State banks mull rate cuts as credit growth slows

Four state-owned commercial banks opened talks to lower their lending rates by 1-2 percentage points in a bid to compete with private lenders and spur investment in the economy.

The development came after the managing directors of the four banks held a meeting on December 13 at the Agrani Bank headquarters.

One state bank first made the proposal as the mismatch between deposit and credit growth rates continues to widen.

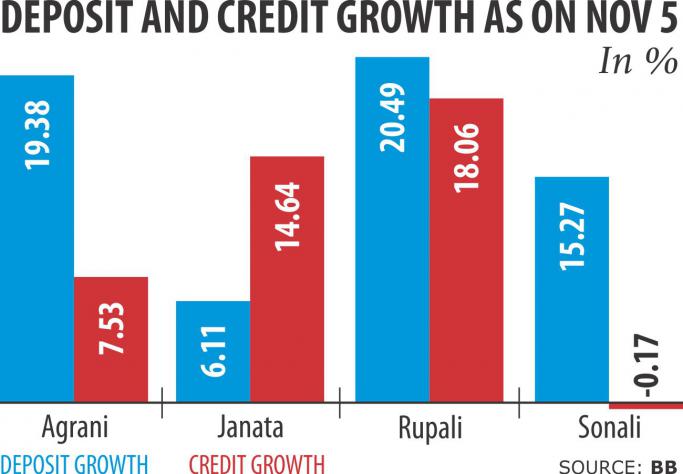

On November 5, the state banks' credit growth stood at 8.49 percent and the deposit growth 13.34 percent, according to central bank statistics. For instance, the deposit growth of the largest state bank, Sonali, was 15.27 percent while its credit growth was negative.

Subsequently at the meeting, Agrani proposed cuts of up to 2 percentage points, which Sonali supported. Rupali and Janata were in favour of holding 2-3 more meetings to review the proposal. A high official of Sonali said in many cases the state banks have been losing borrowers to private banks, which offer lower interest rates.

At present, the state banks offer interest rates within the 10 to 15 percent range.

The rate of interest on term loans is 13-14 percent, while that for working capital is 14 to 15 percent, according to the central bank's November statistics.

In contrast, the private banks offer 11 percent for both term and working capital loans.

When contacted, Agrani Bank Chairman Zaid Bakht confirmed that the banks have discussed the matter of lowering lending rates but no decision has yet been taken.

However, Agrani has been considering giving rebates of up to 20 percent to their best customers as a new year's gift.

Borrowers who make timely payments now must be given 10 percent rebate, according to a Bangladesh Bank directive, which Agrani is offering to its good borrowers.

At the meeting, some were in opposition of lowering the rates this year as they have provision and capital shortfall. If the rate is cut this year, their profitability will fall. Instead, they suggested making the call in January next year.

Subsequently, it was decided that a meeting will be held in January to take the decision on the lending rate cut.

Meanwhile, several state bank officials said the reason for the sluggish loan disbursement is that the bankers are shaky about giving out credit after the spate of scams in recent times.

Though there is pressure from the head offices, the officials at the field level are reluctant to grant loans.

This shaky feeling is a new type of problem the banks have been facing, said a board member of a state bank.

News:The Daily Star/20-Dec-2015

Comments