BB spells out five steps to keep economy on track

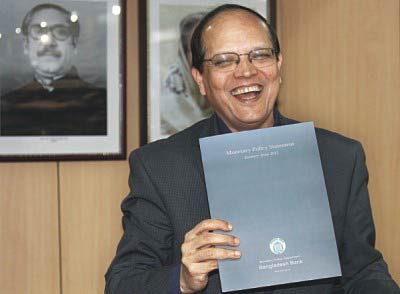

Atiur Rahman

Atiur Rahman

The central bank has announced five steps that include hiking interest rates on savings certificates, mobilising more external and domestic resources and rationalising public expenditures to implement its monetary policy.

The plans came as Bangladesh Bank Governor Atiur Rahman yesterday announced the bank's Monetary Policy Statement for the second half of the current fiscal year, which tightened the policy further to curb soaring inflation and reduce pressure on rocketing exchange rate.

"Ensuring positive real interest rates will strengthen monetary transmission channels, curb non-essential imports, stabilise external reserves and lead to an equilibrium in exchange rate," said the governor at a press briefing at his office in Dhaka.

First, the central bank said there is scope for increasing private sector credit growth for productive investments beyond the programmed level if there is a reduction in growth in credit to the public sector.

The BB also said it plans to reduce the demand for consumer loans to increase the share of lending going towards growth-enhancing investment purposes.

"We will discourage investment in risky sectors. We, however, do not mean investment in stockmarket as risky," Allah Malik Kazemi, a senior consultant of the central bank, told journalists after the briefing.

"There are many loans in the SME (small and medium enterprise) sector that are risky."

Second, the BB will ensure liquidity support for banks, so that productive credit growth is not crowded out. In future, the government's borrowing calendar will need to be modified to allow for a higher percentage of debt auctions in Treasury bills, as the long dated Treasury bonds lack liquidity in the absence of an active secondary market.

Third, while the interest rate regime will remain liberalised, the central bank will focus more on monitoring interest rate spreads so that they remain below 5 percent except for SME lending (as the costs of SME operations are higher) and consumer lending.

Fourth, the central bank said, in order to reach the new external sector equilibrium, overall import demand needs to be rationalised. Opening of letters of credits for non-essential and luxury items will be discouraged, while those for essentials such as petroleum will be unhindered.

The BB said a new coordination committee would aim to ensure that taka liquidity is provided ahead of time so that banks can purchase the needed foreign exchange on the inter-bank market on a regular basis.

As a result, lumpy Bangladesh Petroleum Corporation payments can be met instead of approaching the BB for foreign exchange.

Fifth, the central bank will take further steps to improve the stability and outreach of its financial system.

The BB also said the monetary growth targets for fiscal 2012 are on track that established the credibility of the stance taken in the previous MPS.

In November 2011, reserve money growth and broad money growth were 15.4 percent and 17.7 percent respectively, well below the 16 percent and 18.5 percent targets set out in the July MPS.

"This stance was achieved through open market operations, raising the repo rates by 100 basis points in FY 2012 and lifting caps on lending interest rates other than for agricultural and pre-shipment export credit," said the MPS.

While weighted average lending rates have gone up on average by 1.6 percentage points in 2011, the BB said it is closely monitoring spreads so that they remain in low single digits for all sectors, except SME and consumer credit.

"This stance, along with pro-active liquidity management still ensured adequate year on year private sector credit growth -- more than sufficient to sustain economic growth targets, in line with earlier years and above that of India."

The BB said the extent of crowding out is limited as the weight of government borrowing in total domestic credit remains around 20 percent, which will free up more room for private sector credit growth.

It also said cross-country experiences from around the region illustrate the importance in Bangladesh of using monetary policy to act preemptively to mitigate risks from domestic and external imbalances.

The Daily Star/Bangladesh/ 27th Jan 2012

Comments