Bangladesh Bank

BB launches online library, e-news clipping software

Bangladesh Bank (BB) is going to launch online library and e-news clipping software today.

BB Governor Dr Atiur Rahman will formally inaugurate the modernisation work at the BB conference room at about 11:00 am.

Data on BB, banking sector and socio-economic situation of the country will be available on both the sites.

Central bank officials will be able to log-in to both the sites by using network ID and password in the Bangladesh Bank’s website.

IT operations and Communication Departm- ent of BB has been working to develop the online library and e-news clipping management software. BB sources said presently there are 189 books, 115 Journals, 477 articles and information on 33,682 books in the online library.

The Daily Sun/ Bangladesh/ 13th May 2012

NBFIs call BB move to ease forex rules 'big step'

Non-banking financial institutions (NBFIs) have welcomed the central bank move of relaxing foreign exchange regulations which would allow them providing term loans in local currency to foreign companies through authorised dealer (AD) banks.

"This is a great step taken by the Bangladesh Bank and it will widen our business further," chairman of Bangladesh Leasing and Finance Companies Association (BLFCA) Asad Khan told the FE Monday.

The new arrangements will help create an opportunity for the NBFIs to invest funds in foreign-owned companies.

"We have long been appealing to the bank regulator to withdraw all restrictions in investing our money in foreign companies," BLFCA chairman said.

So long AD banks were allowed to offer such loans to the foreign-owned companies after complying with the conditions set by the BB.

Asad Khan also said that he is confused regarding the Bangladesh Bank circular whether it is applied to fully-owned or partly-owned companies as NBFIs have already been financing in partly-owned entities since they started business in the country.

Under the conditions, the term loans in Bangladesh Taka (BDT) should not exceed, as percentage of total term borrowings, the percentage of equity of the firms/companies held by Bangladesh nationals and firms/companies, not owned or controlled by foreigners.

Besides, the total debt liabilities of the firms/companies must not also exceed the 50:50 debt equity ratio.

Terming it a good sign, Mofizuddin Sarkar, Managing Director of Bangladesh Finance Investment Company Ltd., said it seems that government wants that foreign companies have more involvement in the country.

Normally the foreign-owned companies do borrow funds in the term loans from external sources, he said, adding that the companies are also allowed to receive such loans in BDT from local banks, subject to compliance with specific regulations.

He said the move will certainly boost NBFIs business and help to come out from liquidity shortage-hit non-bankers.

Currently, 31 NBFIs are operating in Bangladesh.

According to the central bank circular, AD banks are also to ensure that the companies follow all provisions, in line with the existing guidelines for foreign exchange transactions (GFET) for the whole amount of financing.

"As per new rules, if the loan is in foreign exchange then transaction has to be under foreign exchange transaction guidelines," he added.

Financial Express/Bangladesh/ 8th May 2012

IMF raises questions on some provisions of BCA

The International Monetary Fund (IMF) has expressed its reservations over a number of provisions, including those relating to acquisition of problem banks and the tenure of bank directors that were incorporated in the proposed Bank Company Act (BCA)-2012, official sources said.

Besides, the multilateral capital donor has also raised questions on the proposed regulation about maintenance of capital adequacy and suggested that the authorities concerned should specify appropriate and relevant criteria for directors and officials of banks and also for establishing new banks.

The observations of the IMF, along with its specific proposals, have recently been submitted to the Bangladesh Bank (BB), the relevant sources added.

The IMF said any acquisition of problem banks, if necessary under certain circumstances, should be made by the BB, instead of the government which was proposed in the BCA.

'Section 58(b) gives the government the decision-making authority, instead of the BB. Also the government may acquire the banking company or one or more of its branches or its undertakings; any intervention\resolution should be considered on a least-cost-to-the-government basis and this section appears to disregard a market-based solution to problem banks," reads the observation of the IMF.

However, top BB officials said, taking lessons from the global financial crisis in 2008, the involvement of the government should be preferred when acquisition of any bank becomes inevitable.

About the tenure of bank directors, the IMF has suggested for two consecutive terms for a director, each spanning for a period of three years.

According to the proposed amendment, the maximum tenure of a bank director has been fixed at three years. The provision, however, will not be applicable to the managing directors of banks, who are also ex-officio bank directors.

The current provision under the BCA, 1991 allows bank directors to serve up to six years in two consecutive terms.

The BB officials concerned said the final decision on this specific issue would be taken later, taking the suggestion of the IMF into consideration.

They, however, said the IMF has endorsed the proposal for restricting the number of directors of a bank company up to a maximum of 13 and also for abolishing the provision for having independent directors in the boards of banks.

The Bangladesh Bank (BB) has recently prepared the draft of the amended act and submitted the same to the Ministry of Finance (MoF) for completion of all the necessary formalities.

Officials in the MoF said a high-powered committee, headed by former Secretary, Mr Abdul Mubin, has been formed to scrutinise the proposed amendments. Upon the completion of this examination, the amendment would be placed before the cabinet and then before the parliament for its approval.

In its suggestions, the IMF said the proposed two-year grace period for fulfilling the requirement for the minimum level of capital should be shortened.

'The minimum capital requirement provides the minimum amount of capital to ensure depositors' confidence and a bank's credibility, irrespective of the amount of a bank's deposits and risk assets,' reads the suggestion of the IMF.

The multilateral body, in its note, said additional criteria are needed in the amendment of BCA (2012) for the licensing of new banks, the sources said.

The BB officials concerned, talking about this particular issue, said the BB has a separate guideline about it.

"It is not essential to enumerate every single detail in the statute," a top BB official told the FE.

Financial Express/Bangladesh/ 8th May 2012

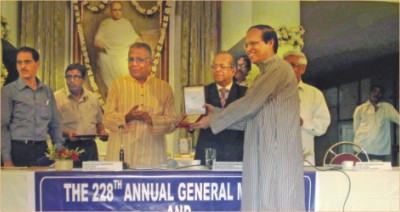

Atiur receives Indira Gandhi Gold Plaque

Atiur Rahman, central bank governor, receives the Indira Gandhi Gold Plaque at a ceremony in Kolkata yesterday.

Atiur Rahman, central bank governor, receives the Indira Gandhi Gold Plaque at a ceremony in Kolkata yesterday.

Bangladesh Bank Governor Atiur Rahman has received the prestigious Indira Gandhi Gold Plaque 2011 at a ceremony in Kolkata, the central bank said in a statement yesterday.

The award was in recognition of his contribution to international cooperation towards human progress.

Justice Asok Kumar Ganguly, the chairperson of West Bengal Human Rights Commission, presented the award at the 228th annual general meeting of The Asiatic Society at the society's Vidyasagar Hall.

“I accept with deep gratitude and utter humility the Indira Gandhi Gold Plaque for 2011 awarded to me by the Asiatic Society in appreciation of my humble efforts towards advancement of human progress through international cooperation,” Rahman said.

“It is a deeply moving experience to see my name added to the elite company of the very distinguished luminaries awarded with this Gold Plaque in the preceding years,” Rahman said in his speech.

“Of further significance to me is that the award bears the name of late Indira Gandhi,” he said.

“Indira Gandhi was instrumental in helping hasten victory in Bangladesh's 1971 liberation war by letting Indian soldiers shed their blood side by side with our valiant freedom fighters.”

“I take this opportunity to pay homage to her soul.”

“Far more than a personal reward and recognition, I see this prestigious award as a recognition and reaffirmation of our high priority for human progress through poverty eradication and social empowerment of the disadvantaged groups in our communities, opening up advancement opportunities equitably for all.”

“I have consistently been driven by a strong urge of deepening civil society activism for human welfare through people-to-people contact and cooperation.”

“In my current assignment as central bank governor, as also in my earlier roles as commercial bank board member/chairman, I have persistently acted to steer traditional urban elite based banking away towards broader, deeper financial inclusion of the underserved poor,” Rahman added.

Prof Pallab Sengupta, president of Asiatic Society, and Prof Mihir Kumar Chakrabarti, general secretary, were also present.

The award was introduced in 1985. The award's past recipients include ex-Swedish premier Olof Palme (1985), Dr DS Kothari (1986), Nobel Laureates Mother Teresa (1987), ex -Secretary General of the United Nations Dr Javier Perez de Cuellar (1988), Dr Nelson Mandela (1989), Rev Desmond Tutu (1990), Aruna Asaf Ali (1992), Yasser Arafat (1993), Prof Amartya Sen (1994) and Aung San Suu Kyi (1995).

The Daily Star/Bangladesh/ 8th May 2012

Bangladesh Bank fears coin crisis as procurement tender cancelled

Bangladesh Bank has feared crisis in the supply of one and two taka worth coins in the next two years as tender for coins’ procurement is canceled after six companies complained about a condition which asks to ensure that there is no health hazards with the coins.

Bangladesh Bank, the country’s currency issuing authority, already sent a new proposal to finance division of the government for a fresh tender. “Finance Division is now scrutinising the Bangladesh Bank’s proposal to cancel tender process after the companies complained about the condition of removing coins’ health hazards,” said a senior official of the banking division on Thursday last week.

The central bank estimates that 2 billion pieces of coins will be required till December 2013 as most of the paper notes have torn out in the past five years since 2007.

The official sources said different companies from Japan, France, Canada, the UK, Netherlands and Salvia raised complaint against a condition which wants avoiding of possible health hazards of the coins.

The central bank wanted DNA tests of DIN 1013-3 and DIN 1061 which are believed to be necessary for metal coins to make sure that the users are secured from all health risks the coins may carry. The central bank didn’t take the health issues of the coins seriously before this time and so carried out no DNA tests.

Banking Division sources said they have already started scrutiny of the Bangladesh Bank’s re-tender proposal which now excludes the condition of DIN Test and Health Guard Coin.

In its proposal, the central bank said that it is not possible to float a fresh tender by end the current fiscal which ends in just next month. It said 2 billion metal coins cannot be procured in this short period of time.

Bangladesh Bank, therefore, has requested the finance division to go for re-tender in the next fiscal.

The central bank also wants a re-allocation of Tk 1.2 billion in the next fiscal’s budget. The cost of procurement of two types of coins is estimated at Tk 1.4 billion.

Chairman of Bangladesh Krishi Bank Khondkar Ibrahim Khaled on Sunday told daily sun that the amount of money involved with one and two taka notes are very small for the country’s money market. “So, I don’t see any major setback will be brought by the coin crisis for the country’s inflation rate situation,” he said. Ibrahim Khaled, however, said that the traders and the consumers might face problems due to crisis of one and two taka coins as the paper notes of these values tore in the last five years.

The government procured 300 million pieces of two taka metal coins in 2010, 180 million pieces in 2008 and 200 million in 2004.

It also procured 500 million pieces of metal coins in 2009 and 400 million in 2003. Earlier, the government procured 265.75 million pieces of two taka paper notes in 2010, 106.40 million in 2009 and 272.80 million in 2007. e portrait of the Father of the Nation Bangabandhu Sheikh Mujibur Rahman will be printed on the proposed one and two taka worth coins.

The Daily Sun/Bangladesh/ 7th May 2012