Banking

CSR activities of banks, FIs rise six times in last 5 years

Expressing his concern over the ongoing political impasse, the Bangladesh Bank (BB) Governor Dr Atiur Rahman said Saturday that country's all achievement will be ruined if destructive trend continues.

He also said the people of the country are looking forward to the politicians to save them from self-destructive politics.

"We have achieved some good economic indicators in the last few years. But, all of these are facing challenge due to the growing political instability and destructive activities," he said while addressing a programme titled 'Mercantile Bank Abdul Jalil Education Scholarship-2012' at a city hotel.

BB Governor said that the political turmoil and lack of developed infrastructure affect the overall investment.

Upholding the economic development of the country, he said according to a London based research Bangladesh progressed in the seven from the eight indicators of development.

Dr Rahman said the gross domestic product (GDP) growth in the country went up more than six percent amid the global recession and internal political crisis. The foreign currency reserve has also crossed the US$17 billion milestone, he said.

The central bank governor also mentioned that expenditures in Corporate Social Responsibility (CSR) activities undertaken by banks and non-banks financial institutions were increased six times during the last five years.

In last five fiscal years, the banks, financial and non-bank financial institutions spent Tk 30.05 million in conducting different CSR activities, he added.

The contribution of CSR activities to the growth of financial inclusion has strengthened and balanced the country's overall micro-economy, hepointed out.

In recent times, inflation came down to 7.03 per cent, forex reserve roared to US$ 17.6 billion and per capita income reached $ 1044, the governor said adding that the country's balance of payments was also in a very stable position right now.

Mercantile Bank Limited (MBL) organised the programme where some 174 students from various colleges and universities were awarded scholarship for their outstanding results.

Each of students received Tk 750 monthly basis for excellent results in JSC level, Tk 1000 monthly basis for brilliant results in SSC level and Tk 1500 monthly basis in HSC level.

MBL Managing Director M Ehsanul Haque said total 760 meritorious students will be awarded the scholarship from across the country. The bank will distribute the scholarships to district level students through nine branches of the bank.

MBL chairman M Amanullah presided over the programme.

News:The Financial Express/24-Nov-2013

Banks pay scale faces new hurdle

Asif Showkat Kallol

Although the prime minister has approved a new pay scale for Bangladesh Bank and four state-owned commercial banks three weeks before, implementation of it faces a fresh hurdle.

The government now finds no law under which a separate pay scale for the four state-owned banks could be materialised, said official sources.

In Bangladesh, the pay scales of any government offices are executed under the Services (Reorganisation and Conditions) Act, 1975.

But the state-owned commercial banks were made public limited companies in 2007 and remain outside the purview of the Services Act.

Finance Secretary was given the responsibility of ownership of those banks that include Sonali Bank, Janata Bank, Agrani Bank and Rupali Bank.

Rupali Bank has a 9% private ownership.

“There is no law for the pay-scale of the state-owned commercial banks. Finance Secretary has already been informed about it,” said a senior official at pay-scale implementation division at the finance ministry on Saturday.

Early this month, a government committee led by cabinet secretary Musharraf Hossain Bhuiyan had submitted a proposal on a separate pay scale for the banks.

The new pay scale was then approved by the prime minister with increase in the employees’ basic salaries.

Under the new 11-grade pay scale, which will replace the existing 20-grade pay structure, the basic salary for those in the lowest grade will be Tk6,000 and Tk55,000 for the highest grade.

After a meeting with cabinet division on 14th this month, finance minister AMA Muhith told the journalists that the government would issue an order on the new pay scale just the following week.

Meanwhile, Bangladesh Bank governor Dr Atiur Rahman described the PM’s approval to new pay scale as an achievement for the central bank and the state-run commercial banks.

The scale separated the banks’ pay scale from the national pay scale.

“After the government issues order in this regard, I will take matter to the central bank’s board,” said Dr Atiur Rahman.

News:Dhaka Tribune/24-Nov-2013

Race to be delisted as loan defaulters

Jebun Nesa Alo

The loan defaulters are making serious efforts to reschedule their accounts so they do not disqualify for participating in the upcoming general election, said Bangladesh Bank sources.

As per the amended Representation of the People Order (RPO), the aspirants of the parliamentary election require clearance of default loans and outstanding utility bills.

Meanwhile, Bangladesh Bank governor Dr Atiur Rahman recently instructed the Credit Information Bureau (CIB) of the central bank to prepare related data.

A senior official of CIB told Dhaka Tribune that they are “ready logistically to provide information on loan defaults by the announcement of election schedule.”

Bangladesh Bank has seen an increase in applications for loan rescheduling recently from both the state-owned and private commercial banks, said a central bank official.

“We are following regulation in approving applications,” he added.

The banks also utilised the chance of loan rescheduling before election to recover their classified loans by receiving down-payments.

“Defaulters can regularise their loans either for short time or long time if they want to take part in the election. It is a great chance for banks to recover classified loans,” said Nurul Amin, managing director of National Credit and Commerce Bank Ltd.

“It will help reduce burden of nonperforming loans in the balance sheet.”

He said they have received many applications for rescheduling big loans for past few days particularly from business people.

However, there were no such applications that used political influence, added Nurul Amin.

Echoing with the NCC Bank MD, Pubali Bank MD Helal Ahmed Chowdhury said: “Many politicians are negotiating with us to reschedule their loans.

But it’s a great opportunity for us to recover classified loans.”

According to a Bangladesh Bank circular, no default loan can be rescheduled more than three times.

The first time rescheduling is done on payment of at least 15% of overdue instalments or 10% of total default amount, whichever is lower.

In the second rescheduling, at least 30% of overdue or 20% of total default loan – whichever is lower – will have to be paid.

The third rescheduling requires payment of at least 50% of overdue instalment or 30% of the total default loan – whichever is lower.

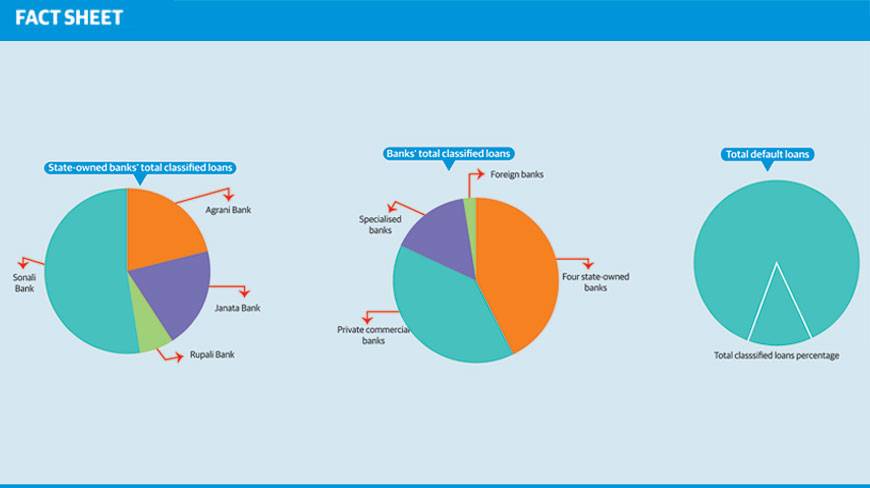

The classified loans rose 8% to Tk567bn in the July-September period quarter from Tk523bn of the previous three months, said Bangladesh Bank data.

The classified loans are about 13% of total default loans which amount to over Tk4tn.

Of the total classified loans, four state-owned banks have Tk241bn, private commercial banks Tk223bn, specialised banks Tk87bn and foreign banks Tk14bn.

Of the state-owned banks, Agrani Bank’s classified loan stood at Tk51bn, Janata Bank Tk47bn, Rupali Bank Tk16bn and Sonali Bank Tk125bn.

News:Dhaka Tribune/24-Nov-2013

New GB law shows nine directors the door

Nine female members of the Grameen Bank board have lost their posts as the parliamentary affairs ministry has published a gazette notification on the passage of the Grameen Bank Act 2013, which replaces the 1983 ordinance.

An official of the Grameen Bank said the bank would prepare for an election to the board after the Banking Division received the election rules from the ministry and in the meantime the three government members and chairman of the bank would operate the bank.

The election to the board has to be held within six months of receiving the election rules.

The law, justice and parliamentary affairs ministry on Tuesday issued the gazette notification on the new Grameen Bank law.

Tahsina Khatun, one of the nine female members of the Grameen Bank board, alleged that the government was removing them from the board “forcibly” through the new law.

“We were elected to the board of directors for up to 2015 but the government has done everything just to remove the poor women from the board,” she told the Dhaka Tribune. “It will be remembered in the history as an example of the government’s blunt intervention.”

Tahsina said the Grameen Bank board would not need the female directors as the chairman and three government-appointed members would fulfil the board’s quorum.

The Grameen Bank ordinance used to require the chairman and four members of the board to fulfil the quorum.

Parliament passed the much-talked-about Grameen Bank Act 2013 on November 5, elevating the government’s role in running the microcredit organisation without any increment of its ownership stakes. Finance Minister AMA Muhith last month said the nine “pro-Yunus” female directors of Grameen Bank would lose their positions once parliament approved the relevant bill.

News:Dhaka Tribune/21-Nov-2013

Demand for industrial loans drops amid political turmoil

Sajjadur Rahman

The disbursement of industrial term-loans continues to slide on the back of growing political unrest.

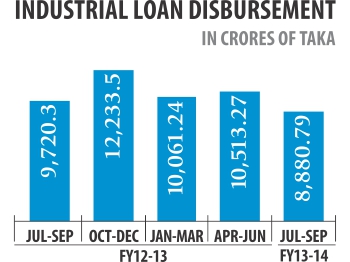

Between July and September, banks and non-bank financial institutions disbursed over Tk 8,880 crore of term loans, down 8.63 percent year-on-year and 15.53 percent from the previous quarter, according to data from Bangladesh Bank.

The disbursement of industrial term loans were Tk 10,061 crore and Tk 10,513 crore in the first and second quarters of the year respectively.

Industrial term loan includes disbursement of fresh credit, rescheduling of term loans and fund release for balancing, modernisation, rehabilitation and expansion of industrial units.

Bankers said uncertainty in the run-up to elections has acted as the biggest reason for the slowdown in industrial activities, but the tight BB policies and extra cautiousness by banks in the wake of rising fraudulence, has not helped matters either.

But Helal Ahmed Chowdhury, managing director of Pubali Bank, pointed out the recent trend of taking out low-cost loans from foreign sources and adjusting their term loans domestically, as the reason for the banks’ falling disbursement of industrial term loans.

The rising non-performing loans, of nearly 13 percent, have also squeezed many banks’ hands, he added.

“Borrowers and bankers, both are cautious as it is an election year,” said Nurul Amin, managing director of NCC Bank.

The accompanying political turmoil, together with the existing constraints of poor infrastructure and scarcity gas and electricity, has made business conditions “very tough”, he added.

The development, however, does not bode well for the country’s economy, as the industrial sector has been vital in sustaining the steady economic growth over the past one decade.

The sector’s contribution to gross domestic product (GDP) stood at 32 percent in fiscal 2012-13, in contrast to 26 percent in fiscal 2000-01 and 21 percent in fiscal 1990-91.

News:The Daily Star/22-Nov-2013