Bangladesh Bank

BB to tighten monetary policy

Bangladesh Bank will announce its monetary policy today for the second half of the current fiscal year with a further tightening approach.

A high official of the central bank said the main target of the policy will be to achieve the targeted GDP (gross domestic product) growth and contain high inflation.

This time, the monetary policy will also reflect the recommendations of the International Monetary Fund (IMF) as Bangladesh is going to enter the credit programme of the donor agency after about a decade.

However, another BB official said the policy the central bank took at the beginning of the fiscal year will continue.

Non-food inflation crossed double digits in the recent years and outpaced food inflation for the first time in December.

The BB officials said one of the main targets of the central bank will be to contain non-food inflation.

Point-to-point inflation has been rising at a double-digit rate for a consecutive nine months since March last year.

Such a rare incident was last seen at the beginning of 1980s when inflation grew at a double-digit rate for a long time.

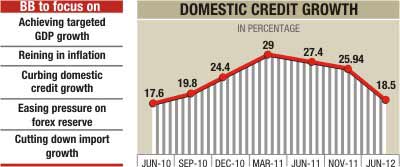

The central bank may also set a target to bring down domestic credit growth below 19 percent by June this year to rein in inflation.

In the first monetary policy of the current fiscal year announced in July the target was 20 percent.

The central bank officials said, to meet the target both public sector and private sector credit growth has to be brought down. However, cutting down public sector credit growth will be a big challenge, they said.

The target for private sector credit growth may be set at 13-15 percent by June next which was 18 percent in the first monetary policy.

The rate of private sector credit growth already came down to 19.33 percent in November 2011 from around 28 percent last fiscal year.

The BB has already taken several steps to contain credit growth. The moves include increasing repo rate and lifting the lending cap. The repo rate may be raised further by June.

To cut loan growth in the unproductive sector, consumers' and housing credit's equity portion of the total amount has been hiked by the central bank recently.

Another target of the monetary policy is to ease pressure on the foreign currency reserve and exchange rate by cutting down import growth.

On January 18 foreign currency reserve was $9.04 billion, down from $10.91 billion on June 30 last year.

The amount of the country's present reserve is equal to 2.87 months' import bill. But according to international standard, keeping the foreign currency reserve equal to a country's three months' import bill is considered as a safe limit.

An IMF report last month said a comprehensive package of macro-policy tightening measures and financial sector restraints is needed to stabilise the economy and avert a near-term balance of payments crisis.

The rapid loss of the central bank reserves over the past few months is expected to continue beyond fiscal 2012 and makes clear that the current policies are unsustainable, with a coordinated policy response essential to restoring macro-economic stability, the report said.

The Daily Star/Bangladesh/ 26th Jan 2012

50pc bank loan for car ends

Gone are the days when you could buy a car paying half the price and the bank loaning you the rest of the money. A Bangladesh Bank decision on Sunday reined in consumer loans such as car loans in the unproductive sector.

A circular issued by the central bank said the margin ratio for car loans and all other unproductive loans had been raised to 30:70, which means 70 per cent of the expense must be borne by the consumer and bank loans will only provide for the remaining 30 per cent.

The margin to loan ratio was 50:50 before this decision. This means consumers can only take loans for cars and other consumer goods if they can pay for 70 per cent of it out of their own pockets.

The ratio in housing finance loans on the other hand have been changed to 70:30 from 80:20, which is a smaller change of proportions.

The circular entailing the measures, signed by central bank’s Banking Regulation and Policy Department head K M Abdul Wadud, took effect immediately.

The Daily Independent/Bangladesh/ 24th Jan 2012

BB to announce new monetary policy on Thursday

Bangladesh Bank (BB) on Thursday will announce its half-yearly monetary policy statement for the remaining six months of the current 2011-12 financial year.

BB Governor Dr Atiur Rahman will announce the policy at a press conference at the central bank’s headquarters in the capital city, official sources said.

Meanwhile, speculations have gone high among bankers, businessmen and share investors that the ensuing monetary policy would be more contractionary to slash unnecessary spending in both public and private sectors.

Earlier, economists and experts suggested the central bank to be more cautious in preparing the monetary policy as it would continuously be dealing with some challenging issues such as escalating inflation, depreciation of Taka and ensuring credit flow to productive sector against rising public borrowing.

They said the next monetary policy warrants some assertive steps by the BB to help the government keep inflation and borrowing within the budget limits of 6.7 percent and 5 percent respectively with achieving 7 percent economic growth.

The Daily Sun/Bangladesh/ 24th Jan 2012

1New deputy governors for BB Nazneen Sultana becomes the first woman for the post

Bangladesh Bank yesterday announced appointments of three deputy governors, with Nazneen Sultana becoming the first woman to hold the post in the history of the central bank.

Abu Hena Mohd Razee Hassan and Shitangshu Kumar Sur Chowdhury are the two other deputy governors, the central bank said in a statement.

Prior to the contractual appointment for a three-year term, they were the executive directors of BB.

The appointment of Sultana shows consistence with its new gender policy, BB said.

The new officials along with two senior advisers and the most senior deputy governor, Md Abul Quasem, will form the governor's senior management team.

Nazrul Huda, Ziaul Hassan Siddiqui and Murshid Kuli were the previous deputy governors who completed their tenures in December.

The Daily Star/Bangladesh/ 24th Jan 2012

Banks allowed to hire agents

Bangladesh Bank (BB) will allow commercial banks to serve clients through agents, apart from their own employees. A BB circular Wednesday, however, says that in case the banks choose to offer door-to-door service to their clients, they would have to bear the risks.

Source: The Independent/ Bangladesh/ 1st Dec 2011