State banks slow to go online

The government banks are lagging behind private and foreign banks in introducing online banking for customers, Bangladesh Bank data shows.

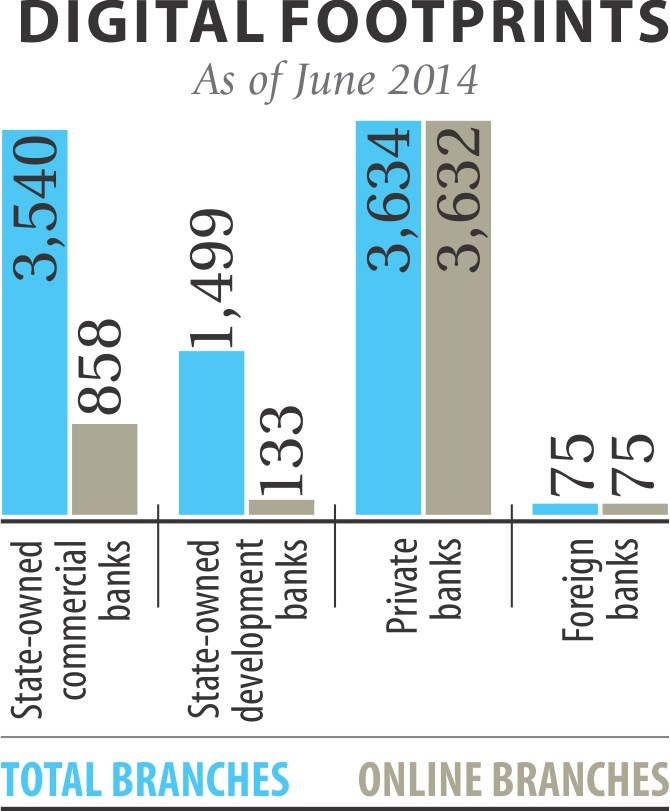

BB's quarterly report as of June 2014 shows that all 75 branches of foreign banks and 3,632 branches or 99.94 percent of private banks have introduced online banking, gaining an edge over the state banks.

A mere 858 branches or 24 percent of the total 3,540 branches of state-owned commercial banks offer online coverage. The situation is more depressing with the state-owned development banks; less than nine percent of their branches have an online facility.

“The government's procurement system is stringent and it takes a lot of time to execute a contract,” said SM Aminur Rahman, former managing director of state-owned Janata Bank. He served the bank for six years before his contract expired on July 27.

He pointed at an excessive number of branches and poor locations for the state banks' lagging in adopting automation and online facilities. Many of the branches are located in places with no internet coverage, he added.

Online banking is an electronic payment system that enables a customer of a financial institution to conduct transactions on a website operated by the institution, such as a bank or a non-bank financial institution. Online banking is also known as internet banking, e-banking, or virtual banking.

Bangladesh is relatively late in introducing online banking. The trend gained momentum in the last five to six years. Now, 46 out of 47 banks scheduled before 2013 have adopted the concept to deliver prompt services to its customers.

Under online banking, banks offer services like checking account balances and recent transactions, downloading bank statements and periodic account statements, ordering cheque books, fund transfers between customers' linked accounts, and paying third parties, including bill payment.

Pubali Bank has the largest online banking network in the country with all its 427 branches now offering such services.

“There is no alternative to modern and technology-driven services that have made our tasks easier,” said Helal Ahmed Chowdhury, managing director of the bank.

Pubali has brought all its branches under the online system by using software developed by the bank's own human resources. Chowdhury said Pubali yesterday signed an agreement with Oracle and Aamra Technology to install the latest technology of Oracle Exadata that offers improved online banking services.

“It is tough in today's world to survive without online banking services,” said Touhidul Alam Khan, deputy managing director of newly established Modhumoti Bank that introduced the system from its inception last year.

Khan, who is also the first Certified Sustainability Reporting Assurer in Bangladesh and a pioneer in initiating green banking activities in Bangladesh, said online banking not only serves promptly but also promotes green banking. Masodul Bari, head of IT of Al-Arafah Islami Bank, said online banking helps both bankers and customers.

“A banker can take prompt decisions by analysing data, while a customer can get many services without going to the bank branches.”

Online services are also cost-effective, he said. If a manual transaction costs a bank Tk 10, it is only Tk 0.10 for an online transaction, he added.

News:The Daily Star/2-Sep-2014

Comments