Bangladesh Bank

Second tranche of IMF loan faces uncertainty

The second installment of IMF credit hangs in the balance as the government will not be able to meet the condition of demutualising bourses by December this year.

According to the government roadmap, the two stock exchanges of the country will be demutualised by June next year.

The global lender has provided Bangladesh with Extended Credit Facility (ECF) fund in a bid to help the country keep its foreign currency reserve stable and introduce financial reforms.

A Banking Division official Saturday said: “We have failed to reach a consensus on demutualisation of two bourses with the visiting IMF officials, as it is set for June 2013 as per road map.”

International Monetary Fund (IMF) approved $987 million ECF on some conditions including the demutualisation of Dhaka and Chittagong stock exchanges by December 2012.

In the second tranche, IMF is supposed to release $141 million.

A Bangladesh Bank official, however, said the government has already met all but four conditions which will also be “addressed shortly”.

“The government could be able to convince IMF about the matter,” he hoped.

The official also expressed his confidence that the second installment of ECF will be available once the IMF approves the loan at its board meeting to be held on 27 and 28 this month.

IMF team is now in Dhaka to see whether the condition of fuel price adjustment has been met. It will leave the city on Thursday.

Besides, another IMF team related with first tranche is set to arrive in Dhaka on Wednesday and stay till 26th of this month. During the visit, it will examine the fulfilling of 16 conditions.

A top official of the banking division said they were able to convince the visiting IMF officials about the deadline of submitting the amended Banking Companies Act to parliament.

“The amended Banking Companies Act and VAT Act will be passed at the current parliament session”, he added.

Earlier, the government agreed to increase fuel oil prices anytime soon to meet a condition tagged by the IMF to release the second tranche of ECF to Bangladesh. Fuel prices will be raised as per automatic price adjustment process as per the conditions.

The IMF approved loan for Bangladesh under its ECF scheme to help the country overcome its macroeconomic pressure.

Then, the government immediately received first tranche amounting to $141 million in April this year. The rest of the money will be given in six equal installments upon showing solid progress in fulfilling the prescribed reform measures.

News: The Daily Sun/Bangladesh/09-Sep-12

Dr. Atiur Rahman, Governor of Bangladesh Bank hands over the ‘Acknowledgement certificate’

Dr. Atiur Rahman, Governor of Bangladesh Bank hands over the ‘Acknowledgement certificate’ and crest to Md. Shafiul Azam, Vice President and Manager of Jessore branch of Islami Bank Bangladesh Limited for its grand success in highest disbursement of agriculture loans in Jessore area.

Dr. Atiur Rahman, Governor of Bangladesh Bank hands over the ‘Acknowledgement certificate’ and crest to Md. Shafiul Azam, Vice President and Manager of Jessore branch of Islami Bank Bangladesh Limited for its grand success in highest disbursement of agriculture loans in Jessore area.

News: The Daily Sun/Bangladesh/06-Sep-12

MCCI condemns Sonali Bank scam

The Metropolitan Chamber of Commerce and Industry yesterday condemned the complete disregard for banking regulations that led to a large-scale scam involving Sonali Bank Ltd and its customer Hall-Mark Group.

"The loan scam of Sonali Bank, the largest of the country's state-owned banks, has come as a rude shock to us," MCCI said.

Dishonesty of bankers and lax management of banks that resulted in the global financial crisis of 2008-2009, shutting down many banks in the developed world, should have been a lesson for Bangladesh Banks, MCCI said.

"The business community is deeply concerned at the disclosure that a single branch of Sonali Bank extended unauthorised loans worth Tk 36.06 billion to five business houses in total disregard of the banking sector rules and regulations.”

“Of this amount, Tk 26.68 billion was lent to a single borrower.”

Blaming weak governance and non-prudent supervisory mechanism of the Bank for such long-term irregularities, MCCI expressed concerns over the inefficiency of regulatory bodies responsible for monitoring the activities of the Bank and the banking sector.

“We also wonder how, despite the information of irregularities reportedly supplied by its internal auditors to the branch management and subsequent warnings of Bangladesh Bank, such big amounts could be unlawfully lent by the Bank branch without being noticed by the higher administration and the board of directors of the Bank,” it said.

The chamber expressed happiness with the parliamentary standing committee on the finance ministry that set up a panel to look into the loan scam and appreciated steps taken by the Bangladesh Bank and Anti-Corruption Commission.

MCCI backs complete independence of the central bank to properly play its regulatory role in the banking sector.

The chamber appreciated the encouragement the finance minister's gave to the business community by saying that the Sonali Bank scam will not have an adverse effect on the banking sector.

MCCI urged the government to unearth and punish the irregularities of the Bank officials and some vested quarters of the business community, recover the scammed amount from defaulters, and enforce transparent and efficient governance of banks to prevent any such scandal in future.

News: The Daily Star/Bangladesh/06-Sep-12

Monetary policy's prime target: growth or inflation?

While monetary policy is regarded as the most important economic guideline in developed countries, it is treated as a complementary promise to fiscal policy in most developing countries. In Bangladesh, the scenario is even worse. Here the finance minister, as a fiscal-policy leader, dictates explicitly what Bangladesh's monetary policy should be -- exhibiting the total absence of monetary-policy independence.

While monetary policy is regarded as the most important economic guideline in developed countries, it is treated as a complementary promise to fiscal policy in most developing countries. In Bangladesh, the scenario is even worse. Here the finance minister, as a fiscal-policy leader, dictates explicitly what Bangladesh's monetary policy should be -- exhibiting the total absence of monetary-policy independence.

Bangladesh Bank, as the central bank of the country, announced its monetary policy in July this year as it does every year. Interestingly, the central bank's restrained stance on monetary policy this July was no surprise, because the finance minister had clearly signalled the stance of the upcoming monetary-policy in his budget speech that was made public in June. The finance minister explicitly declared that the upcoming monetary policy will be 'restrained,' making the monetary-policy statement simply a 'compliance report' by the central bank. While the influence of the government on the central bank is well known, particularly in developing countries, this type of predetermination lacks respect to the monetary authority, and is never seen in neighbouring countries such as India and Pakistan.

Given the coverage of its operation, the central bank is the most powerful economic institution even in a developing country like Bangladesh. For example, the amount of banking-sector loans is almost 52 percent of total national output, whereas the fiscal budget covers only 18 percent of national income. Of course, that 18 percent is very crucial to mobilising outstanding loans of 62 billion dollars, but it must not be ignored that the central bank plays a gigantic role in growth by involving the largest segment of national workforce of the economy. As the monetary-policy statement of 2012-2013 asserts, the two main objectives of the central bank include controlling inflation and fostering economic growth. This dual mandate of Bangladesh Bank becomes hard to accomplish when the finance ministry targets high growth but low inflation. High growth is often inflationary and high inflation is always detrimental to growth. In the last fiscal year, Bangladesh had achieved economic growth of 6.4 percent, while inflation was slightly above 10 percent. For the fiscal 2012-2013, the government aims at achieving growth of 7.2 percent but targets inflation at 7.5 percent, making the task of the central bank tougher than before. Since moderate inflation is the prime goal of any monetary policy, Bangladesh Bank is left with no option but to adopt a restrained monetary policy that limits broad-money growth to 16 percent and reserves money growth to 14.5 percent for fiscal 2013.

The government's excessive influence on the central bank is a sign of authoritarian economic management that contradicts public policy on deregulation and the market economy. We have a bad tradition of seeing the central bank as an accommodating institution to fiscal desperation that usually originates from short-term political priorities. That is why money supply grows so fast in Bangladesh and hence inflation hovers over the double-digits. This tradition must be changed. The central bank must be empowered with greater monetary policy independence to bridle inflation and ensure macro-stability to eventually stimulate growth.

If money-velocity growth is assumed to be constant and economic growth turns out to be 7 percent, money growth of 16 percent will bring inflation down to around 9 percent, which is still above the targeted inflation of 7.5 percent. Hence, money supply must be more conservative than it is now, but that stance may reduce the growth of private credit, which again will lower economic growth. Thus, Bangladesh Bank is forced to operate in a difficult zone when inflation is already of double digits.

The scenario becomes even worse when the government spells out a long-term inflation rate of 5 percent in the budget speech of 2012-2013. We are not sure where this magic number of 5 percent comes from, but we are sure that the government wants moderately low inflation for the long run to make economic growth sustainable. If that is the case, Bangladesh Bank must continue its conservative stance on money growth until inflation drops down to 5 percent. Neither reserve-money growth of 14.5 percent nor broad-money growth of 16 percent looks conducive to long-term inflation of 5 percent. Money growth should fall below 15 percent in a gradual fashion, and that might temporarily lower output growth.

We have to accept this tradeoff to make Bangladesh Bank function as per long run goals of macro-stability and sustainable growth. Then monetary policy surely requires independence. Various studies show that a higher degree of monetary-policy independence is associated with a lower inflation across the globe. The government's expectations on Bangladesh Bank are too high to accomplish. It wants that the central bank will kill two birds with one stone every time. If low inflation is a priority, as it should be the case for the sake of sustainable growth, the government has to compromise on ambitious growth targets at least in the short run.

Inflation tormented the global economy over the 1970s. Paul Volcker, the Federal Reserve chair, realised that controlling inflation must be the first priority for a central banker. He tightened money supply to an extreme point even knowing that it will lower output growth. America experienced its first manmade recession in history in the early 1980s, but the scenario eventually took a positive turn. Not only did inflation come under control, but the US economy also entered the long boom for 17 years until the end of the 1990s.

Volcker was able to accomplish his goals in a sequential fashion because he could work independently. He shot one bird at a time without any concession to inflation. Time has come for our central bank to act first on inflation in the similar fashion. Are we ready to make our governor accountable directly to people and parliament, rather than compliant to the fiscal desperation? The central bank, the main anchor of the economy, must work independently to ensure macro-stability and respectable growth in an emerging economy.

The writer is an associate professor of economics at the State University of New York at Cortland. He can be reached at [email protected].

News: The Daily Star/Bangladesh/06-Sep-12

Remittance grows 6pc year-on-year in Aug

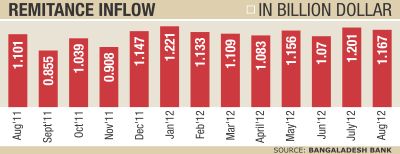

The month of August saw non-resident Bangladeshis send $1.167 billion in remittance, down by 2.84 percent from July's receipts of $1.201 billion, the central bank said yesterday.

The month of August saw non-resident Bangladeshis send $1.167 billion in remittance, down by 2.84 percent from July's receipts of $1.201 billion, the central bank said yesterday.

The figure, however, is 6 percent higher than the $1.102 billion recorded for August 2011.

This is the ninth consecutive month that Bangladesh has received over one billion dollar in remittance.

The remittance in the first two months of 2012-13 rose by 11.9 percent over the same period a year ago.

Bangladesh's more than 7 million migrant workers sent home $12.84 billion in fiscal 2011-12, 10.32 percent higher than the previous fiscal year.

Along with the rebound in garment exports, the healthy flow of remittance has boosted the country's foreign exchange reserves. The reserves, which rose for the third month in a row in August, as of yesterday, stood at $11.44 billion.

August's remittance was the third highest recorded since January, as migrant workers sent more money to their relatives on the occasion of Eid-ul-Fitr.

News: The Daily Star/Bangladesh/04-Sep-12