Bangladesh Bank

BB to supply 180 fake note detecting machines to cattle markets

The Bangladesh Bank (BB) will Supply 180 machines to different cattle markets in the capital to detect counterfeit notes on the occasion of the Erid-Ul-Azha, said an official release of the central bank.

To this goal, the BB has provided 80 machines to the Dhaka Metropolitan Police (DMP) and another 25 to the Border Guard Bangladesh (BGB).

Besides, the other branches of the Bangladesh Bank have provided another 75 fake note detecting machines to the law enforcing agencies in their respective areas.

Earlier, the BB has provided adequate number of fake note detecting machines to the law enforcing agencies, said an official of the BB Sunday.

Moreover, the other scheduled banks also will install booths at the cattle markets across the country where the experienced cashiers of these banks will provide service through checking the counterfeit notes with the help of these machines and it will continue till the last day of the cattle trading.

News: The Daily Sun/Bangladesh/22th-Oct-12

Banks asked to ensure cash at ATM booths during festival days

Bangladesh Bank (BB) authority Sunday asked banks to ensure uninterrupted supply of cash at ATM (Automated Trailer Machine) booths for clients during the Durga Puja and Eid-ul-Azha festivals.

Payment Systems Department (PSD) of the central bank issued a circular to this effect in the wake of complaints that banks are not caring enough to provide cash service through ATM booths during festival holidays. As a result, clients suffer due to shortage of cash which disappoints them.

“BB directive is aimed to make cash available at ATM booths near shopping malls and cattle markets to meet growing demand for funds,” said an official of the central bank, wishing not to be named.

The official said the number of ATM card users increased significantly in the country as banks have been luring clients by offering a lot of benefits.

“Often there are complaints during the festival holidays that either ATM booths are not functioning properly or there is no cash,” he said.

News: The Daily Sun/Bangladesh/22th-Oct-12

Checking Unauthorised AccessBB asks FIs to ensure signatures of CEOs on financial statements

In order to prevent unauthorised correspondence, Bangladesh Bank has directed chief executive officers (CEOs) of all financial institutions (FIs) to put respective signatures on financial statements or regulatory documents that need to be sent to the central bank authority.

A circular issued by the BB authority Sunday said the signatories of FIs authorised by respective CEOs is also acceptable on their periodic statements.

In both the cases, the FIs will need to send sample of signatures of the CEOs or authorised officials to the central bank’s Financial Institution and Market Department for verification.

A BB official said this would prevent unauthorised access to the core matters of financial sector regulations.

The official said any unauthorised access to the regulatory affairs may lead to devastation in respect to financial security.

News: The Daily Sun/Bangladesh/22th-Oct-12

When will regulators act like regulators?

The headline of a front-page story in the October 02, 2012 issue of the Financial Express was, "Banks' stock market exposure set at 40pc, BB denied control over SCBs." The news basically says that in the proposed amendments of Bank Company Act (BCA), 1991, the maximum limit of a bank's exposure to the capital market has been set to 40 per cent of the total paid-up capital of a bank. The existing exposure limit of a bank is 10 per cent of its total liabilities as stipulated in the existing BCA (amended), 2003. On October 03, 2012, other leading newspapers also carried news on this subject and said that this decision would benefit the stock market in Bangladesh as banks will be able to invest more once the amendment comes into effect. All those news and the aftermath pointed out two facts: one, market is smart and the other, there is severe regulatory failure.

The headline of a front-page story in the October 02, 2012 issue of the Financial Express was, "Banks' stock market exposure set at 40pc, BB denied control over SCBs." The news basically says that in the proposed amendments of Bank Company Act (BCA), 1991, the maximum limit of a bank's exposure to the capital market has been set to 40 per cent of the total paid-up capital of a bank. The existing exposure limit of a bank is 10 per cent of its total liabilities as stipulated in the existing BCA (amended), 2003. On October 03, 2012, other leading newspapers also carried news on this subject and said that this decision would benefit the stock market in Bangladesh as banks will be able to invest more once the amendment comes into effect. All those news and the aftermath pointed out two facts: one, market is smart and the other, there is severe regulatory failure.

The proposed amendment, available on the Bangladesh Bank's website, says that banks will be able to invest in the stock market 40 per cent sum of their total paid-up capital, share premium and statutory reserve - not only paid-up capital. All these three components, total paid-up capital, share premium and statutory reserve, are subset of total equity on the balance sheet. Total equity component of a bank can include many other items beyond those three elements. Many times, banks' statutory reserve could be higher than paid-up capital. Share premium could be zero to any amount.

It is not correct to say that setting banks' stock market exposure at 40 per cent in the proposed amendment will increase banks' investment in the stock market. And of course, data doesn't support that kind of conclusion. Because of the nature of its business, bank's total liability is much higher than its paid-up capital or even total equity. To make our analysis easier and consistent across the board, let's make an assumption that in the amendments of Bank Company Act, banks are allowed to invest 40 per cent of their "total equity" instead of only paid-up capital, share premium and statutory reserve. Generally speaking, sum of paid-up capital, share premium and statutory reserve is lower than total equity of a listed Bank. As already has been mentioned, the paid-up capital, share premium and statutory reserve are elements of total equity component on the balance sheet.

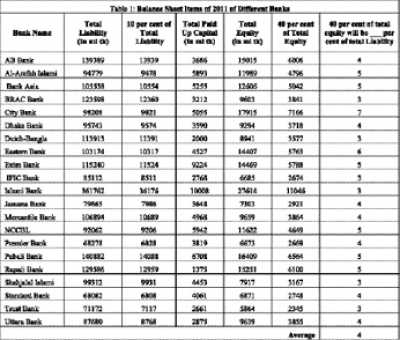

This article is based on my study of balance sheets of 21 listed Bangladeshi banks in 2011. (See the Table). For nine out of 21 banks, 21, 10 per cent of the total liability is even greater than total equity. For all the sample banks, 10 per cent of total liability is more than double when compared with 40 per cent of the total equity. On Average, 40 per cent of total equity looks like 4 per cent of total liability. Thus, in the proposed amendment, the ability of banks to invest in the stock market is actually reduced, on average, by more than 60 per cent when compared with existing exposure limit, i.e., 10 per cent of the total liabilities. So, if proposed amendment comes into effect, it will actually demand banks to reduce their investment in the stock market substantially.

Market also responded immediately to the newspaper reports on the proposed amendment of the Bank Company Act. On October 02, DSE (Dhaka Stock Exchange) General Index (DGEN) increased 2.55 per cent or 117 points. Out of 2.55 per cent increase in DGEN Index, banking sector alone represented 1.31 per cent or 60 points. However, the market is smart. The market found the loopholes in the newspaper reports and quickly adjusted as necessary which was reflected in the subsequent market returns. After the October 02 market rise, stock market declined for the next four consecutive business days.

Unfortunately, the whole situation is also an example of regulatory failure. None of the regulatory organisations, such as, the Bangladesh Bank, Securities and Exchange Commission (SEC) and the Dhaka Stock Exchange (DSE), came up with proper explanation of the proposed amendments in the Bank Company Act (BCA), and ultimately general investors had to pay the price. It takes years to instill confidence among investors but needs just a second to destroy it. The incident actually raised serious doubt on SEC's effort to control rumour and manipulation in the stock market. When will the regulators actually act like regulator?

The writer is a Faculty, School of Business, Independent University, Bangladesh (IUB).

mainul188@gmail.com

News: The Daily Financial Express/Bangladesh/21th-Oct-12

Banks continue to defy BB directive on spread

The average spread between lending and deposit rates of banks crossed 5.50 per cent despite the central bank's directive to bring down the gap to the level below 5.0 per cent, said sources with the Bangladesh Bank (BB).

Twenty-nine banks are not complying with the directive of the central bank on cutting the spread between interest rates. The spread between lending and deposit rates of the banks is more than 5.0 per cent, the latest data available with the BB shows.

Of them, six banks have the spread above 7.0 per cent and three banks between 9.0 and 12.44 per cent, according to data available with the central bank.

The lending rate means the interest rate a bank charges on a loan and the deposit rate means the interest rate it offers to a client on a deposit.

In August alone the banks' average spread stood at 5.56 per cent against 5.47 per cent in July last, as per the BB data.

The banks' average lending rate in August was 13.90 per cent against 13.77 in the previous month.

On the other hand, the deposit rate increased to 8.34 per cent in August, up from 8.30 per cent in July, the data shows.

The spread increased due to raising the lending rates by banks, BB sources said.

Most depositors are of the view that the banks make profit at their cost as the banks gain from the high spread.

In a meeting of bankers last month, all banks were told to comply with the BB directive on cutting the spread to the level below 5.0 per cent.

Chief executives of all banks attended the meeting, presided over by BB Governor Dr Atiur Rahman.

In that meeting, the BB placed a report on the rates of interest on credit and deposit for the month of July last.

The report said the upper cap on the rate of interest on credit was withdrawn earlier. It resulted in an upward trend in the rate of interest on both credit and deposit.

A central bank official said an unhealthy competition was going on among the banks in mobilising deposits. So they were offering higher interest rates on deposits, and as a result the rate of interest on credit was also going up.

The BB official said the spread in the private and foreign banks was much higher than that in other banks.

A bank was fined under the Banking Company Act for offering a higher interest rate than its official rate, said the report.

The BB report also said the credit flow to the small and medium enterprise (SME) sector was drying up due to the higher rates of interest.

A high official at a first generation private bank blamed some weak banks for ruing the healthy competition in the banking sector.

These banks resort to various ill practices to attract depositors, the official said, requesting not to be named. "As a result, other banks have to increase their rate of interest as well."

Another official at a private bank said if the rate of interest on deposit could be kept low, the rate of interest on credit would have also remained low and, resulting in the decline in spread.

He said the central bank should strengthen monitoring so that the banks do not go for any unhealthy competition.

News: The Daily Financial Express/Bangladesh/21th-Oct-12