Banks' profit erodes

Most listed commercial banks are going through hard times in the second half of the year as a huge provisioning against non-performing loans pushed them to the negative profit zone.

Most listed commercial banks are going through hard times in the second half of the year as a huge provisioning against non-performing loans pushed them to the negative profit zone.

Some banks even incurred losses in the third quarter as their core banking business was hit by low credit growth, according to their quarterly disclosures made public recently.

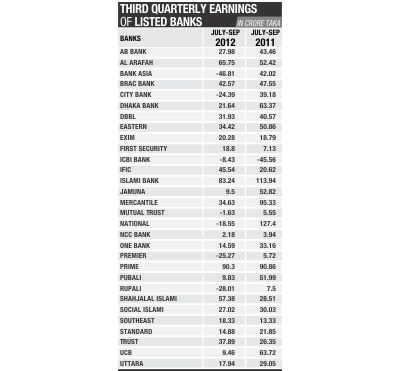

Of the 30 listed banks, 16 registered negative net profit growth year-on-year in July-September, six incurred losses and seven made positive growth.

Losses from the investment in the stockmarket also added to their worries, bankers said.

“Revenues fell in July-September mainly for two reasons,” said K Mahmood Sattar, managing director of The City Bank.

Interest rates were high, but demand for loans was low; and the banks also had to set aside huge funds to stay safe against classified loans, he said.

In the July-September period, the total specific provisions for classified loans at all listed banks doubled to around Tk 1,200 crore, compared to the second quarter.

Sattar said most of the burden of non-performing loans came from the ship-breaking industry.

“Steel prices dropped faster locally compared to the international markets,” he said.

He said, except for a few, net profit of all banks declined compared to the same period last year; even some of them incurred losses during the third quarter.

“The situation may worsen further in December when the new regulations on loan provisioning will come into effect,” he added.

BRAC-EPL Stock Brokerage said the third quarter saw the impact of provisioning like no other previous quarters and it became the single most vital element, affecting the banks' profitability.

“Loan provisioning is the biggest chunk of total provisions and in the third quarter it witnessed a skyrocketing growth on the backdrop of new loan provisioning guideline,” the stockbroker said in an analysis.

The new guideline will shorten the timeframe for loan classification, causing provisions to rise, even if the total amount of classified loans remains the same.

In June this year, Bangladesh Bank made it mandatory for banks to classify loans for non-repayment within three months instead of six months earlier, amid opposition from banks. The new rules aim to reduce the number of willful defaulters and benefit both banks and borrowers.

“Banks with medium or low asset qualities started to charge higher provisions early to smooth out their net profit even though one more quarter is left before the guideline will become effective,” said the BRAC-EPL analysis.

Nurul Amin, managing director of NCC Bank, said the negative earnings or losses were for temporary reasons, including higher loan provisioning and the new regulations, poor business and lower credit growth.

“Although the banks fared badly, I am optimistic as the demand for private sector credit will increase in the last quarter, helping the banks to maintain profitability like previous years,” said Amin, also the president of Association of Bankers, Bangladesh.

Ali Reza Iftekhar, managing director of Eastern Bank, also said majority of the banks' income from core business dropped significantly.

In addition, he said, many of the banks incurred losses from their investment in the stockmarket.

Although the banks' average exposure to the stockmarket remained low at 3 percent of their liabilities, the continuous fall in stock prices hit the portfolio of the banks and their clients.

News: The Daily Star/Bangladesh/22-Nov-12

Other Posts

- FSIBL opens ATM at Andorkillah, Ctg

- SJIBL EC meets

- Private banks sitting on surplus funds Low demand for loans pushes up their unused funds to Tk 20,000-25,000cr

- Course on ‘Credit Appraisal and Management’ ends

- Bangladesh can raise 38pc trade, says WB

- NRBs to invest directly in Bangladesh Fund

- Training on Islamic banking held

- BB ponders commission for foreign brokers

- Set up finance commission for local government bodies Former governor of Bangladesh Bank suggests in his presentation on urban public finance

- Call for cuts in bank interest rates Kazi Akramuddin introduces his panel for FBCCI polls

- A 11-member delegation of Woori Bank led by its President and CEO of Lee Soon Woon call on Bangladesh Bank Governor Dr Atiur Rahman at the latter’s office in Dhaka Tuesday.

- IMF deal reached on $4.8b loan for Egypt

- HSBC completes its first trade in yuan

Comments