BB buys $648m from banks to curb inflation

The central bank has purchased about Tk 5,000 crore worth of US dollars from banks in the past one and a half months in a bid to contain inflation.

Between December 1 last year and January 16 this year, Bangladesh Bank has bought about $648 million from kanks 'ban with the central bank's 30-day bills and Islamic bonds -- instead of paying upfront in cash.

A high official of the central bank said they have taken up the new strategy to curb inflationary pressures.

Although overall inflation has come down to single digit, non-food inflation still remains in the double digits, according to the official.

Non-food inflation in December 2012 stood at 10.24 percent.

Another reason behind the BB purchase of large amounts of dollars -- almost every month -- is to maintain the exchange rate in the face of falling imports.

The central bank purchased $2.36 billion from the foreign exchange market between July 1, 2012 and January 16, 2012, according to central bank statistics.

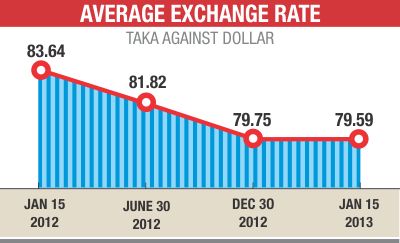

In recent times, the taka has been appreciating continuously against the dollar.

On January 15, the taka's weighted average rate against the dollar stood at Tk 79.59, down from the Tk 83.68 recorded for the same date a year ago.

The rate stood at Tk 81.82 on June 30 of last year.

“The central bank is buying dollars in a way that it does not fuel appreciation of the taka against the dollar,” said the official.

The BB is not supplying cash against the purchases.

BB's main target is to ensure competitiveness of the exports and not to put off expatriates from sending in remittances, according to the official.

In July-November, imports fell 4.31 percent year-on-year to $13.47 billion, while exports increased 3.96 percent, according to BB data.

The foreign exchange reserves marked a rise in recent times: it crossed $13 billion in the first week of January, but after making payments to the Asian Clearing House, it came down to $12.63 billion on January 15.

The BB officials said Islamic Development Bank's credit line for import of petroleum is about $2.5 billion this fiscal year, much higher than last year's $1 billion.

As a result, payments against petroleum import by local banks are less this year, another reason behind the low demand for foreign currency.

The BB official, however, said demand for foreign currency is likely to increase from next month, when the foreign banks and companies start to repatriate their profits.

News:The Star Bangladesh/19-Jan-2013

Comments