b in 4 yrs

The Asian Development Bank (ADB) in its strategic country plan for Bangladesh pledged to provide U$$ 3.715 billion fund for 2011-14 to develop the country's weak infrastructure, power and energy sector and the capital market.

The multilateral development agency planned to provide around $1.40 billion to set up power plants with 9500 megawatt capacity in the period.

Around 33 per cent of the loan will be provided for power and energy sector development. Transport and information technology development sector will get $745 million or 26 per cent of the loan package.

ADB planned to provide the loan package in its strategic country plan for Bangladesh which will be placed to the Economic Relations Division (ERD) today (Wednesday).

The donor agency has given the highest priorities on development of the power sector during 2012-14.

A mission on 'Bangladesh country partnership strategy' arrived in the country last Sunday to offer the loan package. The mission will sit with all of the government high-ups to discuss the strategic plan.

ADB has prepared the strategy paper titled 'country business plan' by projecting GDP (gross domestic product) growth of 6.0 per cent in the current year.

The strategic paper said ADB will provide US$ 3715 million or Tk 260 billion to Bangladesh in the 2011-14 period.

It will provide US$ 900 million in 2011 for five major sectors. ADB has pledged to provide $2815 million in 2012-14 period for 23 projects.

For agriculture and natural resources development, it pledged to allocate $140 million or 5.0 per cent of the total loan package.

Education will get $390 million or 14 per cent of the total loan while $80 million will be provided for the financial sector development.

Water supply and infrastructure development of urban areas will get $535 million loan from the package.

The development partner focused on four main sectors to expedite development that include power, infrastructure for better communication, urbanisation and education.

ADB said the Bangladesh will have to include climate change in all of its economic activities. It has set the priorities for the loan package.

The ADB plan said it would provide $900 million for agriculture, primary education, power, railway and water supply projects in the current fiscal.

Education will get $320 million, the highest amount, in loan this year, while power is the next priority with $ 300 million.

For 2012, the development partner pledged to provide $910 million for capital market development, climate change, education, power sector, Public-Private Partnership (PPP), sustainable primary health services for urban area, development of transportation system in the greater Dhaka and transport corridors.

Power sector will get the highest priority in 2012 with $250 million loan out of $910 million.

Transport corridor development projects will get $175 million in 2012, while $80 million will be allocated for development of stock market in 2012.

PPP will get $150 million, while development of the city's transportation system will get $145 milion in 2012.

For 2013, the ADB allocated $965 million for regional power generation and transmission, secondary education development, Khilkhet water supply projects, coastal urbanisation infrastructure development projects, sub-continental railway projects.

The ADB plan has allocated $910 million for 2014 giving highest priority to power development, PPP, Chittagong port development, railway, river dredging, urbanisation.

In the strategic plan, the ADB has focused on the country's manpower strength and vibrant private sector. It also appreciated impressive growth of textile and agriculture.

The plan said the government is moving in the right direction to achieve Millennium Development Goal (MDG) as it has successfully reduced child and maternal mortality rate and improved pure water supply.

Source: Financial Express/Bangladesh/May-25-2011

Govt, Islamic Development Bank (IDB) sign $140m loan deal on Padma Bridge

Finance Minister AMA Muhith and IDB president Dr Ahmad Mohamed Ali signing the US$ 140 million loan agreement on behalf of their respective sides in the city Tuesday. — PID photo

The government Tuesday signed a US$140 million loan agreement with the Islamic Development Bank (IDB) to finance the Padma Multipurpose Bridge Project.

Finance Minister A M A Muhith and visiting IDB President Dr Ahmad Mohamed Ali signed the deal at the Ministry of Finance (MoF).

The length of the proposed Padma Bridge is 6.15 kilometres, and its total estimated cost is US$ 2.9 billion. After construction, the bridge would connect the country's 19 south-western districts with the capital.

Among others, Communications Minister Syed Abul Hossain, Prime Minister's Adviser Dr Mashiur Rahman, and Economic Relations Division (ERD) Secretary Musharraf Hossain Bhuiyan were present at the loan signing ceremony.

The government already signed a $1.12b loan agreement with the World Bank in April, and another $415m loan deal with the Japan International Cooperation Agency on May 18 to construct the country's largest bridge.

The deal with the Asian Development Bank will be signed on June 6.

Finance minister, after signing the agreement, said the bridge would help augment the country's economic progress through removing the isolation of the south-west districts from the rest of the country.

"The economic development of a country significantly gets slower, when there is no good communications network," Muhith told reporters after the meeting.

"We would be able to maintain the time schedule in completing the mega project," he added.

The IDB president said he was confident that the project would be completed within the set timeframe in a transparent manner and without any additional cost.

"Cooperation between the IDB and Bangladesh has been increasing in a number of areas," the IDB head said.

Communications Minister Syed Abul Hossain said the World Bank would provide Bangladesh $300 million more in addition to $1.2 billion, committed earlier.

"We'll build the bridge with the highest level of integrity and transparency," the communication minister asserted.

Prime Minister's Adviser Mashiur Rahman said the people of the south-west region would be immensely benefited after construction of the Padma Bridge.

"This is a good example of political leadership, civil servants and development partners working together," he said.

Besides the Padma Bridge deal, another loan agreement of $14.84 million was also signed by the finance minister and the IDB president, as the bank is going to finance a water supply and sanitation project in the country's cyclone-prone coastal areas.

"Both the projects are of high importance for the socio-economic development of the country," reads a release, issued by the MoF.

While speaking at a press briefing on the last day of his two-day Bangladesh visit, Dr Ahmad Mohammad Ali said IDB will strengthen cooperation with Bangladesh for upgrading the country's infrastructure and cut poverty rate. "We have mobilised US$750 million fund this year from the market to assist our Muslim brothers' countries. We hope our support to Bangladesh will increase further," he added.

Mr Ali said IDB usually works in Bangladesh based on the success rates of projects implemented here. "We hope our operation in the country will improve in the future days,"

The visiting chief of the Jeddah-based donor agency said they would ensure highest transparency while spending the US$130 million grant by an anonymous philanthropist for constructing cyclone shelter-cum-schools where devastating cyclone Sidr played havoc in November 2007.

The philanthropist donated the $130 million fund to IDB for helping Bangladesh to recover from losses caused by Sidr.

The government in May 2008 signed a Memorandum of Understanding with the IDB for proper use of the $130 million grant.

The IDB and the government decided to build cyclone shelter-cum-schools and support the agro-based families at the cyclone affected areas in the southern coastal districts.

IDB has undertaken a scheme titled "Fael Khair Programme" where some $110 million fund has been earmarked for building the cyclone shelter-cum-schools and remaining $20 million for assisting the cyclone-affected poor people.

The programme faced setback in its initial stage as the implementation procedure was very slow in first two years due to some bottlenecks and inefficiency of the executing agencies, sources said.

Source: Financial Express/Bangladesh/May-25-2011