BB slams foreign banks for higher spread

The central bank yesterday came down heavily on foreign banks having operations in Bangladesh for a high interest rate spread, which is depriving both depositors and borrowers.

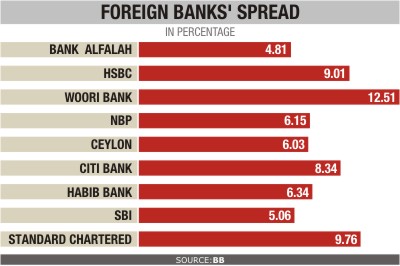

Bangladesh Bank (BB) asked all commercial banks, including foreign banks, to keep the interest rate spread at 5 percent. The average interest rate spread for foreign banks is around 9 percent, which is below 6 percent for the local commercial banks.

The suggestion came at a meeting on implementation of the monetary policy, which was announced last month, at the central bank office in Dhaka with its Governor Atiur Rahman in the chair.

A participant in the meeting quoted Rahman as saying the BB will closely monitor the interest rate spread to keep it below 5 percent, except for small and medium enterprises and consumer loans.

Hassan Zaman, senior economic adviser to the governor, presented a keynote paper on the latest monetary policy and current economic situation.

Zaman said the BB will also ensure adequate liquidity for productive investment, according to the participant in the meeting who requested not to be named.

The spread refers to the difference between the interest rates for lending and deposit.

BB statistics showed the weighted average deposit rate of the foreign banks was 4.51 percent in November 2011, while the weighted average credit rate was 13.34 percent at the same time.

In case of private banks, the weighted average deposit rate was 8.53 percent in November 2011, while the weighted average lending rate was 13.87 percent, BB data showed.

On one hand, the foreign banks are paying less interest to the depositors and on the other, they are making huge profits from a high interest on loans, the BB official said.

The foreign banks have made substantial profits over the years, although they have a limited scale of operations in Dhaka and Chittagong alone.

In 2009, the foreign banks made a net profit of Tk 930 crore, which was Tk 915 crore in 2010, according to BB data.

After the meeting, Sitangshu Kumar Sur Chowdhury, deputy governor of the BB, told journalists, “We asked the commercial banks to discourage loan disbursement to non-productive sectors and encourage loans for the productive sectors.”

He also said one of the major objectives of the recently launched monetary policy is to bring down the inflation rate to a single digit.

He said the BB also called upon bankers not to discourage imports of basic commodities.

Mohammed Nurul Amin, chairman of the Association of Bankers Bangladesh (ABB), said he supports the central bank's move to discourage loan disbursement to non-productive sectors.

The latest monetary policy targets to cut credit growth to the private sector to 16 percent by June. It was around 20 percent in December.

Both the BB deputy governor and ABB chairman said bringing down credit growth for the private sector to 16 percent is enough to achieve the current fiscal year's economic growth target.

A few days ago, the ABB leaders set a self-imposed cap on deposit and credit rates at 12.5 and 15.5 percent, to discourage unhealthy competition in the banking system.

At yesterday's meeting, all bankers committed to following the self-imposed cap on deposit and lending rates, said Chowdhury, adding that the central bank did not intervene in this process.

In addition, the primary dealer banks are currently facing a liquidity crisis as they cannot cash the excess investment in bonds at around Tk 16,000 crore.

The Daily Star/Bangladesh/ 10th Feb 2012

Other Posts

- Bank Alfalah group CEO in town

- EXIM Bank MD Addresses Customers & Well-Wishers of Mirpur Branch

- Citizens to monitor World Bank projects

- New DMDs for City Bank

- NBL offers 65pc stock dividend for 2011

- SIBL distributes foundation course certificates

- Local officials of StanChart, HSBC unaware of takeover bid

- BB puts conditions for old ship import

- BB refutes claims on fake notes

- BB signs deal for national payment switch

- BB sits with bank MDs today

- RBI nod a must for India offices by companies from 6 nations

- BB refutes claims on fake notes.

- Economic indicators improving: BB

- BBTS to install optical fibre network for Trust Bank Ltd

Comments