Scams push up loan defaults The amount rises by Tk 7,282cr during July-Sept

Bad loans increased by Tk 7,282 crore or 1.58 percentage points in the third quarter this year as a significant amount of loans related to the recent incidents of scams was classified.

Bad loans increased by Tk 7,282 crore or 1.58 percentage points in the third quarter this year as a significant amount of loans related to the recent incidents of scams was classified.

The central bank is putting pressure on the banks to get the real picture of their loan defaults.

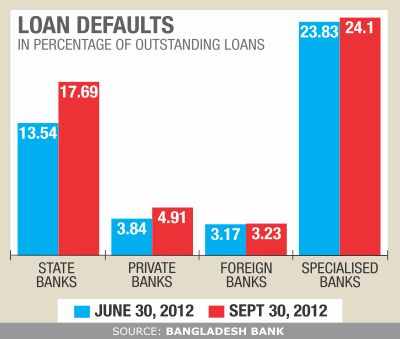

On September 30, the total amount of bad loans in the banking sector was Tk 36,282 crore or 8.75 percent of the total outstanding loans.

The amount was Tk 29,000 crore or 7.17 percent of total loans on June 30.

According to Bangladesh Bank statistics, the highest increase in such loans was in the state-owned commercial banks that saw a rise by Tk 3,746 crore in the third quarter.

The amount of total classified loans at these banks stood at Tk 15,518 crore on September 30.

The classified loans at the private banks also marked a rise, by Tk 3,280 crore during the same period, and reached Tk 13,585 crore.

Bankers said the central bank recently detected loan-related irregularities in some public banks, and put pressure on the banks to classify the loans.

Hall-Mark Group and some other businesses embezzled Tk 3,547 crore from Sonali Bank's Ruposhi Bangla branch on forged documents.

On November 18, Finance Minister AMA Muhith also said in parliament that a significant amount of funds was also embezzled through Sonali Bank's Gulshan and Agargaon branches.

The finance minister said incidents of forgery were also detected in the accounts of some customers of Rupali, Janata, Agrani and BASIC Bank.

According to BB statistics, the amount of bad loans increased by Tk 1,733 crore in Sonali Bank, by Tk 758 crore in Janata, by Tk 1,092 crore in Agrani, and by Tk 163 crore in Rupali Bank during the July-September period.

Though BASIC is not a state-owned commercial banks, it is run under the government's control. During the period, bad loans increased by about Tk 200 crore at BASIC Bank.

The entire amount of the money involved with the irregularities unearthed recently has not yet been classified and the loan defaults may increase further in December when these loans will be classified.

Pradip Kumar Dutta, managing director of Sonali Bank, told The Daily Star that Tk 400 crore, a portion of the loans taken by the Hall-Mark Group, was classified in September.

The rest of the amount is likely to

be classified in December this year,

he added.

On the increase in loan defaults, the Sonali Bank's chief executive said the amount of bad loans marked a rise as their recovery, write-off and rescheduling was less this year compared to the previous year.

He also said they wrote off around Tk 800 crore last year, but the amount was only Tk 2 crore so far this year.

Dutta also said, to realise the loans from the Hall-Mark Group, the bank has taken the Group's 88 acres of land as mortgage. The lands are worth about Tk 560 crore on conservative estimates made by the bank.

Another 45 acres of land are being taken as mortgage, said the official of the bank.

He said, as a result they hope to securitise about Tk 1,000 crore against the loans given to Hall-Mark.

A central bank official said the BB has tightened its supervision after the incidents of loan scams were detected in some state banks.

The central bank also identified irregularities in some private banks that have already classified the loans, leading to a rise in default loans in those banks, he said.

News: The Daily Star/Bangladesh/23-Nov-12

Other Posts

- Mercantile Bank honours meritorious students

- ONE Bank CPC opens

- BASIC Bank's bad loans pile up on aggressive lending

- Pubali Bank donates Tk 0.5m to KAMPS

- Pubali Bank launches quarterly publication

- BB extends deadline for refund of classified term, farm loans

- BB asks merchant banks, brokers to follow SEC order

- Euro zone, IMF fail to strike Greek debt deal

- Singapore summit set to showcase Bangladesh's investment prospects The daylong event on Dec 4 will connect 200 potential investors

- BB directs FIs to follow margin loan guidelines

- Myanmar could be Asia’s ‘rising star’: IMF

- Setting Up Plants for 675MW Power by 2015Govt may seek Tk 39b loans from foreign banksInterest rate varies from 4.22 to 4.67pc

Comments