BB takes tough line on farm loan

Posted by on Tue, May 17 2011 04:14 am

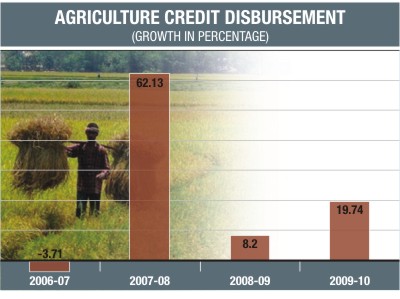

Bangladesh Bank (BB) has taken a tough stance against private and foreign banks who will fail to reach their targets of farm loan disbursement.

In case of failure, the banks will have to deposit the money with the central bank for one year.

The BB yesterday issued a circular in this regard. However, bankers have expressed their disappointment over the directive, but a BB official said the central bank can issue such a directive.

The private and foreign banks will have to fix a target of distributing agriculture or rural loans to the tune of 2.5 percent of their total loans disbursed till March 31 of the previous fiscal year, said the BB circular.

It also said, the bank concerned will review in every quarter whether the loans have been disbursed in line with the target. If it fails to meet the target, the unfulfilled portion of the target will have to be deposited with the central bank for one year.

The central bank will give interest at 5 percent on the deposited amount. The circular also said the banks will have to set their target considering the demand for agriculture and rural loans and the bank's ability and efficiency in disbursing loans in this sector every year.

The BB asked both public and private banks to contribute equally to the farm sector.

“Many private and foreign banks do not have any investment in agriculture and rural sectors. Though many banks have small investment, the amount is not satisfactory compared to their total loans and advances.”

The central bank said all banks should participate with a logical level of investment in giving agriculture and rural loans.

An official of the central bank said, according to banking regulations, the BB can give such directive to any bank. He said, in 2008 a specific guideline has been given to every bank for their participation in agriculture and rural loan disbursement.

He also said, in the first nine months of the current fiscal year eight private banks could not reach 20 percent of their target for distributing agriculture loans.

The official said, in the current fiscal year a bank set 16 percent as its target of disbursing agriculture loans, but another bank's target was at 0.4 percent.

He said the private and foreign banks do not show interest in disbursing the amount they set as target for agriculture loans. He also said, in India it is mandatory for the banks to disburse 18 percent of their total loan in the agriculture sector. If any bank fails to fulfill its target, the amount has to be deposited with Indian agriculture bank on a mandatory basis.

The official said there is also provision for such action in Sri Lanka and Nepal.

Managing directors of some private banks on condition of anonymity told The Daily Star that at present there is a slight liquidity crunch in their banks. They will hold discussions with the central bank on how much logical such a step will be.

A chief executive of a private bank said, “We are now forced to close the credit-deposit ratio. In such a situation, the circular may create money problem for many banks.”

Association of Banks, Bangladesh (ABB) President K Mahmood Sattar said he has not yet seen the circular. He said, if such a circular has been issued, he will talk about it with the central bank.

He said they will discuss with the BB what types of problems the banks will face in implementing the directive of the central bank.

News: The Daily Star/ Bangladesh/ May-17-2011

Comments